Are you looking for tips on how to write an effective and attention-grabbing tax consultant resume? Writing a resume is a daunting task, especially if you’re transitioning into the world of consulting. You need to make sure that your resume effectively communicates your professional experiences, qualifications and expertise. To help you out, we’ve put together a comprehensive guide on how to write a tax consultant resume. We’ve also included some examples to inspire you, so you can get started with creating a resume that will help you land your dream job.

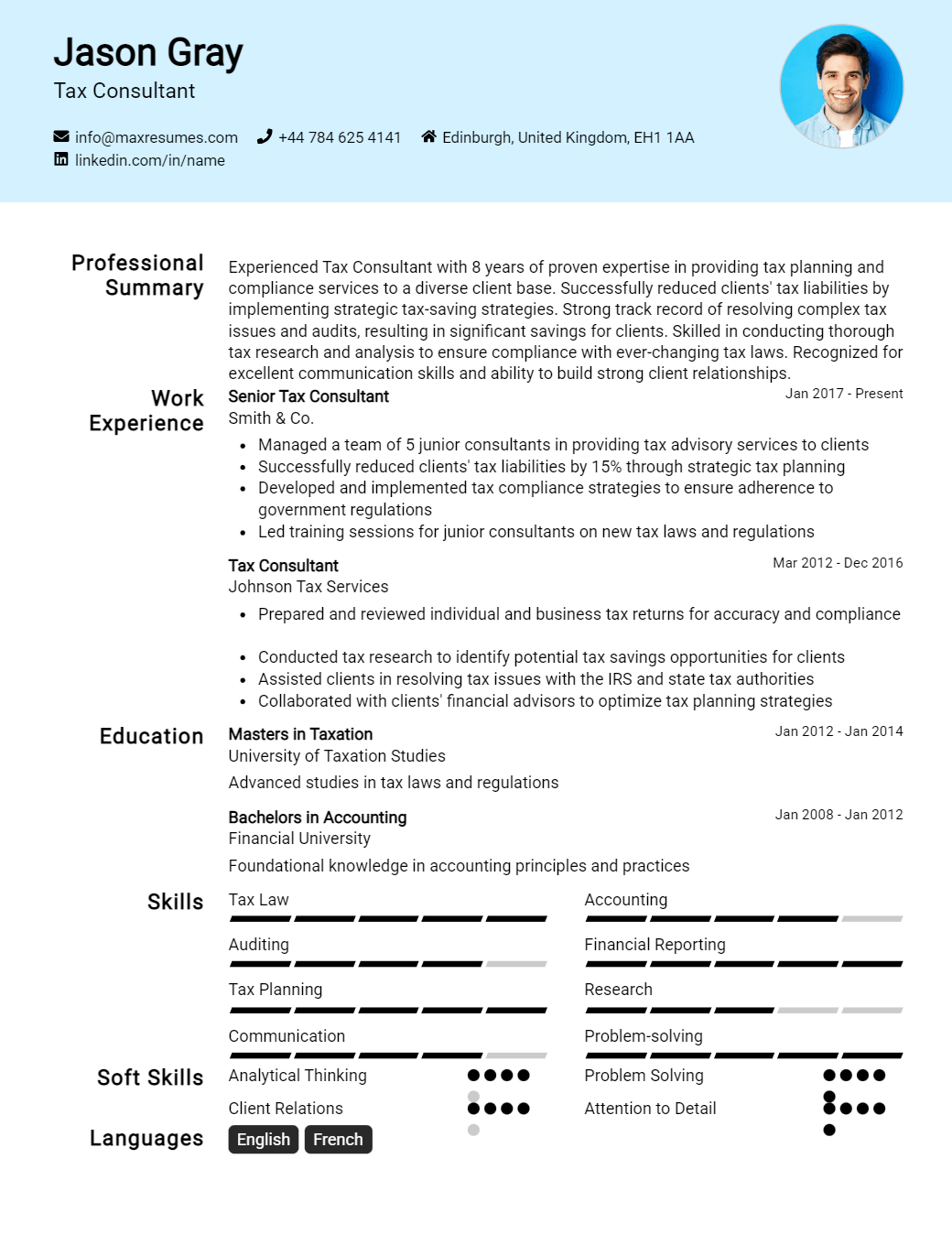

Tax Consultant Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Tax Consultant Resume Examples

John Doe

Tax Consultant

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

As a tax consultant with 8+ years of experience, I have specialized in providing tax consulting services for small- medium businesses and individuals. I have detailed knowledge of tax accounting, tax preparation and compliance with federal, state and local regulations. I have strong analytical and problem solving skills that have enabled me to streamline processes, develop efficient strategies and improve reporting accuracy. My professional experience and education have enabled me to become a trusted advisor and consultant to my clients, providing them with the highest level of expertise and service.

Core Skills:

- Tax Accounting

- Tax Preparation

- Compliance with Federal, State and Local Regulations

- Analysis and Problem Solving

- Strategy Development

- Reporting Accuracy

Professional Experience:

Tax Consultant, ABC Consulting – Los Angeles, CA (2015 – Present)

- Provide tax consulting services for small- medium businesses and individuals.

- Research and recommend tax strategies to clients in order to maximize savings.

- Ensure compliance with federal, state and local regulations.

- Analyze financial records to identify potential tax liabilities.

- Develop and implement tax planning strategies.

- Prepare and file tax returns.

Tax Accountant, XYZ Consulting – New York, NY (2010 – 2015)

- Processed and prepared tax returns for small- medium businesses and individuals.

- Provided advice and assistance to clients regarding tax matters.

- Analyzed financial records to identify potential tax liabilities.

- Developed and implemented tax strategies to reduce tax liability.

- Researched and recommended tax strategies to maximize tax savings.

Education:

Bachelor of Science in Accounting, University of California – Los Angeles, CA (2008 – 2010)

Tax Consultant Resume with No Experience

Recent graduate with a Bachelor’s degree in Accounting and Taxation who is eager to join a respected tax consultant firm to gain experience in the field. Highly organized and detail- oriented, with excellent problem solving skills and the ability to communicate complex tax information in a clear, concise manner.

Skills

- Knowledge of taxation laws and regulations

- Ability to analyze financial data and prepare tax returns

- Excellent organizational and time management skills

- Proficient in accounting software such as QuickBooks and Peachtree

- Excellent verbal and written communication skills

- Strong interpersonal skills and ability to work as part of a team

- Ability to work with clients in a professional manner

Responsibilities

- Gather and analyze financial data to determine tax liabilities

- Prepare tax returns and other related documents

- Review and analyze financial statements in order to identify potential tax savings

- Respond to client inquiries regarding tax issues

- Provide tax consulting and planning services

- Keep up to date with changes in tax laws and regulations

- Prepare and present reports to management on tax issues and recommendations

Experience

0 Years

Level

Junior

Education

Bachelor’s

Tax Consultant Resume with 2 Years of Experience

I am a Tax Consultant with two years of experience helping businesses, individuals, and families navigate the complex landscape of taxation. With comprehensive knowledge of tax codes, regulations, and software, I am adept at providing comprehensive tax planning and services. My core skills include preparing tax returns, creating plans for tax savings, and consulting with clients. I am also experienced in researching tax laws and regulations and providing advice on their application. I am confident in my ability to ensure that my clients are compliant with all taxation regulations and take advantage of available tax incentives.

Core Skills:

- Comprehensive knowledge of tax codes, regulations and software

- Expertise in preparing tax returns

- Proficient in creating plans for tax savings

- Experienced in researching tax laws and regulations

- Ability to advise on the application of tax laws

- Ensuring clients are compliant with all taxation regulations

- Ability to take advantage of available tax incentives

Responsibilities:

- Developed and implemented tax plans that optimized clients’ tax savings

- Conducted research on tax laws, regulations, and rulings

- Prepared tax returns for individuals, businesses, and families

- Assisted clients in understanding current tax laws, regulations, and filing requirements

- Analyzed and managed complex financial situations

- Provided advice on the implications of specific tax strategies

- Ensured compliance with all state and federal tax regulations

- Analyzed financial data to provide tax planning and tax consulting services

- Represented clients in tax audits and dispute resolution proceedings.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Tax Consultant Resume with 5 Years of Experience

I am a highly experienced Tax Consultant with 5 years of experience in providing tax- related services, such as filing taxes, preparing legal documents, and providing general tax advice. I have excellent communication and problem- solving skills and am well- versed in tax law, accounting procedures, and financial management. Additionally, I am an enthusiastic team player with a solid reputation for reliably and efficiently completing projects.

Core Skills:

- Financial Analysis

- Tax Law Knowledge

- Accounting and Bookkeeping

- Account Reconciliation

- Tax Return Preparation

- Problem Solving

- Strategic Planning

- Tax Planning

Responsibilities:

- Consulting with clients on tax management, tax planning, and compliance with federal, state, and local tax laws

- Preparing, submitting, and filing personal and corporate tax returns

- Conducting research and analyzing financial data to determine the most advantageous tax strategies

- Assisting clients in navigating the complexities of corporate and individual taxes

- Identifying and mitigating tax risks

- Reviewing financial documents and providing expertise to ensure accuracy

- Developing and executing tax planning strategies

- Providing auditing services and responding to notices from the tax authorities.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Tax Consultant Resume with 7 Years of Experience

A highly motivated Tax Consultant with 7 years of experience in providing expert advice and guidance to clients on tax matters, including corporate tax, income tax, and other related tax obligations. Proven ability to ensure clients are in compliance with tax laws and regulations, and to assist with filing tax returns and other paperwork. Experienced in developing and implementing tax strategies and performing tax analysis, as well as providing financial advice and cost- saving measures to help clients reduce their tax burden while meeting compliance standards.

Core Skills:

- Tax Compliance

- Tax Planning

- Tax Analysis

- Financial Analysis

- Tax Return Preparation

- Financial Reporting

- Client Consulting

- Tax Strategies

- Cost- Saving Measures

- Research and Problem- Solving

Responsibilities:

- Provide advice and guidance to clients on tax matters, including corporate tax, income tax, and other related tax obligations.

- Ensure clients are in compliance with tax laws and regulations.

- Assist with filing tax returns and other paperwork.

- Develop and implement tax strategies.

- Perform tax analysis.

- Provide financial advice and cost- saving measures to help clients reduce their tax burden while meeting compliance standards.

- Conduct research and provide problem- solving.

- Prepare financial reports.

- Consult with clients and make recommendations.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Tax Consultant Resume with 10 Years of Experience

A highly experienced Tax Consultant with over 10 years of experience in helping businesses and individuals to maximize their financial potential and achieve their goals. Possesses a comprehensive understanding of taxation rules and regulations, as well as the ability to develop and implement tax strategies. Adept at staying up to date with the changing legal and statutory requirements. Driven to build long- term client relationships and provide exceptional customer service.

Core Skills:

- In- depth knowledge of the taxation laws, regulations and practices

- Analytical and problem- solving skills

- Highly organized and efficient

- Excellent communication and interpersonal skills

- Proficiency in financial software and applications

- Proficient in Microsoft Office Suite

- Ability to develop long- term client relationships

Responsibilities:

- Assess and review financial records and transactions to identify potential tax liabilities

- Prepare and file tax returns for individuals and businesses

- Ensure compliance with all taxation laws and regulations

- Identify risks and tax- saving opportunities

- Research relevant topics and develop strategies to minimize taxation

- Negotiate with government auditors

- Provide advice and assistance to clients regarding tax- related matters

- Develop and maintain relationships with clients to ensure continued compliance

- Provide support and guidance to colleagues and junior staff

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Tax Consultant Resume with 15 Years of Experience

Highly experienced Tax Consultant with over 15 years of experience in the tax industry. Possess an extensive understanding of the tax laws, regulations and procedures that govern the taxation system. Skilled in providing personalized and professional tax advice on the effective and efficient tax planning and optimization strategies. Possess excellent communication and interpersonal skills with a commitment to providing quality customer service.

Core Skills:

- In- depth knowledge of taxation laws and regulations

- Highly organized and able to prioritize tasks

- Excellent analytical and problem- solving skills

- Excellent written and verbal communication skills

- Proficient in the use of computers and software

Responsibilities:

- Manage and review tax returns for individuals and companies

- Provide advice and counsel on tax planning and optimization strategies

- Assist clients in understanding and minimizing their tax liabilities

- Develop and implement tax strategies to reduce taxes owed

- Research and analyze tax implications of business decisions

- Represent clients before tax authorities

- Analyze and interpret changes in taxes law and regulations

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Tax Consultant resume?

The job market for tax consultants is competitive, so it is important for potential candidates to make their resumes stand out to get noticed by employers. A resume for a tax consultant position should include information that highlights the candidate’s qualifications and experience while also showcasing relevant skills and accomplishments. Here are some key items to include in a tax consultant resume:

- Professional Summary: A concise summary of your work experience, qualifications, and any special skills related to the role. This should be tailored to the specific job you are applying for and should clearly outline your ability to do the job.

- Education: Highlight any relevant educational qualifications, such as degrees, certificates, or other qualifications related to taxation.

- Work Experience: List any experience you have in tax consulting and any related positions. Include job titles, dates of employment, and a brief description of the duties and responsibilities you held.

- Technical Skills: Outline any relevant technical skills, such as proficiency in tax software, understanding of tax regulations, and knowledge of financial processes.

- Professional Skills: Include any additional professional skills such as problem-solving, communication, organization, and attention to detail.

- Accomplishments: Highlight any major accomplishments related to tax consulting, such as resolving complex tax issues or successfully closing deals.

By including these items in your tax consultant resume, you will have a better chance of standing out to employers. With a well-written resume, you will be in a better position to get an interview and land the job.

What is a good summary for a Tax Consultant resume?

A Tax Consultant is a professional who assists businesses and individuals in filing their taxes, managing their financial portfolios, and providing advice and guidance on tax-related issues. As such, a good summary for a Tax Consultant resume should highlight the candidate’s expertise in the field, experience in the industry, and knowledge of the latest tax laws and regulations. Specifically, the summary should emphasize an understanding of the taxation process, familiarity with various tax software applications, and the ability to provide clear and concise advice. Additionally, the summary should demonstrate strong organizational and problem-solving skills, as well as a dedication to providing exceptional customer service. Ultimately, a well-written summary statement can help a Tax Consultant stand out from the competition and increase their chances of securing a job.

What is a good objective for a Tax Consultant resume?

A Tax Consultant is responsible for helping individuals and businesses understand and manage their taxes. Crafting an effective resume objective is a great way to stand out to potential employers and highlight your qualifications. Here are some tips for creating a good objective for a Tax Consultant resume:

- Focus on key qualifications: Highlight your experience in tax planning, tax law, and financial planning.

- Showcase relevant certifications: If you have CPA, EA, or other tax-related certifications, include them in your objective.

- Demonstrate a commitment to accuracy: Stress your commitment to accuracy and compliance with tax laws and regulations.

- Emphasize customer service: Showcase your ability to understand and meet clients’ needs.

- Demonstrate organizational skills: Show that you can keep track of important documents and deadlines.

- Demonstrate comprehensive knowledge: Show employers that you have a comprehensive understanding of tax law and regulations.

- Stress professionalism: Make sure that you emphasize your professional demeanor and ability to work in a fast-paced environment.

How do you list Tax Consultant skills on a resume?

As a tax consultant, you will need to ensure your resume has the right set of skills to show the potential employer that you are qualified for the position. Here are some of the skills you should consider including on your resume to make sure you stand out from the competition:

- Knowledge of taxation laws: A tax consultant should have a comprehensive understanding of federal, state, and local taxation laws to guarantee accuracy in tax filings.

- Research skills: Excellent research skills are essential for a tax consultant to identify and resolve complex tax issues.

- Attention to detail: A tax consultant must be able to pay close attention to detail to ensure accuracy in their work.

- Problem solving: Tax consultants will often come across complex issues that require creative problem solving and analytical thinking.

- Communication: Tax consultants must be able to communicate clearly and concisely in order to explain complex tax issues to their clients.

- Interpersonal skills: A tax consultant must possess excellent interpersonal skills in order to gain clients’ trust and build lasting relationships.

- Teamwork: Tax consultants must be able to work effectively in a team in order to ensure accurate and timely filing of taxes.

These are just a few of the skills you should consider including on your resume to make sure you stand out from the competition. By demonstrating you possess all of the necessary skills and knowledge for a tax consultant, you will be able to make a strong impression on potential employers.

What skills should I put on my resume for Tax Consultant?

When looking for a job as a tax consultant, an employer will want to know that you have the right set of skills to effectively perform the role. To stand out on your resume, it is important to highlight the relevant skills that make you qualified for the position.

Including the right skills on your resume for a tax consultant role can help you land the job you want. Here are some skills to consider adding to your resume:

- Analytical Thinking: Tax consultants must be able to analyze complex tax data and identify any issues or discrepancies.

- Knowledge of Tax Regulations: You should have a thorough understanding of the tax regulations and laws that apply to the region you are working in.

- Research Skills: Tax consultants must be able to use various resources to find information and help clients find the best tax solutions.

- Communication Skills: Being able to effectively communicate with clients is essential for a tax consultant. You must be able to explain complex tax laws and regulations in a simple and easy-to-understand manner.

- Interpersonal Skills: Tax consultants must be able to establish a rapport with their clients and build trust and confidence.

- Time Management: Tax consultants are often dealing with multiple clients and projects at once, so it is important to have good time management skills and be able to prioritize tasks effectively.

By including these skills on your resume, you will give employers a better understanding of your qualifications and show why you are the ideal candidate for the job.

Key takeaways for an Tax Consultant resume

Your Tax Consultant resume is your opportunity to showcase your experience and highlight the special skills and expertise that sets you apart from the competition. In order to make the most of it, there are a few key elements you should consider including.

- Include your relevant experience: It’s important to highlight your experience in the field of tax consulting. If you’ve worked as an accountant or tax preparer, make sure the details of the job are included. Additionally, if you’ve done any volunteer work related to tax consulting, such as helping a nonprofit with its taxes, make sure to include that as well.

- Demonstrate your technical knowledge: Showcase your technical knowledge of tax laws, regulations, and other relevant concepts. Include any certifications or classes you’ve taken to stay on top of the latest tax changes and trends.

- Describe the results you’ve achieved: If you’ve taken part in successful tax consulting projects, it’s important to include the details. Describe what the project entailed, the challenges you faced, and the results you achieved. This will demonstrate your problem-solving skills and will show potential employers that you can achieve results.

- List any special skills you possess: Most tax consulting projects require specialized knowledge and skills. Include any special skills or experience you have that can help you succeed in the job, such as proficiency in a foreign language or experience with tax software programs.

By including these key takeaways, you can create a resume that will stand out from the competition and increase your chances of landing the job. With a little care and attention, you can ensure that your Tax Consultant resume will be an effective tool for finding the perfect job.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder