Writing a resume as a credit representative can be a daunting task. This resume guide provides you with step-by-step advice on how to craft a winning resume that will get you noticed by recruiters and hiring managers. By following our tips, you’ll be able to create a resume that highlights the skills and qualifications you have to offer, making it easier for employers to identify your strengths and value as a potential employee. Furthermore, this guide includes valuable examples and templates to help you create a resume that is professional, clear and consistent. With these tips and examples, you’ll be able to make sure your resume stands out and properly communicates to employers why you are the perfect candidate for the job.

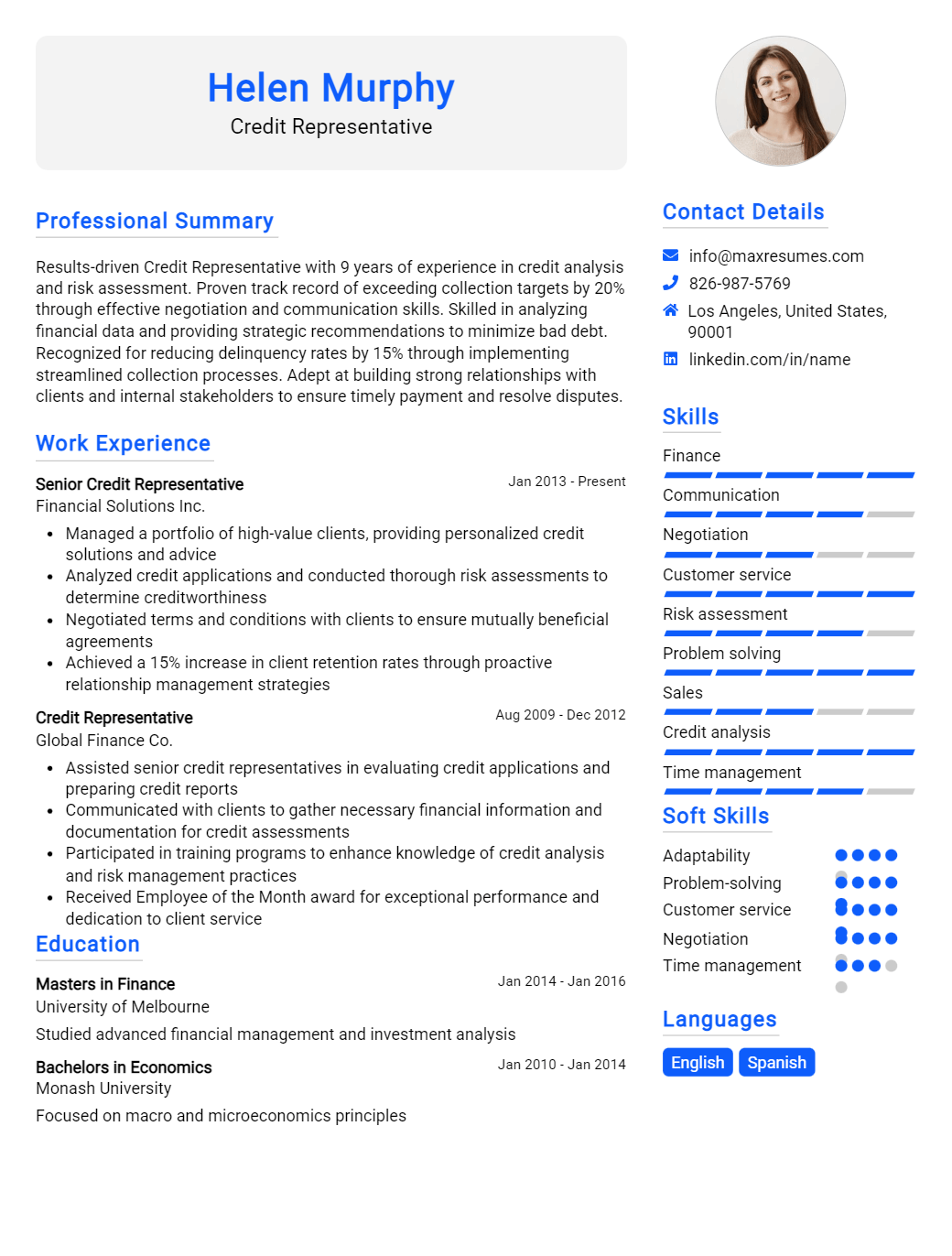

Credit Representative Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Credit Representative Resume Examples

John Doe

Credit Representative

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

A highly experienced and motivated Credit Representative with a proven record of success in providing customer service, credit analysis and financial expertise. Possessing a strong knowledge of credit products, industry regulations, and customer service principles. Experienced in working with both individual and corporate clients on a variety of complex credit cases. Possessing excellent problem- solving and communication skills.

Core Skills:

- Credit Analysis

- Financial Expertise

- Regulatory Compliance

- Customer Service

- Account Management

- Negotiation

- Problem Solving

- Time Management

Professional Experience:

Credit Representative

XYZ Finance, New York, NY

June 2020 – Present

- Analyzed customer financial information to determine creditworthiness based on established criteria

- Developed tailored credit solutions to meet customer needs and risk parameters

- Monitored customer accounts to identify potential credit issues

- Managed sales team to ensure customer service standards

- Negotiated payment arrangements with customers

- Responded to customer inquiries and complaints

- Ensured regulatory compliance on all credit accounts

Credit Analyst

ABC Bank, New York, NY

April 2018 – June 2020

- Reviewed customer financial information to assess credit risk

- Developed credit policies and risk management procedures

- Analyzed customer portfolios to identify trends and issues

- Developed credit reports for senior management

- Maintained customer records in compliance with industry regulations

- Monitored customer accounts to identify potential credit issues

- Negotiated payment arrangements with customers

Education:

Bachelor of Science in Finance

XYZ University, New York, NY, 2018

Credit Representative Resume with No Experience

Hard- working and motivated Credit Representative with a passion for customer service. Have no experience but possess a strong work ethic and the ability to quickly learn new concepts.

Skills

- Strong written and verbal communication

- Excellent interpersonal skills

- Effective problem- solving abilities

- Proficient with Microsoft Office Suite and other computer programs

- Knowledge of credit management and financial regulations

Responsibilities

- Greet customers and provide them with excellent customer service

- Answer questions regarding billing and payment options

- Collect payments from customers

- Handle customer complaints and effectively resolve them

- Negotiate payment plans with customers in order to secure payment

- Monitor and investigate suspicious credit activity

- Update customer accounts and billing information

- Maintain records of all credit transactions

- Provide customers with information about available credit options

Experience

0 Years

Level

Junior

Education

Bachelor’s

Credit Representative Resume with 2 Years of Experience

An experienced Credit Representative with two years of customer service experience and a Bachelor’s Degree in Business Administration. Highly skilled in establishing and maintaining successful customer relationships. Adept in managing accounts, processing payments, negotiating payment plans and resolving customer disputes. Experienced in researching and analyzing credit applications and constructing credit terms. Thorough understanding of collection laws, credit terms and regulations. Committed to providing customer service excellence with professionalism and integrity.

Core Skills:

- Account Management

- Payment Processing

- Credit Application Analysis

- Regulatory Compliance

- Credit Terms Drafting

- Customer Service Excellence

- Credit Dispute Resolution

- Negotiating Payment Plans

- Data Entry

Responsibilities:

- Answered customer inquiries regarding their accounts and payments

- Analyzed and processed customer credit applications

- Maintained customer accounts and records

- Performed collection activities in compliance with state and federal regulations

- Negotiated payment plans with customers

- Verified and updated customer information in the system

- Researched payment discrepancies and disputes

- Drafted credit terms and conditions

- Provided excellent customer service while resolving customer disputes

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Credit Representative Resume with 5 Years of Experience

A highly motivated and driven individual with a proven track record of success in the credit and financial services industry, I have over 5 years of experience in credit representative roles. I have a strong work ethic and a passion for developing relationships with clients. I’m a great communicator and problem- solver, and I have an impressive track record of success in helping to develop and manage credit risk strategies. My interpersonal skills, problem- solving abilities, and knowledge of credit regulations, services, and processes make me a great choice for a credit representative role.

Core Skills:

- Experienced in credit analysis/risk management

- Strong communication, customer service and problem- solving skills

- Understanding of banking regulations and practices

- Excellent written and verbal communication skills

- Proficient in Microsoft Office suite

- Knowledgeable about credit and financial services

- Ability to work independently and collaboratively

Responsibilities:

- Collecting and analyzing customer credit data

- Assessing and evaluating potential credit risks

- Drafting credit reports for potential customers

- Verifying information and credit documents

- Making decisions about granting credit

- Providing customer service to existing and potential customers

- Keeping up to date on changes in credit regulations and services

- Developing and managing credit risk strategies

- Ensuring compliance with credit and financial regulations

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Credit Representative Resume with 7 Years of Experience

A highly- motivated, organized and customer service- oriented individual with 7 years of progressive experience as a Credit Representative. Highly experienced in customer relations, dispute resolution, data entry and problem solving. Possess excellent communication skills, both verbal and written and adept in forming relationships with customers. Highly skilled in making sound decisions and developing customer strategy plans with the ability to prioritize tasks and meet deadlines.

Core Skills:

- Customer Service and Relations

- Research and Analysis

- Data Entry and Documentation

- Dispute Resolution

- Problem Solving

- Time Management

- Verbal and Written Communication

Responsibilities:

- Provided customer service for more than 10,000 customers.

- Performed credit analysis and financial due diligence in order to assess customer credit worthiness.

- Established and maintained relationships with customers in order to aid in dispute resolution and credit line changes.

- Negotiated credit terms and conditions with customers.

- Managed customer accounts and credit limits.

- Prepared and reviewed customer credit reports and financial statements.

- Resolved customer inquiries and complaints in a professional and courteous manner.

- Analyzed and monitored customer credit data.

- Generated customer letters and other documents related to credit.

- Assisted with the development of customer credit policies and procedures.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Credit Representative Resume with 10 Years of Experience

Highly experienced Credit Representative with a decade of experience in the field. Excellent working knowledge of credit and collections, customer service and financial operations. Proven success in achieving high performance and customer satisfaction. Possess excellent communication, negotiation and problem- solving skills.

Core Skills:

- Credit Analysis

- Debt Collections

- Customer Service

- Financial Operations

- Negotiation

- Problem Solving

- Communication

- Payment Processing

- Record Keeping

Responsibilities:

- Assisted with credit inquiries and application processing.

- Conducted credit analysis and made credit decisions.

- Processed payments and prepared related documents.

- Managed and monitored a portfolio of customer accounts.

- Researched and resolved customer inquiries and complaints.

- Negotiated payment arrangements and monitored performance.

- Monitored customer credit limits and issued credit warnings.

- Implemented strategies for collections and debt recovery.

- Analyzed customer accounts and identified delinquent accounts.

- Developed strategies to reduce bad debt and increase customer satisfaction.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Credit Representative Resume with 15 Years of Experience

I am an experienced Credit Representative with 15 years of experience in the banking and finance industry. I have a proven track record of achieving high levels of customer satisfaction while working in a fast- paced, team environment. My expertise includes credit analysis and risk management, customer service, innovative problem solving, and communication. I strive to remain up to date on the latest industry trends, regulations, and best practices. I am passionate about developing creative solutions and cultivating strong professional relationships with customers.

Core Skills:

- Credit analysis and risk management

- Customer service

- Strong problem- solving abilities

- Strong communication skills

- Knowledge of industry trends and regulations

- Strong relationship building skills

Responsibilities:

- Conduct credit analysis and risk assessment of customer applications

- Interview customers and review financial documents to assess creditworthiness

- Develop and maintain relationships with customers

- Monitor customer accounts to ensure compliance with regulations and best practices

- Resolve customer disputes and ensure accurate and timely dispute resolution

- Provide customer service and guidance regarding loan terms and conditions

- Collaborate with team members to ensure customer satisfaction

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Credit Representative resume?

Your resume is your chance to tell potential employers why you should be hired for the role of a Credit Representative. It should demonstrate your skills, qualifications and experience for the position. To make a strong impression, here are some things you should include in your resume:

- Professional Summary: A concise summary of your qualifications and experience, highlighting your most relevant skills and abilities related to the position.

- Education: List any relevant educational qualifications or certifications, such as a Bachelor’s degree in finance or accounting.

- Work Experience: Summarize your past experience as a Credit Representative, including any special projects or successful initiatives.

- Technical Skills: Demonstrate your knowledge of credit and loan processes, risk assessment, and customer service.

- Software Proficiency: List any software programs you are proficient in, such as loan origination systems and databases.

- Writing and Communication Skills: Showcase your ability to effectively communicate with customers and other stakeholders.

- Interpersonal Skills: Demonstrate your ability to build relationships and manage customer expectations.

By including the above elements in your resume, you’ll be able to show potential employers that you’re a qualified and experienced Credit Representative and the perfect fit for their team.

What is a good summary for a Credit Representative resume?

A Credit Representative is a professional who assists customers in dealing with credit-related issues. They are responsible for helping customers identify their credit needs, arranging loan applications and providing advice on credit-related matters. A good summary for a Credit Representative Resume should highlight the individual’s knowledge of credit policies and procedures, as well as their ability to analyze customer’s financial information. They should also demonstrate their excellent communication skills, including their ability to explain complex credit terms in a clear and concise manner. The summary should also demonstrate their ability to work with a wide range of clients, from small businesses to large corporations. Finally, the summary should also highlight the Credit Representative’s ability to effectively manage loan applications and ensure that all customers are satisfied with their credit services.

What is a good objective for a Credit Representative resume?

A Credit Representative resume should demonstrate a proven track record of success in the credit and loan industry. The objective should focus on the skills and experience that make the applicant qualified for the position and should demonstrate the individual’s passion for the role.

An effective Credit Representative resume objective should include the following:

- A commitment to responsible and ethical credit practices

- Strong customer service skills

- Excellent negotiation, communication and problem-solving skills

- A willingness to work with customers to find solutions that meet their needs

- Ability to handle customer inquiries and complaints

- Knowledge of credit and loan laws and regulations

- Proficiency with loan documentation and closing procedures

- Ability to work independently and handle a high volume of credit requests

These skills will help the applicant stand out from other job seekers, demonstrating their unique qualifications and how they can contribute to the success of the organization. Ultimately, the objective should demonstrate why the employer should hire the applicant, and why the applicant is the best choice for the job.

How do you list Credit Representative skills on a resume?

When crafting a resume, it is important to list your Credit Representative skills in a way that will draw the attention of potential employers.

Having a comprehensive list of the relevant Credit Representative skills that you bring to the table can provide recruiters and hiring managers with a clear picture of your qualifications and level of expertise.

Below are some Credit Representative skills to consider listing on your resume:

- Thorough knowledge of lending and collection regulations

- Experience in customer service and problem-solving

- Ability to establish and maintain customer relationships

- Proficiency in data analysis and report writing

- Excellent communication, interpersonal, and organizational skills

- Ability to build and maintain effective working relationships

- Knowledge of applicable banking regulations

- Computer proficiency with MS Office and other documented software

- Detail-oriented and self-motivated

- Ability to multitask and prioritize tasks effectively

- Excellent written and verbal communication skills

By showcasing the necessary Credit Representative skills on your resume, you can give hiring managers a better idea of your capabilities and help them determine if you are the right candidate for the job.

What skills should I put on my resume for Credit Representative?

When applying for a Credit Representative role, it is essential to highlight your skills on your resume in order to stand out from the competition. Your resume should showcase the skills you have that are relevant to the job and demonstrate why you are the best candidate for the position. Here are some of the most important skills that you should include on your resume for a Credit Representative role:

- Knowledge of Credit Procedures: As a Credit Representative, you need to be knowledgeable in credit procedures and regulations. It is essential to demonstrate on your resume that you understand the laws and regulations surrounding credit, and that you can apply them effectively in your work.

- Analytical Skills: You need to be able to analyze data and financial documents in order to evaluate the creditworthiness of a customer. Make sure you highlight your ability to analyze data and draw accurate conclusions quickly.

- Communication Skills: As a Credit Representative, you need to be able to communicate effectively and clearly with customers, lenders, and colleagues. Demonstrate your excellent communication skills by highlighting your ability to explain complex concepts to customers and colleagues in a clear and concise manner.

- Negotiation Skills: Negotiating the terms of credit agreements is a critical part of the job. Make sure you demonstrate your ability to negotiate favorable terms and conditions for customers and lenders alike.

- Problem-Solving Skills: As a Credit Representative, you need to have the ability to solve problems quickly and accurately. Showcase your ability to think on your feet and come up with creative solutions to problems.

- Attention to Detail: It is essential to be able to pay close attention to details in order to ensure accuracy. Demonstrate your attention to detail by highlighting your ability to double-check documents and credit reports for accuracy.

Key takeaways for an Credit Representative resume

When it comes to crafting a credit representative resume, there are some key takeaways to keep in mind that can help you stand out from the competition.

First, it is important to emphasize any relevant work experience you have, especially in the financial industry. This could include working in a bank, loan office, or other financial institution. Showcasing your experience in this field can demonstrate that you are familiar with credit policies and procedures, and you have a strong understanding of how the system works.

Another key takeaway is to include any certifications or other credentials you may have. This can show potential employers that you are committed to staying up-to-date with the latest trends in the field. Credit representatives also need to be proficient in customer service, so highlighting any related experience or training you have can be beneficial as well.

Finally, it is important to highlight any special skill sets or qualities you possess that make you an ideal candidate. This could include being detail-oriented, having strong organizational skills, or being proficient in the use of various financial software applications. Showcasing such skills can help employers recognize that you are a well-rounded credit representative who can handle the job with efficiency and accuracy.

By keeping these key takeaways in mind when crafting your credit representative resume, you can ensure that it stands out and gets noticed by potential employers.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder