Are you looking to become a tax specialist? Writing a resume is an important part of the process, so you need to ensure that it portrays you in the best light to potential employers. This guide will provide you with the tips, tricks and examples you need to create a standout resume for a tax specialist position. We will cover the essential components of a resume, the format, and writing style and provide you with example resumes tailored to the specific needs of tax specialists, so you can create the document that puts you in the best position possible.

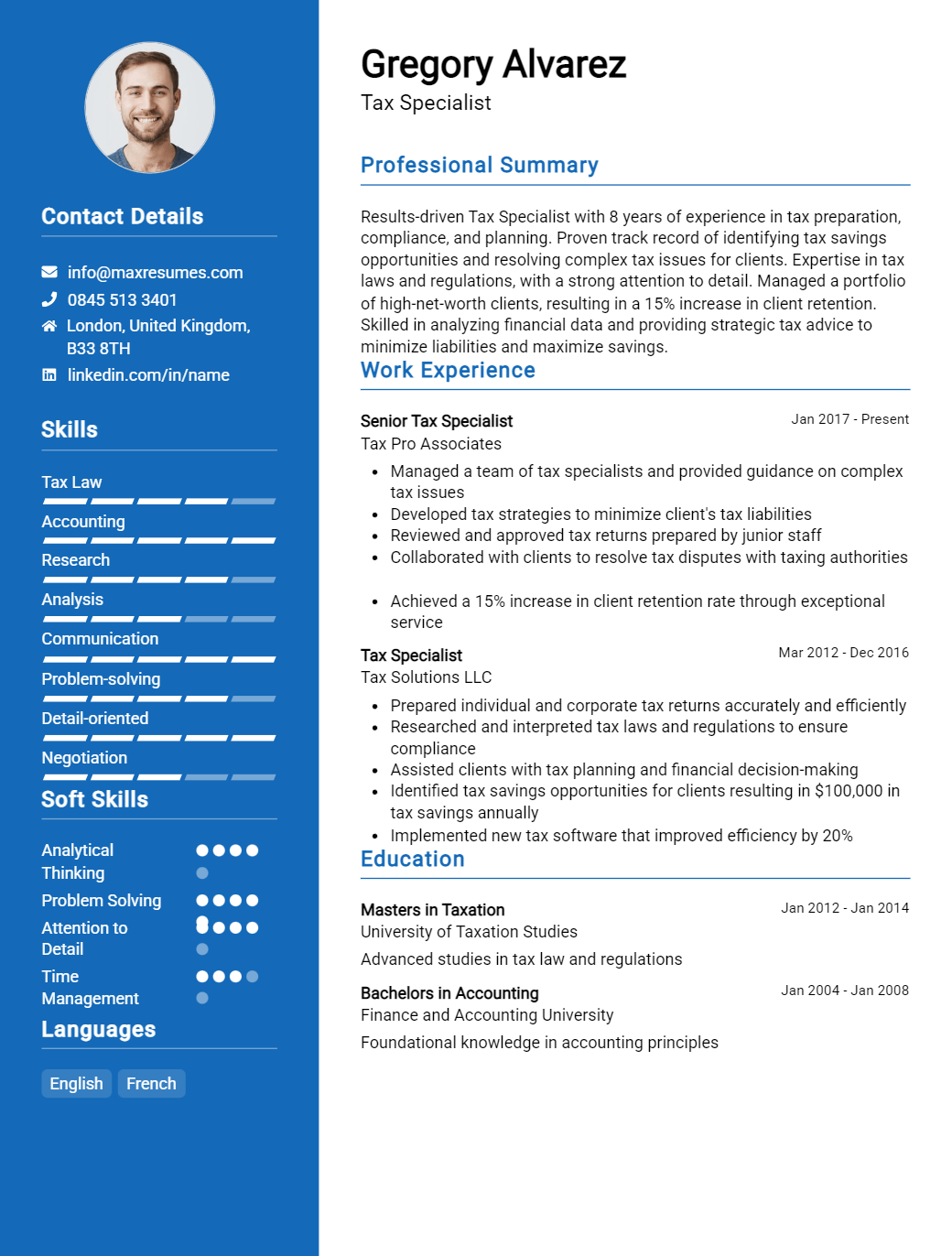

Tax Specialist Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Tax Specialist Resume Examples

John Doe

Tax Specialist

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am a highly organized, detail- oriented individual with 10+ years of experience in the field of taxation. My expertise includes effectively evaluating and analyzing financial statements, properly computing taxes owed, and preparing returns in a timely manner. I possess strong interpersonal skills to help build relationships with clients, as well as excellent problem solving and communication skills. I am confident that my knowledge and experience can contribute to any organization.

Core Skills:

- Tax Preparation

- Financial Statement Analysis

- Tax Law Knowledge

- Accounting Principles

- IRS Correspondence

- Tax Planning

- Research and Compliance

- Auditing

- Problem Solving

- Interpersonal Communication

Professional Experience:

Tax Specialist, ABC Financial Solutions, Houston, TX (2013- Present)

- Gather and analyze financial data to determine tax liabilities

- Accurately prepare and file tax returns for individuals, corporations, and LLCs

- Familiarize self with tax law changes and ensure compliance

- Develop and maintain relationships with clients

- Provide tax guidance and planning services to clients

Tax Accountant, XYZ Financial Services, Dallas, TX (2008- 2013)

- Executed accurate and timely preparation of tax returns

- Developed strategies to minimize tax liabilities

- Collaborated with clients to review tax records and develop strategies

- Communicated with IRS and state tax authorities to resolve any disputes

Education:

Bachelor of Science in Accounting, University of Texas, Austin, TX (2004- 2008)

Tax Specialist Resume with No Experience

Recent college graduate with ambition to enter the field of taxation, eager to use my strong organizational skills to provide exceptional customer service and successful tax preparation.

Skills

- Excellent written and verbal communication

- Proficient in a variety of tax software and applications

- Thorough knowledge of tax laws, regulations and procedures

- Strong organizational and analytical skills

- Ability to work independently and collaboratively

- Ability to manage multiple projects simultaneously

Responsibilities

- Prepare and file tax returns accurately and in a timely manner

- Research and analyze tax laws, regulations and procedures

- Respond to customer inquiries and resolve issues

- Develop and maintain relationships with clients

- Ensure compliance with federal and state tax laws

- Provide guidance and support to customers regarding tax issues

Experience

0 Years

Level

Junior

Education

Bachelor’s

Tax Specialist Resume with 2 Years of Experience

I am a Tax Specialist with two years of experience in preparing, filing and reviewing complex tax returns. With strong problem- solving skills and a thorough understanding of the tax code and regulations, I am highly experienced in tax auditing and consulting. I have abilities to assess and mitigate tax risk, apply tax strategies, and complete tax planning. I am also knowledgeable in international and federal tax law. I have proven expertise in advising clients on complex tax planning strategies and providing essential tax consulting services.

Core Skills:

- Tax Returns Preparation

- Tax Auditing

- Tax Consulting

- Tax Risk Assessment

- Tax Planning

- International & Federal Tax Law

- Tax Strategies

- Client Advising

- Complex Tax Planning

Responsibilities:

- Prepare and file federal, state and international tax returns.

- Analyze audit results and ensure compliance with domestic, international and federal tax law.

- Provide tax advice and assist in tax planning.

- Conduct tax research and resolve any tax- related issues.

- Identify and mitigate tax risks.

- Develop and implement innovative tax strategies.

- Prepare and review financial documents for accuracy.

- Identify potential tax savings for clients.

- Advise clients on complex tax planning strategies.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Tax Specialist Resume with 5 Years of Experience

A Tax Specialist with 5 years of experience in providing accurate and timely advice to clients on tax compliance, filing, and audit. Experienced in working with both individual and commercial tax clients to ensure taxes are filed on time and in accordance with the law. Possesses excellent analytical skills and is knowledgeable in the field of tax law.

Core Skills:

- Tax Compliance

- Filing and Audit

- Client Relations

- Tax Law

- Analytical Thinking

- Time Management

Responsibilities:

- Prepare and file taxes for corporate and individual clients

- Research and interpret new tax laws and regulations

- Analyze financial information and prepare tax returns

- Identify and resolve discrepancies in financial data and tax payment records

- Develop and maintain client relationships

- Create reports and present findings to clients

- Provide clients with advice on tax audits and compliance issues

- Assist with tax return preparation for audit and review

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Tax Specialist Resume with 7 Years of Experience

Highly skilled and motivated tax specialist with over 7 years of experience in analyzing, calculating and filing taxes. Possess an MBA in finance and taxation as well as expertise in accounting, financial analysis and state/ federal tax laws and regulations. Highly adept at identifying and solving tax related issues and ensuring compliance with key fiscal regulations.

Core Skills:

- Tax Preparation

- Tax Analysis

- Tax Law Compliance

- Financial Statements

- Accounting Principles

- Financial Auditing

- Financial Forecasting

- Budget Analysis

Responsibilities:

- Prepared and filed tax returns for individuals, businesses, trusts and estates

- Analyzed financial statements and tax returns to identify potential tax liabilities

- Calculated taxes due, utilizing applicable tax laws and regulations

- Reviewed tax statutes and kept up- to- date on current tax regulations

- Developed and implemented strategies to reduce tax liabilities

- Ensured compliance with all applicable state and federal tax regulations

- Prepared and submitted quarterly tax estimates

- Audited financial statements, payroll records and corporate tax returns

- Provided financial analysis and assistance with budgeting and forecasting

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Tax Specialist Resume with 10 Years of Experience

Highly experienced and motivated Tax Specialist with 10 years of experience in the field. Dedicated to providing accurate and efficient tax services to clients. Proven history of successful proficiency in compliance strategies, audits, IRS regulations and taxation. In- depth understanding of accounting and tax software, with a sincere commitment to client service and satisfaction.

Core Skills:

- Tax Preparation & Compliance

- Tax Research & Planning

- Auditing & Accounting

- IRS Regulations & Compliance

- Financial & Tax Analysis

- Client Relations & Service

- Tax Software & Technologies

- Problem- solving & Decision- making

Responsibilities:

- Preparation and filing of tax returns for individuals, corporations, and other entities.

- Audit and review of financial statements and other accounting documents.

- Research and analyze tax laws, regulations, and industry trends.

- Provide tax advice and assistance to clients.

- Resolve tax- related issues and disputes with the IRS.

- Prepare and review financial statements and other documents.

- Manage and coordinate tax audits and other compliance activities.

- Ensure compliance with federal, state, and local tax laws and regulations.

- Monitor and analyze tax legislation for implications and impacts.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Tax Specialist Resume with 15 Years of Experience

Experienced tax specialist with 15 years of experience in providing financial planning and tax management services for individuals and small businesses. Comprehensive knowledge and experience regarding the preparation and filing of personal, corporate, and partnership tax returns. Strong analytical, problem- solving, and organizational skills, with the ability to manage multiple tasks and deadlines effectively.

Core Skills:

- Tax Preparation & Analysis

- IRS Tax Law & Regulations

- Budgeting & Forecasting

- Financial Planning & Advice

- Accounting & Bookkeeping

- Payroll & Audits

- Business & Tax Consulting

Responsibilities:

- Prepared and analyzed federal, state and local income tax returns, corporate and partnership tax returns, payroll tax returns, and other tax filings.

- Analyzed financial records and tax returns to identify potential tax savings and deductions.

- Established and maintained positive working relationships with clients by providing accurate and timely information and advice.

- Prepared and monitored budgets, forecasts and other financial reports.

- Provided advice and financial planning services for both individuals and businesses.

- Assisted in developing methods for measuring the effectiveness of tax strategies and preparation.

- Determined and monitored the impact of changes in tax laws.

- Assisted in audits of financial and tax records.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Tax Specialist resume?

Writing a resume as a tax specialist requires an understanding of all the duties and responsibilities of the job. The resume should include information to showcase your qualifications, expertise, and experiences in tax accounting, tax filing, and other related roles.

In order to make a great impact, here are the key points to include in your tax specialist resume:

- Education: Include your degree or certification in accounting, finance, or a related field. Also, list any additional certifications or trainings you have completed related to taxes.

- Work Experience: List all the jobs you have held that involved tax-related duties. Be sure to include the name of the company, the position you held, the start and end dates, and a brief summary of the duties you performed.

- Skills: List any special skills or qualifications you possess that relate to your job as a tax specialist. This could include tax software proficiency, knowledge of IRS regulations, and experience with filing taxes.

- Software: Mention any software you are familiar with and experienced in using, such as tax filing software, accounting software, or data analysis tools.

- Professional Memberships: If applicable, list any professional memberships related to tax accounting, such as the American Institute of Certified Public Accountants or National Association of Tax Professionals.

By including all of these key points in your resume, you should be able to make an impression with potential employers and highlight why you are the best candidate for the job.

What is a good summary for a Tax Specialist resume?

A tax specialist resume summary should be concise and provide a concise overview of your unique skills and qualifications that make you the best candidate for the job. This should include your ability to analyze complex tax matters, suggest solutions to tax-related issues, and provide tax planning and compliance services. Additionally, highlight your knowledge of the applicable tax laws and regulations, your ability to manage multiple projects simultaneously, and your ability to work with a variety of clients. In addition, mention any relevant certifications or other qualifications that make you stand out as a tax specialist.

What is a good objective for a Tax Specialist resume?

A great objective for a Tax Specialist resume should showcase the candidate’s knowledge and expertise in the field, as well as their passion for staying up to date on the latest tax laws and regulations. A successful Tax Specialist should be able to accurately file tax returns, detect potential discrepancies, and provide sound financial advice.

- Demonstrate an extensive knowledge of tax laws and regulations

- Possess excellent organizational and problem-solving skills

- Proven ability to prepare and file accurate tax returns

- Adept at researching and analyzing financial data

- Skilled in identifying potential discrepancies, errors, and inconsistencies

- Experienced in providing sound, tax-savvy financial advice

- Committed to staying updated on the latest tax laws and regulations

- Ability to work independently and as part of a team

- Excellent interpersonal, communication, and customer service skills

How do you list Tax Specialist skills on a resume?

When it comes to listing tax specialist skills on your resume, it’s important to make sure you are accurately representing your qualifications. This includes both technical and soft skills, as well as any certifications you may have. Here is a guide to help you list your tax specialist skills on your resume:

- In-depth Tax Knowledge: Demonstrate your comprehensive understanding of tax laws, regulations and practices, as well as the ability to interpret and apply them to various situations.

- Tax Preparation: Display your experience in preparing individual and business tax returns.

- Problem-Solving: Showcase your ability to identify challenges, research potential solutions, and implement the best course of action.

- Financial Acumen: Highlight your knowledge of financial operations and ability to develop, track, and analyze budgets.

- Research Skills: Demonstrate your ability to search for and compile data, and analyze and evaluate financial records.

- Communication Skills: Illustrate your ability to effectively communicate with clients and co-workers, both verbally and in writing.

- Interpersonal Skills: Demonstrate your ability to work with a diverse group of people, build relationships, and effectively collaborate to achieve desired results.

- Time Management: Describe your ability to manage multiple projects and tasks, meet deadlines, and work within specified budgets.

- Certifications: Showcase any certifications in tax preparation that you may have obtained.

What skills should I put on my resume for Tax Specialist?

When applying for a job as a Tax Specialist, you want to make sure your resume includes the right skills to set you apart from other candidates. To help you get started, here are some of the key skills you should consider including on your resume for a Tax Specialist position:

- Tax Preparation: As a Tax Specialist, you should list your experience in preparing different types of tax returns. This includes income tax, corporate tax, state tax, and more.

- Tax Planning: Tax Planning involves making decisions that minimize the overall tax liability of an individual or business. This is an important skill for a Tax Specialist to have, as it helps ensure taxes are paid in the most efficient way.

- Tax Research: Tax Research involves gathering data and information to support tax planning activities. You should list any experience you have in researching and analyzing tax laws, regulations, and other information to identify any tax savings opportunities.

- Auditing: Tax Specialists may also be responsible for conducting audits to ensure accurate tax returns are filed. List your experience in this area, such as auditing financial records and documents, to show potential employers your knowledge in this area.

- Problem Solving: As a Tax Specialist, you should be able to quickly identify potential issues and develop solutions. List your problem solving skills to show employers you are able to handle complex tax issues.

By including these key skills on your resume for a Tax Specialist position, you can demonstrate to potential employers that you have the knowledge and experience to succeed in the role.

Key takeaways for an Tax Specialist resume

When it comes to applying for a job as a tax specialist, the key is to create a resume that stands out from the competition. A great resume will highlight your qualifications and experience in a way that will give potential employers an understanding of why you are the best candidate for the job. Here are some key takeaways for creating an effective tax specialist resume:

- Highlight your specialized skills. Showcase your skills in areas such as tax law, accounting, and financial analysis. This will give employers an idea of your expertise and show them that you are capable of tackling complex tax issues.

- Demonstrate your experience. List any internships, positions, or other related work that you have done in the past. This will help employers understand your technical knowledge and experience with tax-related matters.

- Showcase your knowledge of tax software. It’s important to demonstrate that you are knowledgeable about the various tax software programs and understand how to use them effectively.

- Demonstrate your ability to meet deadlines. Employers want to see that you are able to manage your time well and meet deadlines. Show them that you can handle the pressure and work efficiently.

- Demonstrate your communication skills. Demonstrate that you can communicate with clients and other professionals in a clear and concise manner.

By following these key takeaways, you can create an effective resume that will help you stand out from the competition when applying for a job as a tax specialist. Employers want to see that you have the skills and experience necessary to be successful in the position, so make sure to highlight your qualifications and experience in your resume.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder