When it comes to creating a resume for an actuarial analyst job, it is essential to highlight your knowledge and skills in the financial industry. An effective resume should demonstrate your ability to analyze risks, assess financial markets and interpret data. To help you create a winning resume, this guide provides tips on how to write a professional resume for an actuarial analyst role, with examples of the best resumes to use as a reference.

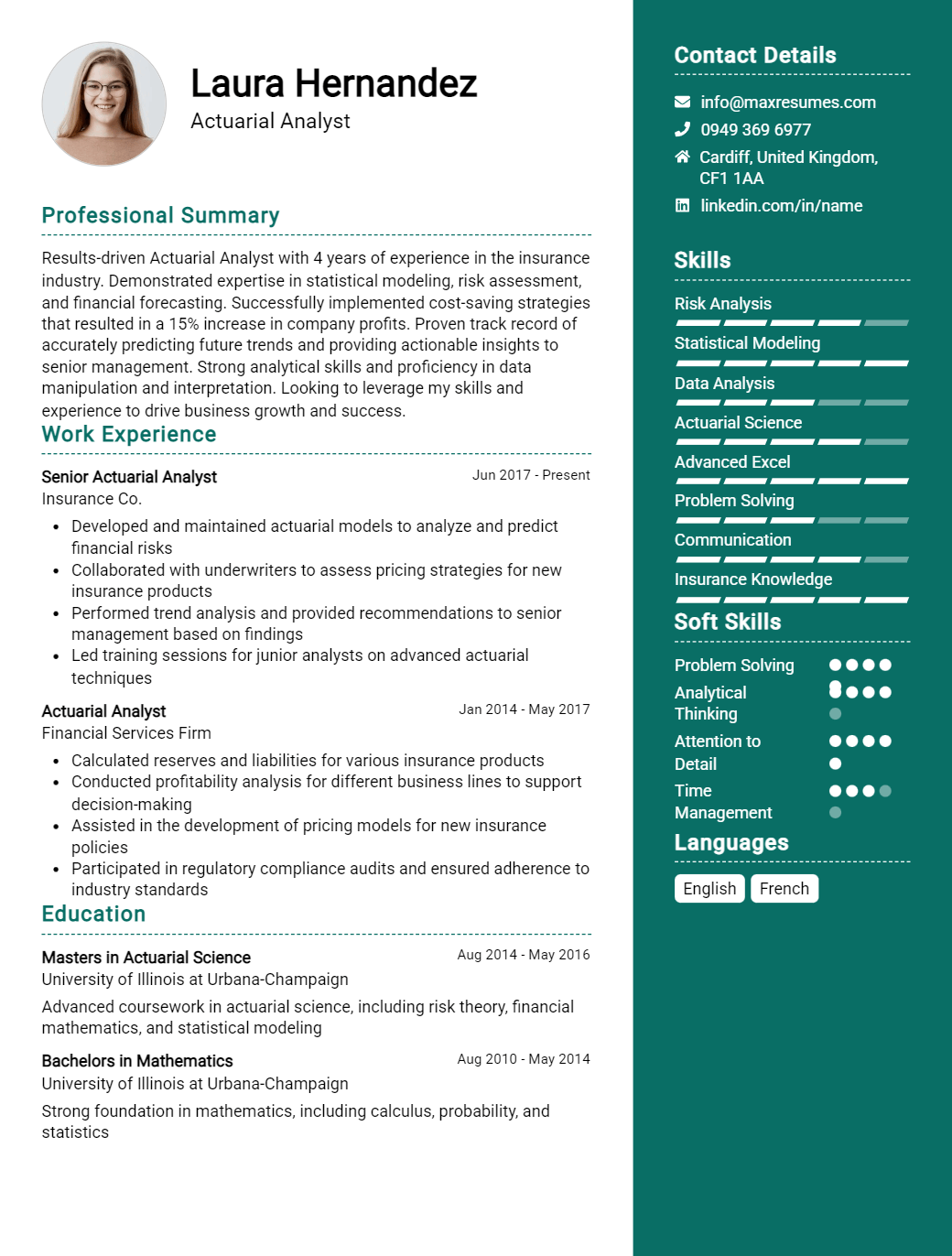

Actuarial Analyst Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Actuarial Analyst Resume Examples

John Doe

Actuarial Analyst

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

Highly motivated and analytical Actuarial Analyst with 4+ years experience developing and managing actuarial models for insurance companies. Expert knowledge of various actuarial tools and techniques and experience using actuarial software to create models that accurately predict risk and costs. Proven ability to develop and maintain accurate financial models and ensure compliance with applicable laws and regulations. Adept at working in fast- paced environments and meeting tight deadlines.

Core Skills:

- Actuarial Modeling

- Data Analysis

- Statistical Modeling

- Financial Risk Analysis

- Regulatory Compliance

- Advanced Excel

- Microsoft Access

- Risk Management

Professional Experience:

Actuarial Analyst, ABC Insurance Company, Chicago, IL – 2016- 2020

- Developed and maintained actuarial models to calculate and analyze financial risk

- Analyzed large sets of data to identify and assess potential risk, and created detailed reports to present findings

- Collaborated with other actuaries to create models that accurately predicted risks and costs

- Ensured compliance with applicable laws and regulations

- Created and maintained financial models to manage various aspects of the business

Actuarial Assistant, XYZ Insurance Group, Chicago, IL – 2013- 2016

- Assisted senior actuaries in developing and maintaining actuarial models

- Evaluated large sets of data to identify and assess potential risks

- Produced detailed reports to summarize data analysis

- Assisted with financial risk analysis and identified areas for improvement

- Ensured compliance with applicable laws and regulations

Education:

Bachelor of Science in Actuarial Science, University of Illinois at Urbana- Champaign, IL – 2013

Actuarial Analyst Resume with No Experience

Actuarial Analyst with no experience and a passion for numbers. Possess a strong educational background in mathematics, economics and statistics. Focused on becoming a member of an actuarial team and utilizing knowledge gained in school to help develop innovative solutions.

Skills

- Advanced mathematical and statistical analysis

- Expertise in Microsoft Excel and Access

- Knowledge of theory and practice of actuarial science

- Strong problem- solving skills

- Excellent communication and interpersonal skills

- Attention to detail

Responsibilities

- Collect and analyze data to identify trends and patterns

- Develop and implement actuarial models

- Perform statistical analysis and computations

- Create actuarial reports and presentations

- Research and evaluate new actuarial concepts and techniques

- Participate in the development of new and existing products and services

- Utilize software and applications to analyze data

- Monitor and assess the impact of changing economic conditions on financial models

Experience

0 Years

Level

Junior

Education

Bachelor’s

Actuarial Analyst Resume with 2 Years of Experience

A results- driven insurance professional with 2 years of experience as an actuarial analyst. Proven expertise in using advanced mathematical techniques to analyze and evaluate complex actuarial models and statistical data. An analytical thinker with exceptional problem- solving skills, a keen eye for details and the ability to work independently. Adept at managing multiple tasks, meeting deadlines and ensuring accuracy of data.

Core Skills:

- Advanced mathematical knowledge

- Data analytics

- Statistical analysis

- Report writing

- Data management

- Risk management

- Analytical problem- solving skills

- Strong communication skills

Responsibilities:

- Utilized advanced mathematical techniques to develop and analyze actuarial models.

- Reviewed and analyzed statistical data to assess risk and make sound recommendations.

- Monitored and assessed insurance industry trends to identify opportunities for improvement.

- Assisted in the development of risk assessment models for various insurance products.

- Analyzed actuarial claims data to identify and correct anomalies.

- Prepared and presented reports outlining results of actuarial analysis.

- Conducted financial analysis and reviewed actuarial documents for accuracy.

- Provided assistance to management in developing and implementing risk management strategies.

- Tracked and maintained records of actuarial data and documents.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Actuarial Analyst Resume with 5 Years of Experience

Highly skilled, motivated and detail- oriented actuarial analyst with five years of experience in providing outstanding financial services for a wide array of clients. Proficient in performing sophisticated quantitative analysis, including trend analysis, forecasting, financial modeling and risk analysis. Experienced in managing complex projects from inception to completion. Proven ability to develop innovative solutions and strategies to improve efficiency and reduce costs. Highly experienced in developing and implementing new actuarial processes and practices.

Core Skills:

- In- depth knowledge of actuarial principles and methodology

- Extensive experience in financial modeling and forecasting

- Strong analytical, problem solving and decision making skills

- Excellent communication, interpersonal and organizational skills

- Proficient in MS Office Suite and actuarial software

- Ability to work independently and as part of a team

Responsibilities:

- Performed complex actuarial calculations and analysis to assess financial impacts of risk and uncertainty

- Developed and implemented actuarial models, processes and practices to improve efficiency

- Conducted trend analysis and forecasting to evaluate financial performance of clients’ portfolios

- Developed financial models for pricing and risk management purposes

- Provided accurate and timely financial reports to stakeholders

- Performed stress testing to identify potential financial risks and vulnerabilities

- Prepared detailed presentations for the management team on financial performance

- Assisted in developing and implementing strategies to reduce costs and maximize profits

- Analyzed financial data to identify and address potential areas of improvement

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Actuarial Analyst Resume with 7 Years of Experience

I am an Actuarial Analyst with 7 years of experience in the field. I have a thorough understanding of financial analysis and risk management principles, as well as expertise in actuarial models and tools. I have experience analyzing financial data, developing pricing models, performing portfolio analysis and forecasting, leading financial and actuarial projects, and performing actuarial studies. I have a strong background in mathematics, statistics, and economics which I use to make intelligent decisions and provide insightful advice to stakeholders.

Core Skills:

- Financial and Risk Analysis

- Actuarial Modeling

- Project Management

- Data Analysis

- Mathematical Modeling

- Financial Forecasting

- Statistical Analysis

- Economics

Responsibilities:

- Performed financial and risk analysis to calculate risk measures, including Value- at- Risk

- Developed actuarial models to assess the financial impact of various business decisions

- Managed actuarial projects and studies, including the development of assumptions and data analysis

- Analyzed financial data to identify trends and patterns

- Developed financial and actuarial forecasts to project future results

- Performed portfolio analysis to assess risk and return

- Provided guidance and advice to stakeholders on financial and risk management decisions

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Actuarial Analyst Resume with 10 Years of Experience

Highly experienced and skilled Actuarial Analyst with over 10 years of experience in analytics, risk assessment, and financial modeling. A successful track record of creating and building predictive models, analyzing and interpreting complex data, and implementing actuarial initiatives that improve workflow and optimize customer experience. Thorough understanding of actuarial principles such as probability theory, statistics, and mathematics and their application to actuarial analysis. Detail- oriented, with extraordinary problem- solving skills and the ability to think logically to create accurate and reliable solutions.

Core Skills:

- Actuarial Principles

- Mathematical Analysis

- Risk Assessment

- Financial Modeling

- Database Management

- Analytical Problem Solving

- Statistical Techniques

- Process Improvement

- Documentation

- Report Writing

Responsibilities:

- Developed and implemented actuarial analyses and models to evaluate customer risk and optimize customer experience

- Evaluated and monitored customer data to identify trends and project future outcomes

- Developed and maintained actuarial databases to organize, store and analyze data

- Assessed the impact of new actuarial tools and procedures on customer experience

- Identified and implemented improvement initiatives to optimize customer experience

- Developed and implemented loss forecasting models

- Performed complex mathematical calculations to assess customer risk

- Developed and maintained accurate documentation of all actuarial analyses and models

- Presented findings to stakeholders and senior leadership in the form of reports and presentations

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Actuarial Analyst Resume with 15 Years of Experience

Seasoned actuarial analyst with 15 years of experience in financial risk management and data analysis. Adept at supporting the development of insurance products and services. Proven ability to leverage data modeling, Microsoft Excel, and statistical analysis to identify, evaluate, and manage financial risks. Skilled at developing and implementing strategies to improve financial performance. Proven ability to effectively build relationships with stakeholders and clients.

Core Skills:

- Financial Modeling

- Statistical Analysis

- Insurance Product Development

- Risk Management

- Microsoft Excel

- Data Analysis

- Relationship Building

Responsibilities:

- Developed actuarial models for the pricing of new insurance products, taking into account the cost and profitability of each product

- Collaborated with stakeholders and clients to identify and evaluate financial risks

- Prepared reports, presentations, and documents to analyze financial performance and proposed strategies to mitigate risks

- Utilized Microsoft Excel and various statistical analysis techniques to evaluate and measure financial risks

- Developed and implemented strategies to improve financial performance

- Sourced and analyzed data from financial documents to identify trends and patterns

- Developed and maintained relationships with stakeholders and clients to ensure successful execution of strategies

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Actuarial Analyst resume?

It’s important for anyone looking to become an Actuarial Analyst to have a resume that stands out from the competition. To ensure your resume is up-to-date and showcases your most marketable skills, consider these key points when crafting your resume:

- Education: Include any degree-level qualifications related to actuarial analysis, such as a degree in mathematics, statistics, economics, or finance.

- Professional Experience: Outline any prior experience in the actuarial field, such as internships or entry-level roles. Make sure to include the name of the company and the dates of employment, as well as the tasks and responsibilities you performed.

- Skills and Knowledge: Show off your analytical, quantitative, and problem-solving skills by listing any software or programming languages you may have used, as well as any other relevant technical knowledge.

- Certification: Highlight any certifications or industry qualifications you may have obtained in the actuarial field, such as the Chartered Financial Analyst (CFA) or the Associate of the Society of Actuaries (ASA).

- Awards and Recognition: Include any awards and recognition you have received for your work in the actuarial field.

- Relevant Hobbies and Interests: Demonstrate your commitment to the profession by listing any extracurricular activities, such as participating in actuarial associations or volunteering for industry events.

By following these tips, you can create an Actuarial Analyst resume that is sure to help you stand out from the competition.

What is a good summary for a Actuarial Analyst resume?

A strong summary for an Actuarial Analyst resume is one that concisely describes the candidate’s qualifications and experience. It should include details of the candidate’s education and professional background, their expertise in the field of actuarial analysis, and any relevant professional certifications or awards that they hold. Additionally, the summary should highlight the candidate’s key strengths and any relevant achievements. This summary should be tailored to the specific job opportunity, as each position may require a different set of skills. Finally, the summary should demonstrate the candidate’s enthusiasm for the position and the potential impact they can have on the organization.

What is a good objective for a Actuarial Analyst resume?

Writing a resume for an Actuarial Analyst position can be daunting. It requires not only an understanding of the skills and qualifications required for the role, but also a clear and concise objective statement. A good objective statement should give a potential employer an insight into your skills and qualifications, as well as what you can bring to the table.

- To secure a position as an Actuarial Analyst where I can utilize my quantitative and analytical skills to analyze data, develop models, and create accurate predictions.

- To join a team of professionals and use my communication, problem-solving and technical skills to effectively assess the risk and profitability of the organization.

- To apply my knowledge of quantitative techniques and statistical methods to develop complex actuarial models.

- To use my experience in data analysis, actuarial science and risk management to create robust and reliable models.

- To utilize my knowledge of mathematical methods and actuarial principles to help the organization make informed decisions.

A good objective statement should be specific and succinct, while conveying the main points of your background and qualifications. Keep it concise and to the point to ensure it stands out from the competition. With a good objective statement, you can demonstrate your commitment and enthusiasm for the position and give the employer the confidence that you are the best candidate for the job.

How do you list Actuarial Analyst skills on a resume?

When listing Actuarial Analyst skills on a resume, it’s important to demonstrate your understanding of mathematics, economics, and statistics. It’s also important to showcase your ability to process large amounts of data. Here are some key skills employers will be looking for:

- Data Analysis: Ability to analyze and interpret large data sets, and draw meaningful conclusions from the analysis.

- Quantitative Analysis: Knowledge of mathematical and statistical models, as well as the ability to apply them to real-world problems.

- Risk Management: Understanding of risk models and the ability to evaluate the potential impact of risk scenarios.

- Financial Modeling: Knowledge of financial modeling processes and the ability to create models that accurately reflect market conditions.

- Problem-Solving: Ability to identify potential issues and develop solutions to them.

- Communication: Ability to effectively communicate complex data and information to stakeholders.

- Computer Skills: Proficiency in computer languages, software, and applications.

- Attention to Detail: Ability to accurately document and process data.

- Time Management: Ability to organize and prioritize tasks to meet deadlines.

What skills should I put on my resume for Actuarial Analyst?

If you are looking to get a job as an Actuarial Analyst, you need to make sure your resume stands out from the competition. Having the right skills on your resume is essential for catching the eye of potential employers. Here are some key skills to include on your resume for an Actuarial Analyst position:

- Mathematics: As an Actuarial Analyst, you will be expected to have a deep understanding and mastery of mathematics. Make sure to highlight any courses or certifications in mathematics you have completed.

- Excel: A great Actuarial Analyst will be well-versed in Excel and other data analysis programs. If you have any Excel certifications, be sure to add this to your resume.

- Statistical Analysis: Actuarial Analysis involves using statistics to assess risk and analyze data. Make sure to highlight any courses or certifications in statistics you have completed.

- Risk Assessment: Actuarial Analysts must be able to assess and predict risk in different situations. If you have any experience in risk assessment, be sure to add this to your resume.

- Communication: Actuarial Analysts must be able to clearly communicate their findings to their colleagues and clients. Make sure to list any public speaking or presentation skills you have acquired.

- Problem Solving: Actuarial Analysis involves problem solving and critical thinking. Be sure to mention any problem-solving skills or experience you have.

By listing these skills on your resume, you can give yourself a competitive edge and make sure you stand out from the other applicants. Good luck!

Key takeaways for an Actuarial Analyst resume

As an Actuarial Analyst, your resume is an important tool in demonstrating your skills and experience. It is important to make sure your resume is up-to-date and tells the story of your career. Here are some key takeaways for creating an effective Actuarial Analyst resume:

- Make sure your resume is tailored to the job you are applying for. Showcase your specialized skills and knowledge, and demonstrate how your skills and experience can contribute to the position.

- Highlight any certifications or qualifications you have attained. Demonstrate your professional growth and development in the field.

- Include examples of your work, such as projects you have completed or any reports you have written.

- Showcase your analytical and problem-solving skills. Demonstrate how you have successfully solved problems within an actuarial context.

- Include any work involving data analysis and modeling. Showcase your ability to work with large data sets and your ability to create models using statistical techniques.

- Showcase any software or programming skills you have. Many employers look for candidates with a strong knowledge of programming languages like R, Python, and SAS.

- Demonstrate your ability to communicate complex information in an easy-to-understand manner.

By focusing on these key takeaways, you can create a resume that will help you stand out from other applicants and get you the job you are looking for.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder