Writing a resume for a financial counselor position can be daunting. After all, this is a field that requires a great deal of knowledge and skill. You must be able to demonstrate your expertise in finance, money management, and investments, while still showing employers why you would be the perfect fit for their team. Crafting a standout resume is essential to success in the world of finance and this guide will provide essential tips and tricks to help you create an effective financial counselor resume that will get you noticed. From choosing the right format and writing a powerful summary to highlighting your experience and skills, this guide will help you craft the perfect resume for your next financial counselor position. Examples are included throughout to ensure you create a resume that will leave employers impressed.

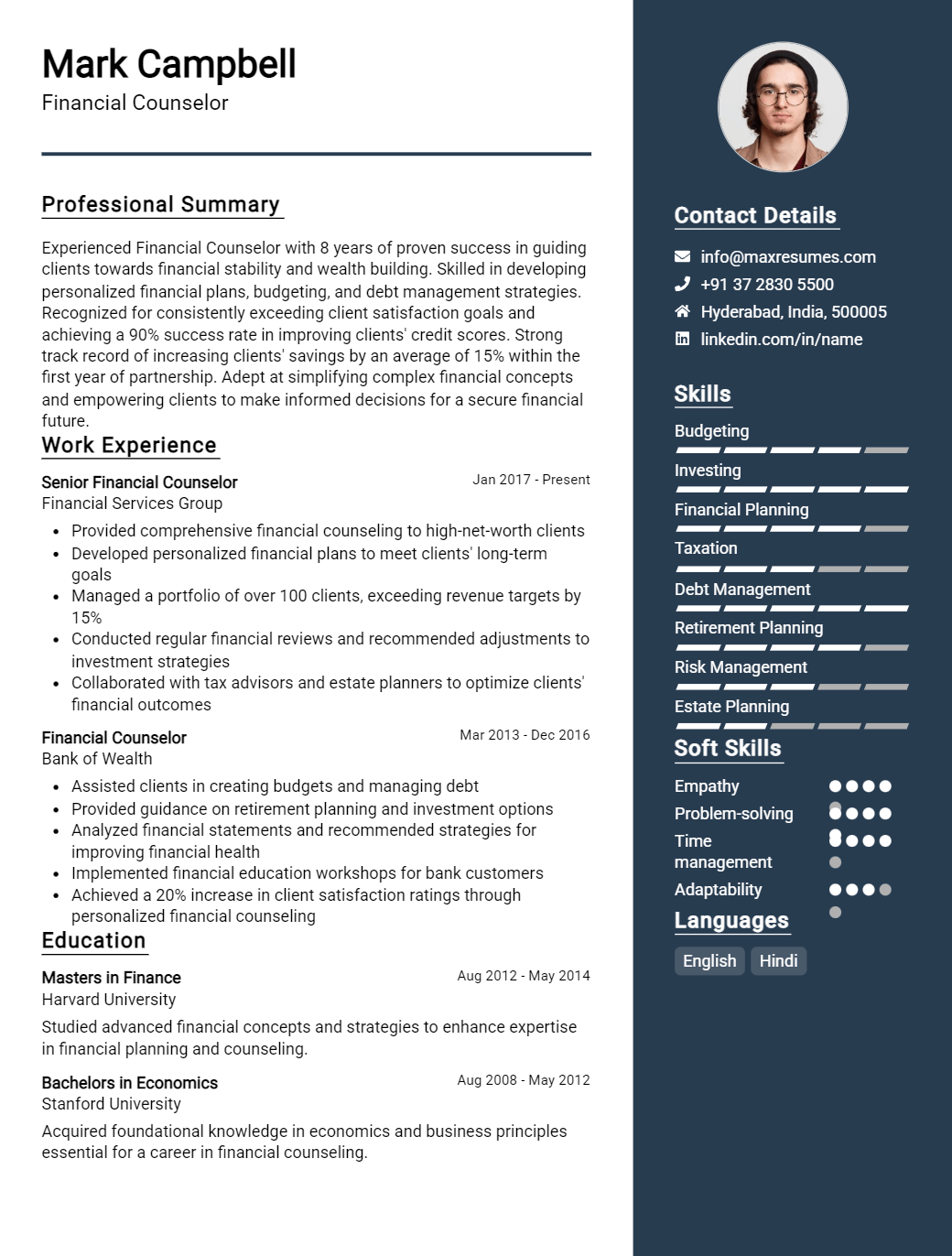

Financial Counselor Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Financial Counselor Resume Examples

John Doe

Financial Counselor

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am an experienced Financial Counselor with 5 years of experience in providing professional financial advice and guidance. I am adept at helping clients make personal budgeting decisions, exploring debt relief options, and developing retirement plans. My passionate commitment to helping people is combined with a strong knowledge of financial products and services. I am a detail- oriented professional who is confident in my ability to provide clients with sound financial advice and counseling services.

Core Skills:

- Knowledge of financial products and services

- Comprehensive understanding of personal budgeting

- Experienced in debt relief options and retirement planning

- Excellent communication, interpersonal, and problem- solving skills

- Ability to work independently and as part of a team

- Highly organized and detail- oriented

Professional Experience:

Financial Counselor, ABC Financial Services – New York, NY (2015- 2020)

- Offered financial advice and guidance to clients on issues such as budgeting, debt relief, and retirement planning

- Analyzed data, prepared reports, and presented financial recommendations to clients

- Established and maintained professional relationships with clients

- Educated clients on financial resources and services available to them

- Developed and implemented strategies to help clients reach their financial goals

Education:

Bachelor’s Degree in Business Administration, New York University – New York, NY (2012- 2015)

Financial Counselor Resume with No Experience

Hardworking and detail- oriented Financial Counselor with a strong focus on providing excellent customer service. Passionate about helping clients make sound financial decisions and developing practical solutions to complex financial issues.

Skills

- Analytical Thinking

- Financial Planning

- Financial Analysis

- Data Interpretation

- Problem Solving

- Strong Verbal Communication

- Customer Service

Responsibilities

- Provide support to customers in their financial planning and decision- making processes.

- Analyze customer’s financial data and advise them on budgeting and debt management.

- Provide sound financial advice and guidance to clients on various investment options.

- Conduct research and provide detailed financial reports to clients.

- Evaluate and analyze customer’s financial goals and objectives to develop tailored solutions.

- Maintain client relationships by responding to customer inquiries and resolving customer issues in a timely manner.

- Keep up- to- date with financial regulations and changes in the market.

Experience

0 Years

Level

Junior

Education

Bachelor’s

Financial Counselor Resume with 2 Years of Experience

A highly experienced Financial Counselor with 2 years of experience in providing financial advice, counseling services and financial planning to individuals and groups. Possess a comprehensive knowledge of financial products, services, and regulations. A track record of developing effective strategies to help clients achieve their financial goals and objectives. Experienced in developing budgets and financial plans and structures.

Core Skills:

- Financial advising

- Budgeting

- Financial planning

- Financial product and service knowledge

- Client relations

- Risk management

- Regulatory compliance

- Investment analysis

- Financial statement analysis

Responsibilities:

- Developed financial plans for individual and group clients, based on their financial goals and objectives

- Analyzed clients’ financial statements to determine their current and future financial situation

- Provided detailed advice and counsel on investment portfolios and retirement planning

- Assessed clients’ risk tolerance and helped them select appropriate financial products and services

- Developed and monitored budgets for clients to ensure their financial goals were met

- Implemented strategies to reduce debt, increase savings and build wealth

- Ensured all services and products met regulatory requirements and industry standards

- Provided ongoing support and guidance to help clients reach their financial goals

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Financial Counselor Resume with 5 Years of Experience

Accomplished Financial Counselor with 5 years of experience providing trusted advice and guidance to individuals and businesses regarding financial matters. Expertise in financial planning, budgeting, debt management, investments, and taxation. Highly skilled at analyzing financial data, developing strategies, and identifying opportunities for maximizing returns. Passionate about providing individuals and businesses with the skills to improve their financial well- being.

Core Skills

- Financial Planning

- Taxation

- Investment Analysis

- Debt Management

- Budgeting

- Financial Reporting

- Financial Research

- Financial Modeling

- Data Analysis

Responsibilities

- Provided consultation and guidance to individuals and businesses on financial matters

- Analyzed financial data to identify opportunities for improving financial performance

- Developed financial plans, budgets and strategies to help individuals reach their financial goals

- Facilitated the setup of investment portfolios and tracked investments to maximize returns

- Prepared financial reports and forecasts to monitor progress

- Assisted with tax preparation and planning to ensure compliance with tax laws and regulations

- Provided advice on debt management and repayment

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Financial Counselor Resume with 7 Years of Experience

Highly motivated and enthusiastic Financial Counselor with 7 years of experience assessing and evaluating clients’ financial situation, providing helpful financial advice and assisting clients in making sound financial decisions. Possessing excellent problem- solving and communication skills and a commitment to maintain the highest level of client confidentiality.

Core Skills:

- Financial counseling

- Budget planning

- Credit management

- Client assessment

- Problem solving

- Data analysis

- Communication

- Accountability

- Confidentiality

Responsibilities:

- Assessed and evaluated clients’ financial and asset portfolio

- Developed and implemented appropriate financial solutions tailored to the individual needs and objectives of the clients

- Assisted clients in creating, managing and evaluating their budgets

- Provided guidance on credit management, debt repayment and investment planning

- Reviewed and monitored clients’ financial situation and provided recommendations on ways to improve their financial performance

- Facilitated financial planning and asset management workshops to clients

- Ensured a high level of client confidentiality and provided ethical financial advice in accordance with professional standards

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Financial Counselor Resume with 10 Years of Experience

Highly experienced Financial Counselor with 10+ years in the financial services industry. Skilled in providing financial guidance to customers on a range of financial services, including budgeting and debt management. Comprehensive knowledge of banking regulations, lending processes and credit policies. Proven track record of providing superior customer service and resolving customer concerns in an effective and timely manner.

Core Skills:

- Comprehensive knowledge of banking regulations, lending processes and credit policies

- Experienced in budgeting, debt management and financial planning

- Skilled in counseling customers on a range of financial services

- Proven track record of providing superior customer service

- Excellent interpersonal and communication skills

- Detail- oriented and highly organized

Responsibilities:

- Develop and implement strategies for meeting customer’s financial goals

- Advise customers on available financial services and products

- Evaluate customer’s financial situation and provide personalized financial advice

- Monitor customer’s accounts and provide updates on any changes

- Assist customers with budgeting and debt management

- Address customer inquiries and complaints in a timely and professional manner

- Provide financial counseling to customers on loan products and services

- Maintain accurate records of customer’s accounts and activities

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Financial Counselor Resume with 15 Years of Experience

A highly motivated and organized Financial Counselor with 15 years of experience providing support throughout the customer life cycle. Experienced in providing customer service, financial advising, banking operations, and customer relations. Highly knowledgeable in financial planning, financial management, and working with customers to provide exceptional banking services. A team player who is reliable, dependable and organized with a strong ability to multi- task and effectively manage time.

Core Skills:

- Customer Service

- Financial Planning

- Financial Management

- Banking Operations

- Customer Relations

- Time Management

- Problem Solving

- Organizational Skills

Responsibilities:

- Provided customer service to clients and responded to inquiries in a timely manner.

- Assisted customers in completing banking transactions such as deposits, withdrawals, transfers, and loan applications.

- Developed financial plans for clients and provided them with advice on budgeting and savings.

- Performed daily banking operations such as balancing cash drawers, opening and closing accounts, and preparing paperwork.

- Worked closely with customers to build long- term relationships and develop trust.

- Resolved customer issues and complaints quickly and with professionalism.

- Monitored customer accounts and provided timely follow- up to ensure customer satisfaction.

- Adhered to banking policies and procedures to ensure accuracy and security.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Financial Counselor resume?

The financial counselor profession is an important one, requiring a great deal of knowledge and expertise. A well-crafted financial counselor resume should communicate the candidate’s qualifications and highlights the unique skills and accomplishments that make them a great fit for the role. Here are a few items that should be included in a financial counselor resume:

- Education: Include the relevant educational degrees and certifications that are necessary for the role, such as a degree in finance, economics, or accounting.

- Professional Experience: List any previous financial counseling experience and highlight any accomplishments. Be sure to include the length of time in each position, the size and type of company, any special projects the candidate was involved in, and the results achieved.

- Skills: List any pertinent skills the candidate has, such as knowledge of financial software, financial analysis, budgeting, and forecasting.

- Accomplishments: Include any awards or recognition the candidate has earned related to financial counseling, such as passing the financial counselor certification exam.

- Languages: Include any proficiency in languages besides English.

- Technology: List any specific software programs or technologies the candidate is familiar with.

- Professional Development: List any industry training courses or professional development seminars the candidate has taken.

By including these items in a financial counselor resume, a candidate can demonstrate the necessary qualifications and experience for the role.

What is a good summary for a Financial Counselor resume?

A Financial Counselor resume should provide a detailed summary of the applicant’s education and experience in the financial services industry. The resume should include a summary of the applicant’s career goals and objectives, education, certifications, and professional affiliations. Additionally, the resume should include a summary of the various activities the applicant has engaged in to further their knowledge and experience in the field of financial counseling. This can include attending seminars and webinars, participating in workshops, and volunteering with organizations related to the financial services sector. Additionally, the resume should highlight the applicant’s interpersonal skills, problem solving abilities, and communication abilities.

Overall, a Financial Counselor resume should provide a comprehensive summary that accurately represents the applicant’s qualifications and experiences in the financial services field.

What is a good objective for a Financial Counselor resume?

A Financial Counselor resume should have an objective that is tailored to the position. The objective should clearly state the job seeker’s career goals and demonstrate their qualifications and experience as it relates to the role.

Here are some examples of good objectives for a Financial Counselor resume:

- Experienced Financial Counselor seeks to utilize 10+ years of experience to promote financial literacy and manage client portfolios at ABC Bank.

- Focused and detail-oriented Financial Counselor wanting to use knowledge of investment strategies and financial planning to help clients reach their financial goals.

- Highly organized Financial Counselor with a track record of success providing comprehensive advice and solutions to clients.

- Dynamic Financial Counselor with a passion for helping clients understand their financial options and develop sound investment strategies.

- Professional Financial Counselor interested in leveraging 10+ years of experience to provide clients with comprehensive financial advice.

How do you list Financial Counselor skills on a resume?

When writing a resume, it is important to include relevant skills for the job you are applying for. This is especially true for positions in the field of financial counseling, where the ability to manage money, work with people, and provide sound financial advice are essential. Below are some of the key skills to include on a resume when applying for a financial counselor role.

- Money Management: Financial counselors need to have a solid understanding of money management concepts such as budgeting, saving, investing, and debt management. They should be able to analyze financial data and make sound decisions to help clients reach their financial goals.

- Financial Planning: An effective financial counselor must be able to create financial plans that are tailored to their clients’ needs, goals, and resources. They should be knowledgeable about the various retirement savings, investment, and insurance products available and be able to advise clients on the best options for their particular situation.

- Communication: Financial counselors must be able to explain complex financial concepts in an easy-to-understand manner since many of their clients may not have a background in finance. They should be able to actively listen to their clients, ask pertinent questions, and provide sound advice.

- Interpersonal Skills: Financial counselors should be able to build trust and rapport with clients and provide a safe and comfortable environment for them to discuss their financial situation. They should also be able to handle difficult situations with empathy and professionalism.

- Customer Service: Financial counselors need to provide excellent customer service to their clients by responding quickly to their inquiries, addressing their objections and concerns, and resolving any issues they may have.

By including these skills on a resume, you can show that you have the necessary knowledge and experience to excel as a financial counselor.

What skills should I put on my resume for Financial Counselor?

When you’re looking for a job as a Financial Counselor, you want to make sure that your resume reflects the skills needed for the position. Here are some of the key skills you should include on your resume:

- Risk Assessment: Financial Counselors must be able to evaluate the risk associated with different investments and make sound financial decisions for their clients.

- Financial Analysis: Financial Counselors must be able to analyze financial data and make informed decisions.

- Communication: Financial Counselors must be able to communicate effectively with their clients, understand their needs and develop a plan that meets those needs.

- Problem Solving: Financial Counselors must have strong problem-solving skills to be able to analyze complex financial issues and come up with effective solutions.

- Organizational Skills: Financial Counselors must be able to keep track of multiple clients and their financial plans, as well as keep up with current industry trends.

- Attention to Detail: Financial Counselors must be able to pay attention to details and ensure accuracy when dealing with financial transactions.

By highlighting these key skills on your resume, you’ll be well-positioned to land a job as a Financial Counselor.

Key takeaways for an Financial Counselor resume

A Financial Counselor resume should be written with the goal of highlighting your strengths and experience as it relates to the financial advising industry. Here are some key takeaways for writing a successful resume:

- Highlight Your Experience: Your resume should emphasize your experience in the financial counseling field. Include specific types of financial counseling services you have provided, such as retirement planning, investment advice, budgeting and debt management, and any specialized training you have received.

- Showcase Your Skills: Showcase your soft skills such as problem-solving, communication, and managerial abilities to demonstrate your ability to provide sound financial advice to your clients.

- Demonstrate Your Knowledge: Showcase your knowledge of financial products and services, such as stocks, bonds, mutual funds, and insurance products.

- Detailed Description: Provide a detailed description of your job responsibilities and the success you achieved in each role.

- Include Certifications: Include any certifications you have obtained, such as a Certified Financial Planner (CFP®), Chartered Financial Analyst (CFA®), Certified Financial Advisor (CFA®), or Chartered Financial Consultant (CFC®).

By following these key takeaways, you can create a resume that accurately reflects your financial counseling experience and qualifications. This will help you stand out as a qualified candidate to potential employers.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder