Writing a cover letter for a position as an Insurance Analyst/Underwriting Analyst can be an intimidating task. Crafting a well-written, effective document that summarizes your qualifications and experience can be the key to landing an interview. This guide will provide you with tips and advice on how to write a successful cover letter, as well as an example to help get you started.

Download the Cover Letter Sample in Word Document – Click Below

If you didn’t find what you were looking for, be sure to check out our complete library of cover letter examples.

Start building your dream career today!

Create your professional cover letter in just 5 minutes with our easy-to-use cover letter builder!

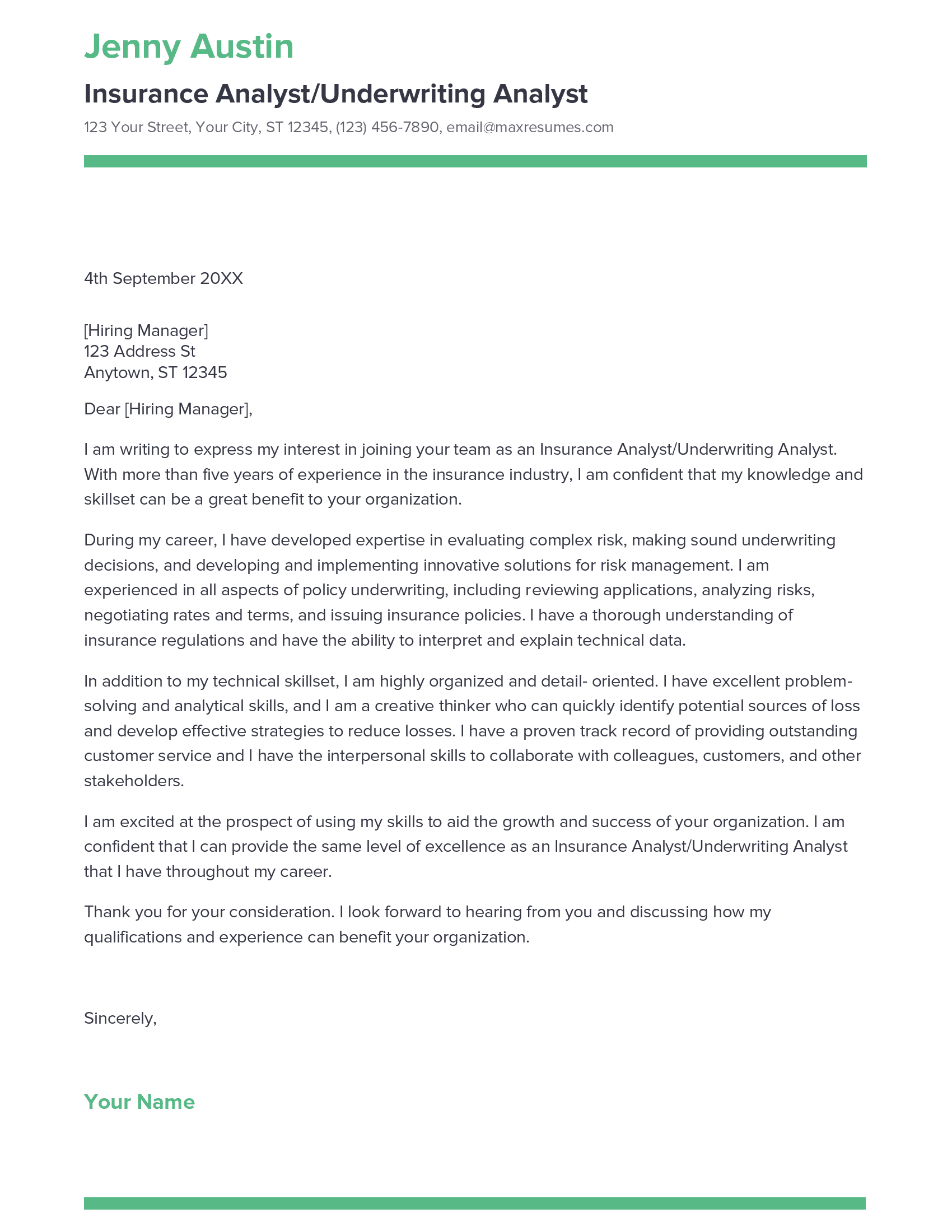

Insurance Analyst/Underwriting Analyst Cover Letter Sample

Dear [Hiring Manager],

I am writing to express my interest in joining your team as an Insurance Analyst/Underwriting Analyst. With more than five years of experience in the insurance industry, I am confident that my knowledge and skillset can be a great benefit to your organization.

During my career, I have developed expertise in evaluating complex risk, making sound underwriting decisions, and developing and implementing innovative solutions for risk management. I am experienced in all aspects of policy underwriting, including reviewing applications, analyzing risks, negotiating rates and terms, and issuing insurance policies. I have a thorough understanding of insurance regulations and have the ability to interpret and explain technical data.

In addition to my technical skillset, I am highly organized and detail- oriented. I have excellent problem- solving and analytical skills, and I am a creative thinker who can quickly identify potential sources of loss and develop effective strategies to reduce losses. I have a proven track record of providing outstanding customer service and I have the interpersonal skills to collaborate with colleagues, customers, and other stakeholders.

I am excited at the prospect of using my skills to aid the growth and success of your organization. I am confident that I can provide the same level of excellence as an Insurance Analyst/Underwriting Analyst that I have throughout my career.

Thank you for your consideration. I look forward to hearing from you and discussing how my qualifications and experience can benefit your organization.

Sincerely,

[Your name]

Looking to improve your resume? Our resume examples with writing guide and tips offers extensive assistance.

What should a Insurance Analyst/Underwriting Analyst cover letter include?

A Insurance Analyst/Underwriting Analyst cover letter should include relevant experience and qualifications that demonstrate your ability to manage and analyze insurance risk. It should also provide evidence of your knowledge of the insurance industry, including an understanding of the latest regulations and best practices. Additionally, you should include your communication and problem solving skills, as well as any related professional certifications. Finally, the cover letter should be tailored to the position, emphasizing why you are an ideal candidate for the job.

Insurance Analyst/Underwriting Analyst Cover Letter Writing Tips

Writing a cover letter for an Insurance Analyst/Underwriting Analyst role can be daunting. After all, you want to make sure your qualifications and relevant experiences will stand out from the competition. To help you craft an effective and persuasive cover letter, here are some tips to bear in mind:

- Research the role and organization: Before you start writing, make sure you understand the job requirements and what the company is looking for in a candidate. This knowledge can help you tailor your cover letter and demonstrate why you’re the ideal fit.

- Showcase your qualifications: List your expertise in insurance and underwriting, including any certifications or special designations, and explain how they make you a strong candidate. Highlight your analytical and problem- solving abilities, as well as your knowledge of insurance principles, processes, regulations, and industry standards.

- Demonstrate your knowledge: Include specific examples of the technical and analytic skills you’ve used in your work and the results you achieved. Explain how you have successfully managed risk, identified potential problems, and developed solutions to keep clients and their investments safe.

- Describe your communication skills: Your cover letter should also demonstrate your ability to communicate effectively with clients and colleagues. Describe your experience in providing client support, writing reports, and preparing presentations.

- Emphasize your success stories: Provide examples of successful projects or initiatives you’ve been involved in, and explain the impact they had on the business.

- Finish off with a call- to- action: Conclude your cover letter with a call- to- action, such as asking the employer to contact you to discuss the role further.

By following these tips, you can create a compelling cover letter that will grab the attention of the employer and demonstrate why you should be considered for the role.

Common mistakes to avoid when writing Insurance Analyst/Underwriting Analyst Cover letter

If you are applying for a position as an Insurance Analyst or Underwriting Analyst, your cover letter is your chance to make a good first impression. A well- crafted cover letter can help you stand out from other applicants, and increase your chances of getting an interview. To ensure your cover letter is as effective as possible, here are some common mistakes to avoid:

- Not customizing your letter: A generic, one- size- fits- all cover letter will not make a great impression. Make sure to tailor your letter to the job you are applying for, and include specific examples of experience and qualifications that make you the best candidate for the position.

- Being too long: Keep your cover letter concise and to the point. A good rule of thumb is to make sure your cover letter is no more than one page in length.

- Not proofreading: It is essential to proofread your cover letter carefully before submitting it. Typos and other errors will reflect poorly on your application, so take a few extra minutes to review your letter and check for mistakes.

- Being too formal: While it’s important to maintain a professional tone in your cover letter, it is also important to avoid being too stiff or formal. Use language that is easy to read, and make sure to include some of your personality.

- Not including contact information: Your full contact information (name, address, phone number, and email) should be included at the top of your cover letter. This will make it easier for the hiring manager to get in touch with you.

By avoiding these common mistakes, you can make sure your cover letter will make the best impression possible. Good luck!

Key takeaways

When writing a cover letter for an Insurance Analyst or Underwriting Analyst position, there are some key takeaways to keep in mind. Below are a few points to consider when crafting your cover letter:

- Focus on the specific position for which you are applying. Show that you have done your research and understand the role and the organization to which you are applying.

- Highlight your experience in the insurance industry. Point out the skills and experience that make you a good fit for the position and explain why you are the best candidate for the job.

- Showcase your analytical skills. Demonstrate how you can analyze data and come to conclusions that will affect an organization’s insurance policies and strategies.

- Provide examples of your problem- solving abilities. This is key to an Insurance Analyst/Underwriter role, so show that you have the skills to tackle challenging tasks and issues.

- Demonstrate your communication skills. Show that you can effectively communicate with customers and other stakeholders in order to foster relationships and ensure the best possible outcomes.

By following these key takeaways when writing your cover letter, you can create an impressive and memorable document that will help you to stand out among other applicants.

Frequently Asked Questions

1. How do I write a cover letter for an Insurance Analyst/Underwriting Analyst job with no experience?

Writing a cover letter for a job in insurance analysis or underwriting analysis can be daunting when you have no experience in the field. However, this doesn’t mean you can’t create a compelling and persuasive cover letter that will grab the attention of a potential employer. To start, focus your cover letter on the skills you do have that are transferable to the job. For example, if you have knowledge of insurance regulations, highlight this in your cover letter. Additionally, emphasize any education, volunteer experience, or internships that show you have the necessary skills and abilities to be successful in the role. Finally, include a few lines about why you’re passionate about insurance and underwriting and how you can contribute to the success of the company.

2. How do I write a cover letter for an Insurance Analyst/Underwriting Analyst job experience?

When you have experience in the insurance and underwriting field, your cover letter should be tailored to highlight your professional accomplishments and successes. This is the place to showcase your knowledge and expertise and to demonstrate why you are the perfect candidate for the job. Start by summarizing your experience and highlighting the types of tasks you have worked on and the areas of insurance and underwriting you have expertise in. Next, include any successes you have had and how your efforts have made a positive impact on the company. Finally, explain why you are passionate about insurance and underwriting, and why you would be a great fit for the job.

3. How can I highlight my accomplishments in Insurance Analyst/Underwriting Analyst cover letter?

Highlighting accomplishments in your cover letter is key to standing out from the other applicants. Start by listing your accomplishments and successes from your previous experience in the insurance and underwriting field. Be sure to include the tasks and projects you have worked on, the results, and how you have contributed to the success of the company. Additionally, include any awards or recognition you have received that demonstrate your expertise in the field. Finally, explain why you are passionate about insurance and underwriting and how you can use your knowledge and skills to benefit the company.

4. What is a good cover letter for an Insurance Analyst/Underwriting Analyst job?

A good cover letter for an Insurance Analyst/Underwriting Analyst job should be tailored to the requirements of the job and include relevant experience and accomplishments. Start by introducing yourself and explaining why you are interested in the job. Next, summarize your experience and mention the types of tasks you have worked on and the areas of insurance and underwriting you have expertise in. Additionally, include any successes you have had and how your efforts have made a positive impact. Finally, explain why you are passionate about insurance and underwriting and why you would be a great fit for the job.

In addition to this, be sure to check out our cover letter templates, cover letter formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

Let us help you build

your Cover Letter!

Make your cover letter more organized and attractive with our Cover Letter Builder