Whether you’re a seasoned trust officer or just starting out in the field, creating a resume can be a daunting task. It’s important to ensure that your resume accurately reflects your qualifications and experience, as this will be one of the first impressions you make in the job market. It’s important to create a resume that demonstrates the unique skills and experience you possess, utilizing the best practices for trust officer resume writing. This guide will provide you with the tips and tricks you need to create a winning trust officer resume.

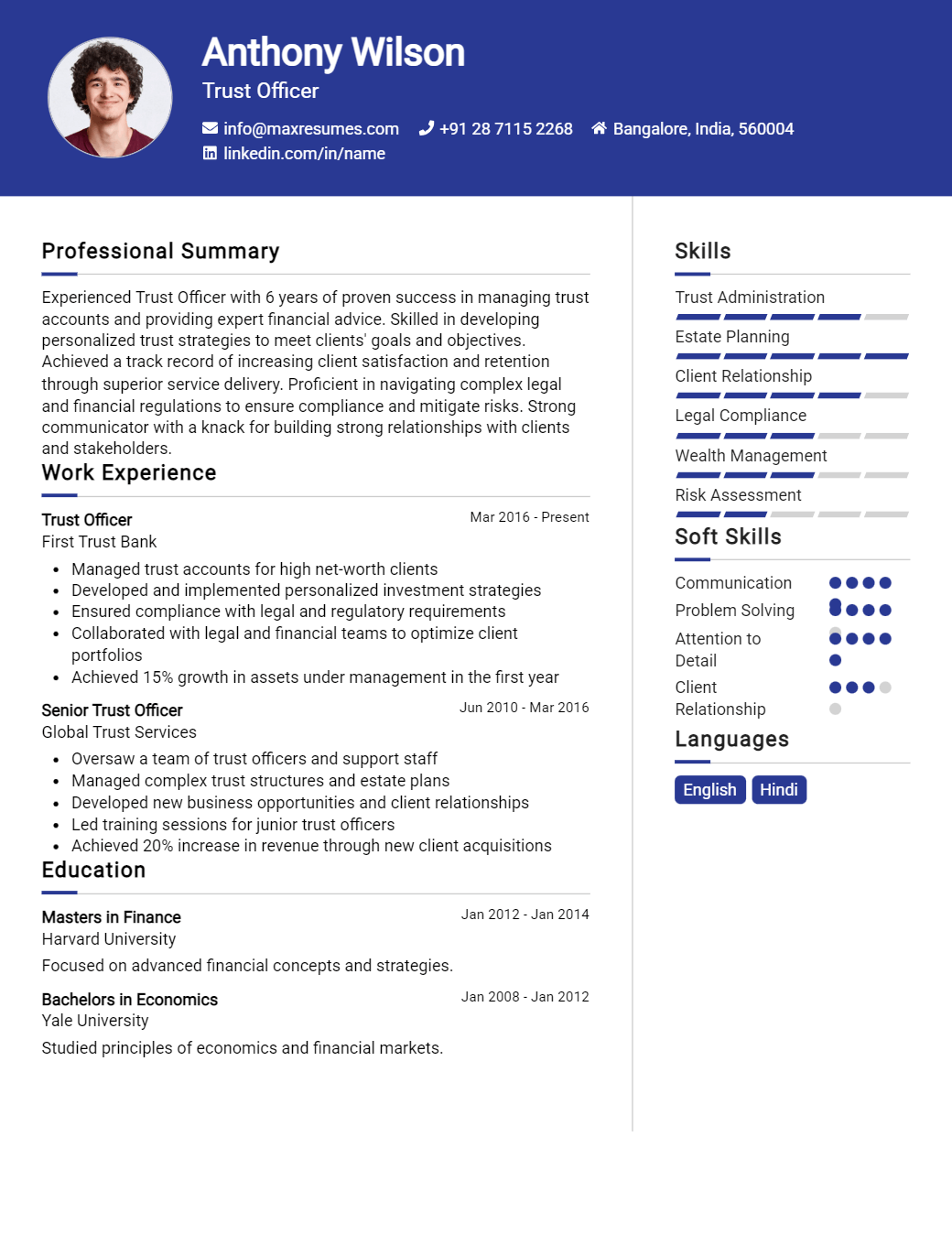

Trust Officer Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Trust Officer Resume Examples

John Doe

Trust Officer

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am a highly experienced trust officer with over 10 years of experience in trust administration. I have a sound knowledge of trust services, wealth management, and fiduciary services. I am proficient in client relationship management, asset servicing, and compliance procedures. I possess excellent communication and interpersonal skills as well as a commitment to delivering the highest levels of service to clients. I am a team player who is able to work independently to achieve the desired results.

Core Skills:

- Trust Administration

- Wealth Management

- Fiduciary Services

- Client Relationship Management

- Asset Servicing

- Compliance Procedures

- Communication

- Interpersonal Skills

- Organizational Skills

- Attention to Detail

- Problem- solving

- Time Management

Professional Experience:

Trust Officer, ABC Bank, Washington D.C. 2010 – Present

- Managed a portfolio of trusts for high- net- worth clients.

- Coordinated with trust beneficiaries to ensure proper trust administration.

- Advised clients on trust management, investment strategies, and asset protection.

- Assisted clients in preparing tax returns, making financial decisions, and managing assets.

- Ensured compliance with local, state, and federal laws governing trust operations.

- Resolved any conflicts or issues related to trust assets and distributions.

Trust Officer, XYZ Bank, Baltimore, MD 2005 – 2009

- Supervised a team of trust officers in the administration of trust accounts.

- Provided fiduciary services to clients, including estate planning and asset management.

- Performed regular reviews of trust documents and made recommendations for amendments.

- Handled client inquiries and complaints related to trust accounts in a timely manner.

- Monitored investments of trust funds to ensure compliance with regulations.

Education:

Bachelor of Arts in Finance, University of Maryland, College Park, MD, 2002

Trust Officer Resume with No Experience

Recent graduate with excellent communication and interpersonal skills, looking for an opportunity to contribute in the field of trust officer.

Skills

- Strong communication skills

- Attention to detail

- Ability to multitask

- Organizational skills

- Excellent time management

- Proficient in MS Office applications

Responsibilities

- Reviewing and analyzing trust documents

- Assist in the preparation and execution of trust documents

- Research and analyze trust instruments

- Monitoring and reconciling trust accounts

- Provide detailed reports on trust accounts

- Review account statements and other documents

- Assist in trust administration and estate planning

- Ensuring accurate and timely trust transactions

- Gathering and maintaining trust records

- Providing advice and guidance to trust clients and beneficiaries

Experience

0 Years

Level

Junior

Education

Bachelor’s

Trust Officer Resume with 2 Years of Experience

I am an experienced Trust Officer with over 2 years of experience in the financial services industry. I am an organized and detail- oriented individual with great customer service skills. I have a deep understanding of legal, taxation, and banking regulations, as well as the ability to exercise sound judgment and risk management skills. I have a proven track record of successfully managing sensitive financial matters for clients, such as trust and estate planning, wealth management, and financial account management. I am confident that my experience and knowledge will provide excellent service to clients.

Core Skills:

- Knowledge of legal and taxation regulations

- Excellent customer service skills

- Risk management and sound judgment

- Trust and estate planning and wealth management

- Financial account management

- Strong organizational, problem- solving and communication skills

Responsibilities:

- Manage trust accounts and financial assets of clients

- Assist in the development and implementation of trust and estate plans

- Ensure compliance with tax, insurance and banking regulations

- Facilitate financial transactions, such as withdrawals and transfers

- Prepare and review documents relating to trust and estate law

- Analyze long- term financial objectives and plans

- Maintain accurate records and financial reports

- Provide customer service, including responding to client inquiries and resolving disputes

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Trust Officer Resume with 5 Years of Experience

Highly experienced Trust Officer with over 5 years of experience supporting clients in meeting their fiduciary responsibilities. Proven ability to create and maintain relationships with clients, conduct appropriate due diligence and review legal documents. Adept at providing excellent customer service and maintaining accurate financial records and reports. Experienced in developing and implementing effective trust administration policies and procedures to meet clients’ needs.

Core Skills:

- Trust Administration

- Client Relationship Management

- Financial Record Maintenance

- Legal Document Review

- Due Diligence

- Communication Skills

- Regulatory Compliance

- Time Management

Responsibilities:

- Managed a variety of financial accounts and trusts in accordance to state regulations

- Monitored and enforced trust regulations in accordance to trust documents and applicable regulations

- Conducted due diligence and review of legal documents to ensure trust policies and guidelines were followed

- Kept client records and financial statements up to date and accurate

- Maintained open communication and positive relationships with clients and their families

- Developed, implemented and monitored trust administration policies and procedures

- Provided excellent customer service to clients and their families

- Ensured compliance with all applicable state and federal regulations

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Trust Officer Resume with 7 Years of Experience

Highly experienced Trust Officer with seven years of professional experience in the banking industry. A proven track record of managing highly complex financial transactions and financial planning. Committed to providing superior customer service while ensuring all trust transactions are completed with accuracy and integrity. Demonstrated excellent problem solving, communication, and organizational skills.

Core Skills:

- Trust Administration

- Customer Service

- Financial Planning

- Risk Management

- Tax Planning

- Investment Management

- Regulatory Compliance

Responsibilities:

- Performed trust administration duties including accounting, record keeping, and investments management

- Reviewed and implemented trust documents, such as wills, to ensure compliance with state and federal laws

- Developed and maintained relationships with clients and trust beneficiaries

- Monitored trust accounts to ensure accurate records and compliance with relevant regulations

- Advised clients on investments, trust tax status, and other financial considerations

- Provided professional financial advice and counsel to clients

- Counseled clients on trust and estate planning, asset protection, and legal issues

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Trust Officer Resume with 10 Years of Experience

Trust Officer with 10 years of experience in the banking and finance sector. Skilled in managing client’s financial affairs, executing legal documents, and helping clients reach their financial goals. Has extensive knowledge of trusts and estate planning and a proven track record in providing accurate and timely services to clients. Proficient in financial analysis and risk management, estate planning, and trust agreement administration. Flexible, organized, and reliable with excellent communication and interpersonal skills.

Core Skills:

- Trust and Estate Planning

- Financial Analysis

- Risk Management

- Client Relationship Management

- Investment Analysis

- Regulatory Compliance

- Documentation and Record Keeping

- Asset Management

- Tax Planning

- Problem Solving

Responsibilities:

- Manage client accounts and establish trust agreements in accordance with applicable laws.

- Analyze client financial status and advise on the best approach to meet their financial goals.

- Execute documents to ensure trust compliance with applicable laws.

- Monitor trust investments and review proposals for any changes.

- Prepare and maintain accurate records in accordance with accounting and tax regulations.

- Work closely with clients to provide advice and assistance with estate planning, trust agreements, and asset management.

- Develop financial plans to help clients reach their financial goals.

- Monitor trust accounts and prepare regular financial reports to clients.

- Ensure compliance with federal and state regulations.

- Maintain client confidentiality and provide professional customer service.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Trust Officer Resume with 15 Years of Experience

Experienced Trust Officer with 15+ years of experience in the banking and financial services industry. Skilled in financial planning and analysis, portfolio management, client services, and relationship management. Proven record of developing and managing trust accounts, identifying and implementing trust strategies, and resolving client issues. A strong communicator with excellent organizational and interpersonal skills.

Core Skills:

- Financial Planning and Analysis

- Portfolio Management

- Client Services

- Relationship Management

- Account Administration

- Trust Strategies

- Regulatory Compliance

- Risk Management

- Conflict Resolution

Responsibilities:

- Established and managed trust accounts for clients, ensuring proper documentation and compliance with regulations.

- Developed trust strategies for clients and provided advice on investment, diversification, and asset allocation.

- Researched and analyzed financial markets, identifying and addressing emerging trends.

- Evaluated and monitored portfolio performance, making adjustments as needed.

- Responded to client inquiries, resolving any issues in a timely and professional manner.

- Developed and maintained positive relationships with clients, providing ongoing support.

- Reviewed and updated trust account records, ensuring accuracy and integrity of data.

- Ensured compliance with all applicable regulations and laws governing the handling of trust accounts.

- Assisted with audits and other trust- related activities.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Trust Officer resume?

- Professional Summary: A brief summary of the candidate’s qualifications, experience, and strengths

- Education: A list of any relevant educational credentials

- Experience: A detailed listing of any work experience, including job titles, companies worked for, and dates of employment

- Skills: A list of any specialized skills or knowledge related to trust officer positions

- Licensures & Certifications: Any trust-related certifications or licensures the candidate has obtained

- Professional Affiliations: Any professional organizations or associations the candidate is affiliated with

- Awards & Recognition: Any awards or recognition the candidate has earned for his or her work

- Additional Information: Any other pertinent information, such as volunteer experience, that could be useful

- References: A list of references who can attest to the candidate’s trustworthiness and qualifications

What is a good summary for a Trust Officer resume?

A trust officer resume should be a concise and comprehensive summary of a person’s experience, qualifications, and skills related to the trust management field. It should provide a comprehensive overview of the individual’s responsibilities and accomplishments working as a trust officer. The resume should include details about any relevant education, certifications, and training, as well as any management, legal, or financial expertise. This section should also highlight any relevant professional relationships and affiliations, such as with financial institutions and accountants. Finally, the summary should provide a clear and accurate representation of the individual’s trust management capabilities.

What is a good objective for a Trust Officer resume?

A trust officer resume should focus on your professional experience dealing with investments, legal documentation and managing finances. When writing the objective for a trust officer resume, it’s important to emphasize your skills and qualifications that can help you excel in the role.

Here are some good objectives for a trust officer resume:

- To leverage my X years of experience as a trust officer to help manage client investments and financial assets

- To apply my legal expertise in trust and estate management to ensure compliance with applicable laws

- To utilize my strong problem-solving and communication skills to provide excellent customer service and support

- To draw on my extensive knowledge of financial markets and investment strategies to help clients reach their financial goals

- To provide clients with personalized financial advice and support in order to help them achieve their desired outcomes

How do you list Trust Officer skills on a resume?

When writing a resume, it is important to highlight specific skills and experience that demonstrate your knowledge and qualifications as a Trust Officer. When crafting your resume, consider including the following skills and qualities to demonstrate your expertise in the role:

- Strong financial analysis and portfolio management skills: A successful Trust Officer must have the financial skills and knowledge to accurately analyze investments and portfolios and make sound decisions.

- Excellent communication and interpersonal skills: Trust Officers must be able to communicate effectively with clients and other professionals to build trust and ensure that their needs are met.

- Organizational and time management skills: Trust Officers must be able to manage multiple clients and tasks simultaneously and efficiently.

- Detailed oriented and problem-solving skills: Trust Officers must be able to analyze complex documents and financial information, identify areas of concern and develop solutions.

- Knowledge of legal and regulatory requirements: Trust Officers must be well-versed in the legal and regulatory requirements that govern the trust industry and ensure compliance.

- In-depth knowledge of estate planning: Trust Officers must be knowledgeable about estate planning and be able to provide clients with advice and guidance.

By incorporating these skills and qualifications into your resume, you can demonstrate that you are a qualified Trust Officer.

What skills should I put on my resume for Trust Officer?

A Trust Officer plays an important role in the financial industry, and it is important to demonstrate the right skills on your resume to stand out from the competition. Here are some recommended skills to include on your resume for a Trust Officer position:

- Knowledge of Trust Law: A thorough understanding of laws and regulations related to trust administration is essential for a successful Trust Officer. Demonstrating knowledge of California probate codes, Uniform Prudent Investor Act, and other applicable laws and regulations can help you stand out from the competition.

- Financial Acumen: Financial skill and knowledge is important for a Trust Officer since they are responsible for managing investments and financial portfolios. Demonstrating your financial acumen, such as experience with auditing, accounting, budgeting, and financial analysis, can support your candidacy.

- Attention to Detail: Trust Officers must be able to manage a variety of details while keeping track of financial accounts and investments. Demonstrating your attention to detail, such as being able to analyze financial statements and portfolios, can help you stand out in the search.

- Communication Skills: Trust Officers must be able to effectively communicate with trustees, beneficiaries, and other stakeholders. Showing that you have strong communication and interpersonal skills, such as the ability to present and explain complex financial concepts, can greatly benefit your candidacy.

- Analytical Thinking: Trust Officers must be able to evaluate and analyze financial data to make informed decisions. Showing that you have strong analytical skills, such as being able to identify trends and potential risks, can help you stand out for the role.

Key takeaways for an Trust Officer resume

When it comes to crafting a standout resume for a Trust Officer, there are a few key elements that should be included. As a Trust Officer, you will be responsible for administering and managing a variety of trusts, so highlighting these skills and experience on your resume is essential. Here are some key takeaways to keep in mind as you create your resume.

First, make sure to highlight your experience managing and administering trusts. Include your experience in setting up trust structures, managing assets, and administering tax, legal, and estate planning. Include any licenses or certifications you have acquired through your work, such as a Chartered Trust Officer.

Second, showcase your financial expertise. Highlight your knowledge of assets such as stocks, bonds, and mutual funds, as well as any accounting or bookkeeping experience. Showcase your knowledge of financial regulations, so hiring managers know you are able to navigate the complex legal requirements of trust management.

Third, emphasize your interpersonal skills. Trust Officers need to have strong communication skills to work with clients, so make sure to highlight your ability to interact with people and build trust. Also, emphasize your organizational skills, as Trust Officers need to be able to keep detailed records and documents for their clients.

By following these key takeaways, you can create a standout Trust Officer resume that will help you stand out from the competition. Highlighting your experience and expertise, as well as your interpersonal and organizational skills, will ensure that hiring managers see you as the ideal candidate for the job.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder