Writing a compelling resume can be a challenge, especially in the competitive field of commercial banking. In order to stand out from the crowd, your resume must showcase your experience and accomplishments as a commercial banker. As such, it is important to consider specific examples that highlight your success within the industry. With this in mind, this guide will provide an overview of how to craft an effective resume for a commercial banker role, from the layout and design to the language used. Examples will be provided to illustrate the do’s and don’ts of writing a successful commercial banker resume.

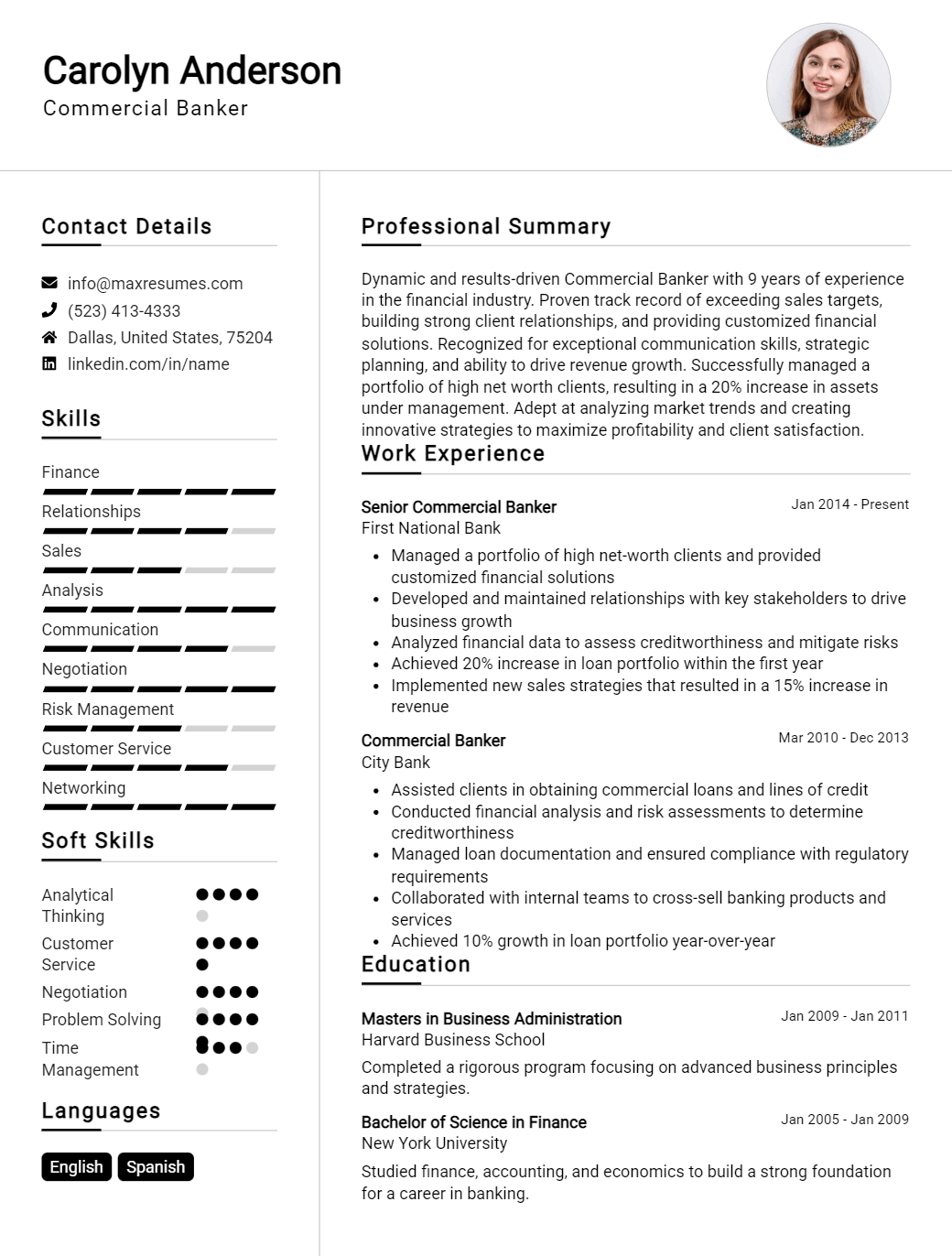

Commercial Banker Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Commercial Banker Resume Examples

John Doe

Commercial Banker

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am an experienced Commercial Banker with 8+ years of experience in providing comprehensive banking services, with a focus on commercial loan origination and project finance. I have a proven track record of success in proactively developing, structuring, and closing complex financial transactions and building strategic relationships with clients. My expertise includes lending, capital markets, treasury management, and debt restructuring, as well as strong interpersonal and negotiation skills.

Core Skills:

- Commercial Loan Origination

- Project Finance

- Lending

- Capital Markets

- Treasury Management

- Debt Restructuring

- Strategic Relationship Building

- Interpersonal and Negotiation Skills

Professional Experience:

Commercial Banker, ABC Bank, 2020- Present

- Managed the origination, structuring and execution of commercial loan transactions for corporate clients

- Conducted due diligence and analyses of financial statements and other financial documents to assess creditworthiness

- Analyzed financial and market data to identify risks and opportunities related to transactions

- Developed a deep understanding of clients’ business needs, objectives, and strategies

- Interacted with clients and internal stakeholders to obtain necessary information and negotiate terms

- Liaised with other departments such as legal and compliance to ensure all transactions were in line with internal policies and regulations

Commercial Banker, XYZ Bank, 2018- 2020

- Originated, structured and closed combined debt, equity and mezzanine financings

- Negotiated terms and conditions of loan agreements

- Evaluated and recommended credit approvals

- Provided financial advice to clients

- Monitored existing loan portfolios and provided regular updates to internal stakeholders

- Developed and maintained relationships with clients

Education:

Bachelor of Science in Business Administration, ABC University, 2018

Commercial Banker Resume Examples Resume with No Experience

Recent college graduate with a Bachelor’s degree in Business Administration and a strong desire to pursue a career in commercial banking. Demonstrated knowledge of banking principles and the ability to apply them to commercial banking processes.

Skills:

- Knowledge of banking principles, banking regulations and financial instruments

- Excellent communication and customer service skills

- Proficient in Microsoft Office Suite

- Ability to evaluate and analyze financial documents

- Ability to multi- task and prioritize tasks

- Detail- oriented

Responsibilities:

- Assist in the development of new commercial banking products and services

- Review credit applications and make credit recommendations

- Analyze and evaluate customer financial records

- Monitor customer account activity and provide account reconciliation

- Develop relationships with customers through frequent contact

- Educate customers on banking products and services

Experience

0 Years

Level

Junior

Education

Bachelor’s

Commercial Banker Resume Examples Resume with 2 Years of Experience

Resourceful commercial banker with two years of experience in providing financial services to corporate customers. Highly skilled in analyzing balance sheets and conducting financial analyses of clients to identify lending opportunities. Possesses excellent problem- solving, communication and customer service skills.

Core Skills:

- Strong background in financial analysis

- Proficient in creating financial statements and conducting credit analysis

- Excellent customer service and communication skills

- Ability to develop relationships with corporate customers

- Knowledge of banking products and services

- Proficiency in using financial software

Responsibilities:

- Conducting financial analysis of corporate customers to assess risk and identify lending opportunities

- Maintaining relationships with corporate customers by providing timely updates on their financial status

- Creating financial statements for clients to be used for loan applications and other banking services

- Assessing the creditworthiness of clients by reviewing financial reports, credit reports and other relevant documents

- Providing support to corporate customers with their banking needs, including assisting with loan applications and other services

- Conducting regular reviews of loan accounts to ensure compliance with terms and conditions of loans and other banking products

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Commercial Banker Resume Examples Resume with 5 Years of Experience

Highly organized and motivated commercial banker with 5+ years of experience in providing comprehensive banking services to businesses. Proven ability to develop innovative financial solutions and restructure client debt to optimize profitability. Possess strong communication and interpersonal skills, with a focus on customer service, problem solving, and conflict resolution.

Core Skills:

- Business banking

- Loan origination

- Risk management

- Credit analysis

- Portfolio management

- Financial reporting

- Accounting

- Regulatory compliance

- Relationship management

Responsibilities:

- Providing sound financial advice and solutions to business clients

- Analyzing and evaluating financial data to determine creditworthiness of loan applicants

- Underwriting loans and investments, recommending solutions to management on the basis of financial and market analysis

- Developing and maintaining strong relationships with existing and potential clients

- Monitoring and assessing client portfolios and loan accounts, ensuring their financial stability

- Establishing and managing credit lines and providing capital management recommendations

- Posting payments and updating loan accounts to ensure accuracy of records

- Ensuring compliance with all banking regulations, laws, and policies

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Commercial Banker Resume Examples Resume with 7 Years of Experience

Highly experienced Commercial Banker with 7 years of working in the financial services industry. Skilled in relationship building, customer service, and problem- solving. Experienced in customer service orientated activities, including processing customer transactions, approving credit, and managing loan portfolios. Proven track record of managing and growing loan portfolios and customer relationships. Possess strong communication and customer service skills to build relationships and ensure customer satisfaction.

Core Skills:

- Loan Portfolio Management

- Relationship Building

- Credit Analysis

- Risk Management

- Financial Analysis

- Communication

- Problem Solving

- Customer Service

Responsibilities:

- Analyzed financial data and credit history to assess creditworthiness of customers and recommend loan products.

- Managed and monitored loan portfolios to ensure repayment on time and in full.

- Developed and maintained relationships with customers to ensure customer satisfaction.

- Analyzed customer’s financial situation and provided financial counseling to meet customer’s needs.

- Ensured compliance with banking regulations and laws.

- Prepared loan documents and collected customer information.

- Monitored loan accounts and payments to ensure timely repayment and contact customers if necessary.

- Investigated loan delinquencies and provide solutions to delinquent borrowers.

- Collaborated with other departments to provide services to customers.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Commercial Banker Resume Examples Resume with 10 Years of Experience

Experienced Commercial Banker with 10 years of experience in the banking industry. Demonstrated success in developing, managing and maintaining commercial banking relationships. Proven ability to evaluate commercial credit applications and financial statements, create risk- based credit decisions, and maintain a portfolio of loans. Possess excellent communication, problem- solving, and negotiation skills.

Core Skills:

- Client Relationship Management

- Commercial Loan Administration

- Risk Analysis

- Loan Structuring

- Financial Statement Analysis

- Credit Risk Assessment

- Risk Mitigation

- Documentation Compliance

- Regulatory Compliance

Responsibilities:

- Developed and maintained client relationships and created client loyalty.

- Analyzed financial statements, credit reports and internal credit scoring models to determine credit worthiness of applicants.

- Assessed and approved commercial loans with appropriate terms and conditions.

- Negotiated loan terms with customers and counseled them on the financial implications of their loan decisions.

- Monitored portfolios on a regular basis and ensured compliance with loan covenants.

- Analyzed portfolio performance on a regular basis and reported to senior management.

- Ensured compliance with applicable banking regulations and laws and maintained accurate records.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Commercial Banker Resume Examples Resume with 15 Years of Experience

Dynamic, results- driven Commercial Banker with 15 years of experience in the banking and financial services industry. Adept at developing and fostering relationships with clients and providing world- class customer service. Skilled in analyzing financial data and devising effective strategies for meeting the financial needs of clients. Proven history of successfully leveraging market trends to generate profitable portfolio growth.

Core Skills:

- Client Relationship Management

- Financial Analysis & Reporting

- Portfolio & Risk Management

- Financial Planning & Forecasting

- Business Development & Acquisition

- Credit & Loan Underwriting

- Regulatory Compliance

- Technology Proficient

Responsibilities:

- Develop and maintain client relationships, providing exceptional customer service

- Conduct detailed analysis of financial data to identify growth opportunities

- Develop and implement effective strategies for meeting client financial needs

- Analyze market trends and leverage them to generate profitable portfolio growth

- Provide expert guidance on loan and credit underwriting procedures

- Ensure compliance with all relevant banking regulations

- Conduct periodic reviews of client portfolios for risk management

- Provide financial planning advice to clients and assist with asset management

- Identify business development opportunities and coordinate acquisitions

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Commercial Banker Resume Examples resume?

A commercial banker resume is an important document for job seekers seeking positions in the banking industry. It showcases the applicant’s relevant experience, education, and skills to demonstrate their qualifications to the potential employer. In order to make a strong impression, the resume must be well organized, contain accurate information, and highlight the most important qualifications. Here are some tips on what to include in a commercial banker resume:

- Professional Summary: A professional summary is a great way to highlight your qualifications in a concise and brief manner. This section should provide a brief overview of your relevant experience, education, and skills as they relate to the job.

- Education: Include the educational institutions you attended, degree earned, and any relevant coursework.

- Work Experience: List any positions you’ve held related to commercial banking, including the dates of employment, job duties, and accomplishments.

- Skills: List any skills that are relevant to the position, such as customer service, financial analysis, and risk management.

- Certifications: Include any certifications that pertain to commercial banking, such as the Certified Banker (CBP) or Certified Treasury Professional (CTP).

- Contact Information: Make sure your contact information is accurate and up-to-date.

Following these tips for what to include in your commercial banker resume will help you make a strong impression and demonstrate your qualifications for the position. With the right information, you can set yourself apart from the competition and be one step closer to obtaining the job.

What is a good summary for a Commercial Banker Resume Examples resume?

A commercial banker resume should highlight a candidate’s experience in banking, financial analysis, and loan management. It should emphasize their knowledge of financial regulations and products, their ability to provide customer service and advocacy, and their analytical skills. A good summary should include the candidate’s job title, years of experience, and a brief description of their accomplishments and abilities. It should also highlight any certifications or special training they may have. Lastly, the summary should highlight the candidate’s leadership potential and ability to work with a team. A great summary will grab the reader’s attention and make them want to learn more about the candidate.

What is a good objective for a Commercial Banker Resume Examples resume?

The job of a commercial banker is to help businesses manage their finances and grow their operations. As such, a good objective for a commercial banker resume should be to demonstrate the ability to provide effective financial solutions that help businesses reach their goals.

To accomplish this, a commercial banker should include the following objectives on their resume:

- Develop and maintain strong relationships with clients to understand their goals and offer customized solutions

- Analyze financial data to identify potential risks and opportunities

- Utilize industry knowledge to develop strategies and plans that help businesses reach their goals

- Monitor market trends and economic conditions for impact on clients’ finances

- Structure loan and investment solutions that maximize profitability and minimize risk

- Provide advice on financial decisions and investment opportunities

- Communicate with clients to ensure understanding of financial solutions and any changes in the market

- Stay current with changes in the banking industry and regulations

How do you list Commercial Banker Resume Examples skills on a resume?

When writing a commercial banker resume, it’s important to highlight your skill set in order to stand out from the competition. Here are some skills to consider listing on your resume to demonstrate your qualifications as a commercial banker.

- Financial Analysis: You should be able to analyze financial statements and reports in order to help clients make sound financial decisions.

- Business Acumen: A strong business acumen is necessary in order to understand the nuances of the banking industry and the needs of the clients.

- Communication: You should be able to communicate clearly and effectively to clients and other banking professionals.

- Problem Solving: As a commercial banker, you must be able to quickly identify solutions to complex financial problems.

- Risk Management: You should be able to assess risk and suggest appropriate strategies to mitigate it.

- Customer Service: Excellent customer service skills are essential to build relationships with clients and ensure their satisfaction with banking products and services.

- Time Management: Commercial banking requires an ability to manage multiple tasks simultaneously and prioritize work to meet deadlines.

- Attention to Detail: As a commercial banker, you must be able to carefully review financial documents and data to ensure accuracy.

What skills should I put on my resume for Commercial Banker Resume Examples?

When crafting a Commercial Banker resume, it’s important to emphasize certain skills that demonstrate your ability to work with clients on a variety of financial products and services. Here are some essential skills that are essential for a successful career in commercial banking:

- Analytical Thinking: As a commercial banker, you will be responsible for analyzing financial data and making informed decisions. Be sure to highlight your ability to think through complex financial issues and draw logical conclusions.

- Financial Modeling: Many commercial banks require their bankers to use financial modeling software to help make informed decisions. List any experience you have with financial modeling software to give yourself a competitive advantage.

- Communication: The ability to communicate effectively with clients is another essential skill for a successful commercial banker. Your resume should emphasize your strong written and verbal communication skills to make yourself stand out from the competition.

- Relationship Management: Commercial banking is all about building relationships with clients. Include any experience you have managing existing relationships or developing new ones to demonstrate your ability to handle this important part of the job.

- Problem Solving: As a commercial banker, you will need to be able to identify problems and develop creative solutions quickly and effectively. List any experience you have solving complex problems to show that you are a problem-solver.

By highlighting your skills in these areas, you can create an effective and professional commercial banker resume that will help you land the job.

Key takeaways for an Commercial Banker Resume Examples resume

When you’re applying for a job as a commercial banker, it is essential to have a well-written resume that highlights your skills and experience. Your resume should be tailored to the job you’re applying for, and there are some key takeaways you need to keep in mind when crafting a commercial banker resume.

First, you should emphasize your experience in the banking industry. Be sure to include any past banking jobs you’ve held, such as an assistant branch manager or a loan officer. If you have any certifications or special training related to banking, such as a certification in Financial Risk Management or Regulatory Compliance, include those as well.

Second, highlight your financial skills. Banking requires a lot of financial expertise, so make sure to list any financial knowledge you have, such as budgeting, asset management, tax preparation, and financial analysis.

Third, show off your customer service skills. Many banking jobs require excellent customer service skills, so be sure to mention any experience you have working with customers. Also, demonstrate your interpersonal skills and how you can effectively interact with customers in a professional manner.

Finally, mention any activities that demonstrate your commitment to the banking industry. This could include any professional associations you belong to or any seminars or courses you’ve attended that are related to banking.

By following these key takeaways, you can create an effective commercial banker resume that will make you stand out from the competition. Be sure to tailor your resume to the job you’re applying for, and highlight the skills and experience that make you a great candidate for the position.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder