Are you searching for a job as a Financial Representative? Having a great resume is key to landing the job of your dreams. Writing a resume can be a difficult and time-consuming task, but with the right tips and tricks, you can be sure you are representing yourself in the best way possible. To help you get started, this guide will provide you with tips on writing a Financial Representative resume, complete with examples and templates to get you started.

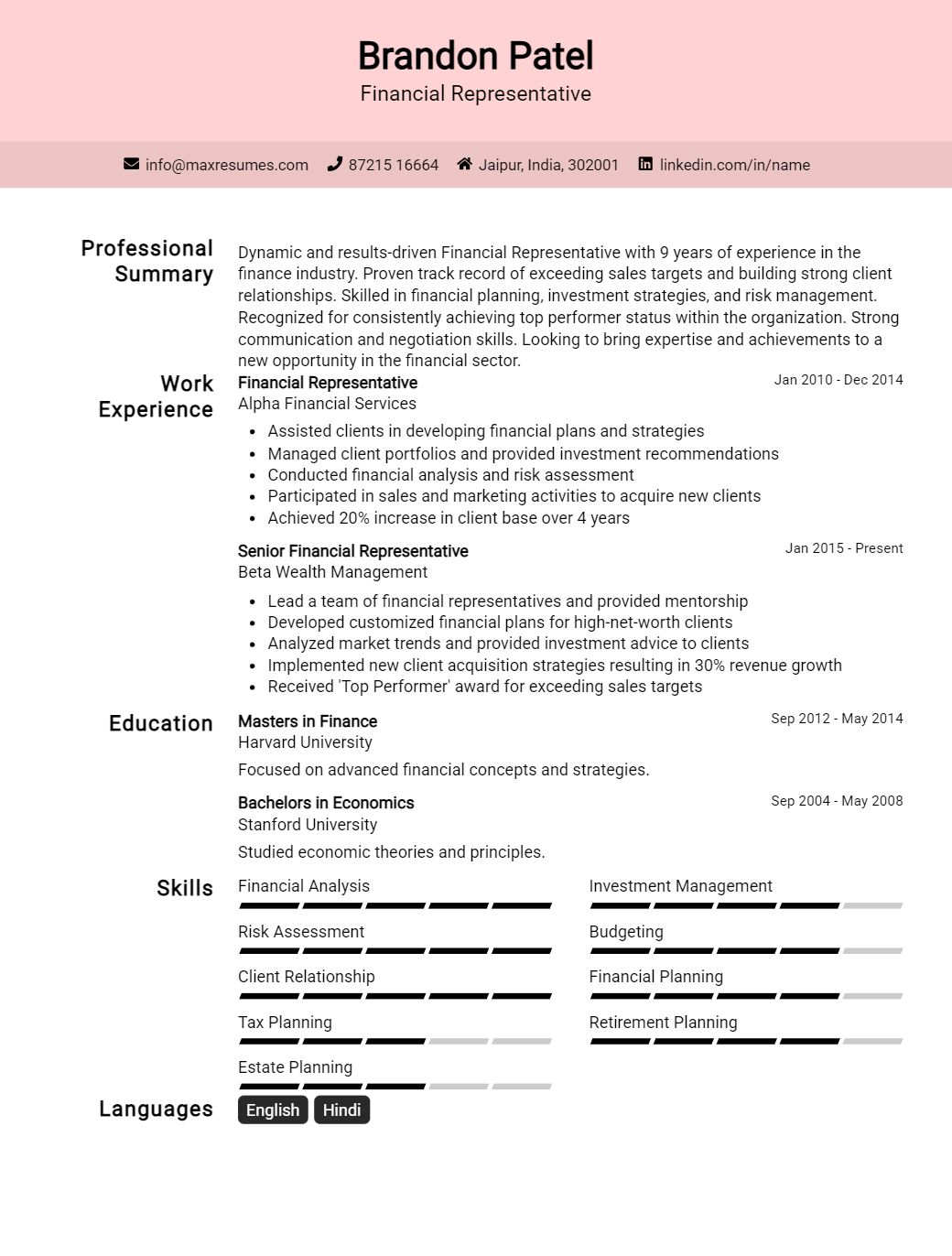

Financial Representative Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Financial Representative Resume Examples

John Doe

Financial Representative

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

Dynamic and results- driven Financial Representative with 8+ years of experience in providing financial advice and servicing to a diverse range of clients. Possess a Master of Science in Economics as well as Series 7 and Series 63 certifications. Skilled in performing financial analysis, establishing long- term strategies, and providing financial advice. Capable of offering client- focused services and managing portfolios with an emphasis on addressing client needs and meeting their financial goals.

Core Skills:

- Financial Analysis

- Relationship Management

- Investment Strategies

- Sales & Services

- Portfolio Management

- Risk Management

- Financial Planning

- Regulatory Compliance

Professional Experience:

Financial Representative, ABC Financial Group – 2018- 2020

- Developed and implemented financial planning strategies and investment portfolios for clients to meet their financial goals

- Researched financial data and analyzed risk to identify suitable investments for clients

- Provided advice and recommendations to clients based on their goals and financial situation

- Maintained client relationships by responding to inquiries, resolving issues, and providing updates on portfolio performance

- Ensured compliance with all regulatory requirements

Financial Consultant, XYZ Financial Group – 2015- 2018

- Developed and managed financial portfolios for clients

- Performed financial analysis and created investment plans

- Developed strategies to minimize risks

- Negotiated with clients to maximize profitability

- Reviewed and updated portfolio performance

Education:

Master of Science in Economics, University of California – 2015

Bachelor of Science in Economics, University of California – 2013

Financial Representative Resume with No Experience

Hardworking and motivated Financial Representative with no experience in the field, but strong interpersonal and analytical skills. Possesses excellent written and verbal communication skills and a strong understanding of financial markets. Able to provide accurate and organized financial advice to customers.

Skills:

- Excellent written and verbal communication

- Strong interpersonal skills

- Analytical and problem solving ability

- Accurate data entry

- Strong understanding of financial markets

Responsibilities:

- Answer customer questions regarding financial services

- Provide accurate and detailed advice to customers

- Process customer orders and transactions

- Ensure customer satisfaction with financial services

- Maintain accurate financial records and data entry

- Assist customers with any financial inquiries or issues

- Support the team in any financial services or customer service related tasks

Experience

0 Years

Level

Junior

Education

Bachelor’s

Financial Representative Resume with 2 Years of Experience

Enthusiastic Financial Representative with two years of experience in research and analysis of financial markets, and providing advice to clients. Excellent problem- solving skills and keen eye for detail help to provide sound financial advice to clients. Highly organized and able to multitask, allowing for the successful completion of multiple projects at once.

Core Skills:

- Investment Analysis

- Financial Planning

- Risk Management

- Customer Relationship Development

- Portfolio Management

- Wealth Management Strategies

Responsibilities:

- Analyze and research financial markets, identifying opportunities and risks

- Provide sound financial advice to clients on investments and strategies

- Develop financial goals and plans to meet client’s needs

- Manage client’s portfolio and investments

- Provide frequent updates to clients on their investments

- Coordinate with other financial professionals in order to provide the best service to clients

- Monitor client’s financial activity and alert them about any changes in their investments

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Financial Representative Resume with 5 Years of Experience

Dynamic and self- motivated Financial Representative with 5+ years of experience in the financial services industry. Possesses an MBA degree in Finance and a CFP certification. Proven ability to build relationships with clients and provide timely and accurate advice on investments and financial planning. Possess strong analytical, interpersonal and communication skills, as well as a drive for success.

Core Skills:

- Financial Planning

- Mutual Funds

- Portfolio Management

- Client Relations

- Investment Strategies

- Strategic Analysis

- Risk Management

- Financial Modeling

Responsibilities:

- Provide personalized investment advice to clients

- Analyze current portfolio and suggest appropriate investment strategies

- Monitor external economic trends and conditions and make recommendations accordingly

- Update client portfolios to reflect market changes and optimize returns

- Develop and execute financial plans to meet the requirements of individual clients

- Keep up- to- date with industry developments, products and services

- Perform risk assessments and provide effective solutions to minimize risk exposure

- Generate sales reports and analyze performance metrics to identify areas of improvement

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Financial Representative Resume with 7 Years of Experience

Results- oriented financial representative with 7 years of experience in financial services, banking, and customer service. Skilled in financial analysis, risk assessment, portfolio management and client relations. Possess excellent communication and problem- solving skills; able to quickly comprehend complex financial concepts and communicate them in a simple and understandable manner. Committed to providing the highest level of customer service and ensuring a positive customer experience.

Core Skills:

- Financial analysis

- Risk assessment

- Portfolio management

- Client relations

- Excellent communication

- Problem- solving

- Customer service

- Account management

- Investment strategies

- Regulatory compliance

Responsibilities:

- Developed and managed client portfolios, keeping abreast of current economic trends and investment strategies.

- Analyzed financial data and provided advice on risk mitigation and portfolio diversification.

- Assisted with complex financial transactions, including loans, investments and insurance.

- Monitored clients’ accounts to ensure regulatory compliance.

- Responded to customer inquiries and provided excellent customer service.

- Developed and maintained relationships with clients, understanding their financial needs and providing tailored solutions.

- Researched and implemented new investment strategies.

- Developed marketing materials and presentations to promote financial products and services.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Financial Representative Resume with 10 Years of Experience

Results- oriented financial representative with 10 years of experience in sales and customer service. Skilled in developing relationships with clients and ensuring the highest level of customer satisfaction. Proven ability to identify areas of improvement and implement changes to streamline processes. Excellent problem- solving, communication, and organizational skills.

Core Skills:

- Financial Analysis

- Data Analysis

- Customer Service

- Public Relations

- Sales Strategies

- Risk Management

- Regulatory Compliance

- Financial Goal Achievement

- Problem Solving

Responsibilities:

- Develop and maintain relationships with financial clients

- Provide comprehensive financial advice and guidance

- Evaluate financial goals and objectives

- Analyze and assess financial plans for clients

- Identify areas for improvement and make recommendations

- Negotiate and secure contracts for clients

- Implement risk management strategies for clients

- Develop and execute sales strategies to achieve financial goals

- Ensure regulatory compliance with all financial regulations

- Create and maintain accurate financial records

- Provide superior customer service and support

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Financial Representative Resume with 15 Years of Experience

Dynamic and performance- driven professional with over 15 years of progressive experience in the financial industry. Adept at identifying and leveraging opportunities to generate revenue and build on customer base. Proven record of providing superior customer service, expertise in financial products and services, and building strong relationships with clients. Skilled in developing and implementing financial strategies to achieve organizational objectives.

Core Skills:

- Comprehensive understanding of financial products, services, and regulations

- Excellent knowledge of financial industry and trends

- Proficient in financial analysis and forecasting

- Superior skills in communication and customer service

- Highly organized and detail- oriented

- Strong interpersonal, problem- solving and leadership skills

Responsibilities:

- Assisted clients in selecting appropriate financial products and services

- Analyzed financial data, developed financial strategies and identified areas to realize cost savings

- Developed marketing strategies to promote financial services and products

- Researched and recommended new financial products and services to clients

- Established relationships with clients and provided exceptional customer service

- Prepared financial reports, reconciliations and statements for clients

- Monitored and managed client accounts, approvals and payments

- Ensured compliance with company policies and regulatory requirements

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Financial Representative resume?

When you are looking to become a financial representative, it is essential to have a resume that highlights your relevant experience and qualifications. It’s also important to ensure that your resume includes the right elements to make a positive impression on potential employers. Here are some of the key details you should include in your financial representative resume:

- Education: Be sure to include your educational background, including the degree you earned, the school you attended, and any relevant courses you took.

- Professional Experience: List any prior experience you have in finance or a related field. Include details such as company names, job titles, responsibilities, and accomplishments.

- Certifications: If you have any financial certification, such as a CFP, CFA, or CPA, make sure to list those in your resume.

- Skills: Outline any relevant technical or interpersonal skills you possess, such as proficiency with financial software, excellent communication skills, and strong problem-solving abilities.

- Achievements: Include notable accomplishments you have achieved in your career, such as closing deals, developing strategies, or managing budgets.

By making sure your financial representative resume includes these important elements, you can maximize your chances of getting the job you want.

What is a good summary for a Financial Representative resume?

A Financial Representative resume summary should emphasize the candidate’s knowledge of banking and financial products, as well as their ability to analyze complex financial data. Additionally, the summary should highlight the representative’s experience in customer service and their success in helping clients reach their financial goals. The summary should also emphasize any special skills or certifications that make the candidate an ideal candidate for the financial representative role. Finally, the summary should showcase the representative’s ability to collaborate with other professionals in the field to develop strategies and plans to achieve clients’ financial objectives.

What is a good objective for a Financial Representative resume?

A Financial Representative is an individual who assists people with financial planning, investments, and insurance services. A Financial Representative should have excellent communication and customer service skills, as well as experience in finance and investments. The following are some objectives that can be used when writing a resume for a Financial Representative position.

- To secure a Financial Representative position where I can use my experience and knowledge in financial planning, investments, and insurance services

- To obtain a position in a financial institution where I can utilize my strong communication and interpersonal skills to benefit clients

- To obtain a job as a Financial Representative in a financial institution and leverage my understanding of the financial markets and investments to provide quality services

- To join a reputable financial organization as a Financial Representative and use my understanding of the financial markets and investments to help clients manage their financial goals

- To utilize my expertise in financial planning, investments, and insurance services to become a successful Financial Representative with a well-established financial organization

- To gain a position as a Financial Representative with a financial institution and help clients manage their financial assets in a responsible and effective manner

How do you list Financial Representative skills on a resume?

When constructing a resume for any career, it is important to list the skills that you possess which will be an asset to the job you are applying for. When it comes to a Financial Representative, there are specific skills that should be highlighted on the resume in order to make it stand out. Here is a list of the most important skills to list when constructing a resume for a Financial Representative position:

- Ability to effectively communicate with clients: The ability to effectively communicate with clients is essential to a Financial Representative in order to ensure that their clients fully understand the financial plans that have been put in place.

- Knowledge of financial products and services: Financial Representatives should have a good understanding of the various financial products and services available in order to best meet the needs of their clients.

- Analytical and problem-solving skills: Financial Representatives must have excellent analytical and problem-solving skills in order to be able to assess their clients’ financial situations and come up with the best possible solutions.

- Understanding of financial regulations: In order to ensure that their clients’ investments are being handled properly, Financial Representatives must have a good understanding of the various financial regulations.

- Ability to manage investments: Financial Representatives must have the ability to research, evaluate and manage investments in order to ensure that their clients’ investments are secure and performing well.

- Time management skills: Financial Representatives must be able to manage their time efficiently in order to ensure that all of their clients’ needs are met in a timely manner.

By including these skills in your resume, you will be demonstrating to potential employers that you have the qualities and abilities to be successful as a Financial Representative.

What skills should I put on my resume for Financial Representative?

As a Financial Representative, you will be responsible for managing and distributing financial products and services to customers. To be effective in this job, there are certain skills and qualities that employers look for in a candidate. Here is a list of skills that you should include on your resume when applying for a position as a Financial Representative:

- Knowledge of Financial Services: It is important that you have a thorough understanding of the financial services industry. This includes familiarity with investment products, retirement planning, and insurance products.

- Strong Communication Skills: As a Financial Representative, you will be interacting with clients on a daily basis. It is important that you have strong communication skills in order to effectively explain complex financial concepts and services to customers.

- Analytical Skills: Being able to analyze data and make sound financial decisions is essential for success in this role. You should be able to identify patterns and trends in financial data, and make decisions based on this information.

- Problem-Solving: Financial Representatives must be able to identify and troubleshoot problems related to financial products and services. You should be able to think critically and come up with solutions to complex financial issues.

- Customer Service: As a Financial Representative, customer service is a key part of your job. You must be able to build relationships with customers and provide them with the best service possible. You should also be able to handle customer complaints in a professional manner.

By including these skills on your resume, you can show potential employers that you are the ideal candidate for the position of Financial Representative.

Key takeaways for an Financial Representative resume

A Financial Representative resume is an essential document when it comes to showcasing your key skills, experiences, and abilities to potential employers. It’s important to take the time to craft a well-organized, professional document that accurately reflects your qualifications and highlights your best assets as a Financial Representative. Here are some key takeaways for creating an effective Financial Representative resume:

- Highlight Your Education and Certifications: Any Finance-related degrees, certifications, or diplomas should be prominently displayed in the resume’s education section. This will show employers that you are knowledgeable about the field and qualified for the position.

- Showcase Your Professional Experience: Employers want to see a track record of success in the Financial Services industry. Make sure to include relevant job titles, companies, and dates of employment.

- Demonstrate Your Ability to Manage Clients: As a Financial Representative, you will be responsible for managing clients and helping them reach their financial goals. List any relevant experience you have managing clients, such as successfully meeting client objectives or building strong relationships with clients.

- Include Your Network: It’s important for Financial Representatives to have a network of contacts in the industry. List any contacts you have in the finance world in your resume, including individuals you’ve worked with and organizations you’ve been a part of.

- Be Prepared: Finally, make sure to have an up-to-date version of your resume ready to go in case an opportunity arises. Having a professional-looking resume with up-to-date information can help you stand out from the competition and make a positive impression with employers.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder