Writing a great resume as a collection manager is essential for getting noticed in the job market. It is important to understand the basics of resume writing and to include the necessary information to create a strong resume. This guide provides a comprehensive overview of collection manager resumes and includes resume examples and tips to help you create a resume that stands out from the competition. With the right guidance, you can easily craft a resume that showcases your qualifications and experience and puts your best foot forward in the job hunt.

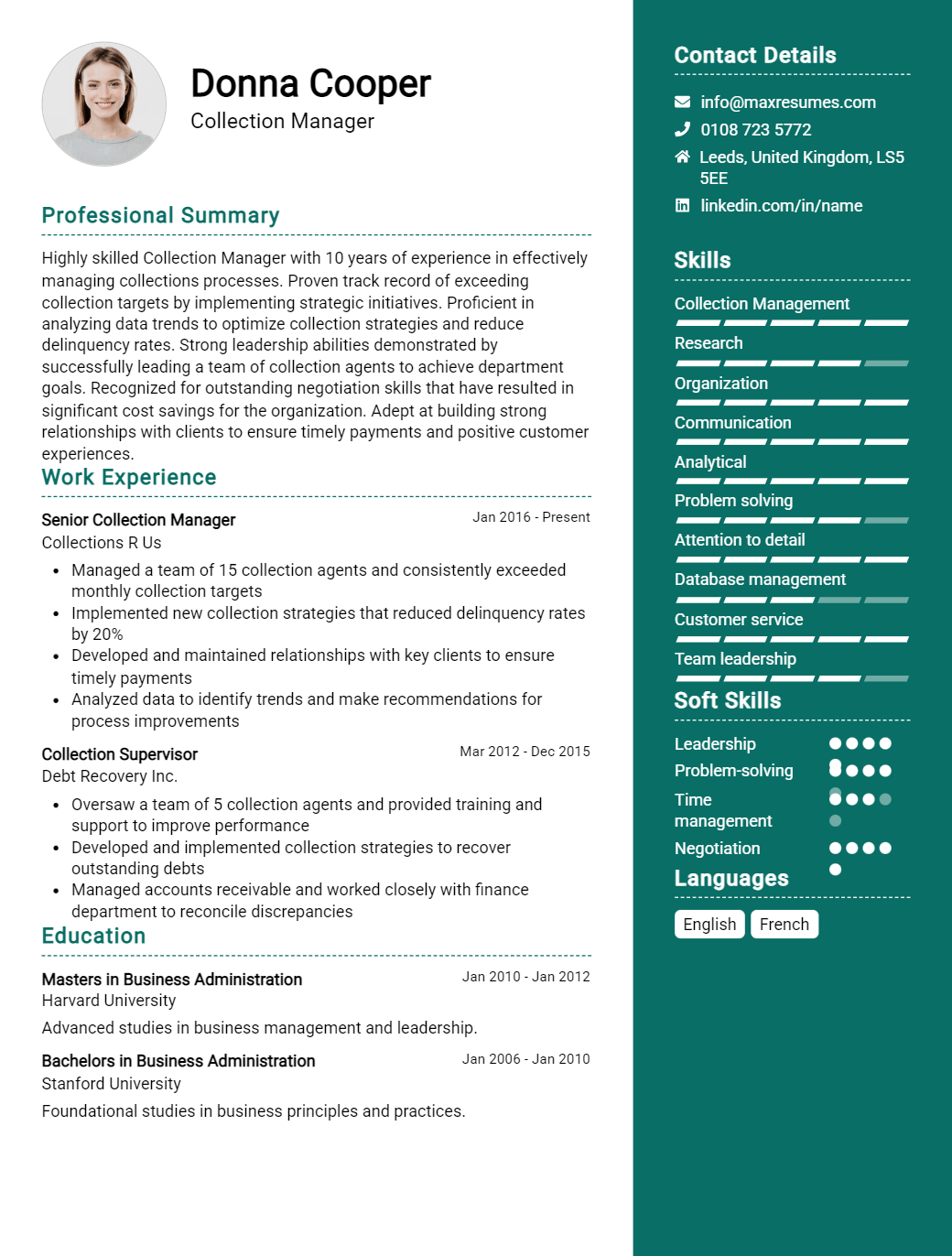

Collection Manager Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Collection Manager Resume Examples

John Doe

Collection Manager

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am an experienced Collection Manager with 10+ years in the banking and finance industry. My expertise lies in collections management, customer service, and dispute resolution. I have a proven track record of success in managing collections processes, improving customer service outcomes, and resolving customer disputes quickly and equitably. I have a strong ability to build and maintain relationships with customers and vendors, as well as identify and implement process improvements.

Core Skills:

- Collections Management

- Customer Service

- Dispute Resolution

- Relationship Building

- Process Improvement

- Data Analysis

- Financial Analysis

Professional Experience:

- Wells Fargo, Collection Manager (2014- present):

- Manage collections process to ensure timely payments and minimize losses from defaults.

- Develop and implement process improvements to maximize efficiency and improve customer service.

- Identify and resolve customer disputes quickly and equitably.

- Build and maintain relationships with customers and vendors.

- Analyze financial data to determine customer creditworthiness and identify areas for improvement.

- Bank of America, Collection Representative (2010- 2014):

- Managed accounts in collections process to ensure timely payments and minimize losses from defaults.

- Evaluated customer creditworthiness using financial data analysis.

- Resolved customer disputes quickly and equitably.

- Developed and implemented process improvements to maximize efficiency and improve customer service.

- Built and maintained relationships with customers and vendors.

Education:

- Bachelor of Arts in Business Administration, University of California, Los Angeles (2008)

Collection Manager Resume with No Experience

- Experienced customer service professional with a strong background in problem- solving and communication.

- Knowledgeable in the principles and practices of collections management, including the collection of overdue accounts.

- Proven ability to build and maintain relationships with customers while protecting the company’s interests.

Skills:

- Strong communication and interpersonal skills

- Excellent organizational and problem- solving skills

- Proficiency in Microsoft Office Suite and other relevant software

- Ability to remain patient and diplomatic in stressful situations

Responsibilities:

- Manage the collections process for overdue accounts

- Ensure that customers are aware of their payment obligations

- Act as a liaison between customers and the company

- Negotiate payment arrangements with customers

- Enforce the company’s policies and procedures

- Maintain accurate records of collection efforts and results in the company database

- Provide regular status updates to the management team

Experience

0 Years

Level

Junior

Education

Bachelor’s

Collection Manager Resume with 2 Years of Experience

A highly motivated and experienced Collection Manager with two years of experience managing accounts receivable, credit, and collections. Adept at implementing innovative strategies to recover and collect outstanding payments, while also maintaining strong customer relationships. Possesses excellent verbal and written communication abilities to successfully negotiate with customers and produce timely and accurate reports. Proven ability to multitask and prioritize multiple collections, and handle challenging customer inquiries with professionalism and diplomacy.

Core Skills:

- Accounts Receivable Management

- Collections and Credit

- Negotiation and Mediation

- Excellent Written and Verbal Communication

- Analytical and Problem- Solving

- Time Management and Prioritization

- Customer Relations

Responsibilities:

- Managed a portfolio of 100+ accounts, mitigating risk, and recovering delinquent receivables.

- Developed, monitored and maintained credit limits for customers.

- Conducted customer credit analysis for new accounts.

- Researched and responded to customer inquiries, complaints and disputes.

- Negotiated payment plans and settlements with customers.

- Reported and communicated customer dispute resolutions to the management team.

- Prepared customer statements and generated customer invoices.

- Provided weekly reports to management on customer aging and collection activities.

- Maintained accurate customer records in the customer relationship management system.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Collection Manager Resume with 5 Years of Experience

Highly experienced Collection Manager with a strong background in developing collections strategies and leading teams to maximize collection efforts. Proven track record of improving collection performance and helping to reduce outstanding debt for clients. Extensive experience in all areas of collections, including skip tracing, dispute resolution, and account negotiation. An effective communicator and problem- solver with excellent customer service, organizational, and team management skills.

Core Skills:

- Collections Strategy Development

- Account Negotiation

- Customer Service

- Team Management

- Skip Tracing

- Dispute Resolution

- Excellent Written & Verbal Communication

- Problem Solving

- Organization

Responsibilities:

- Develop, implement, and maintain effective collection strategies to ensure timely and accurate debt collection

- Negotiate payment plans with clients and ensure timely payments on accounts

- Review account information, dispute resolution, and skip tracing

- Monitor and report on the daily performance of the collections team

- Ensure compliance with internal policies, procedures and applicable laws

- Provide regular training and support to all collections staff

- Develop and maintain positive relationships with clients to ensure strong customer service

- Manage collections process and ensure timely resolution of accounts in dispute

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Collection Manager Resume with 7 Years of Experience

A highly experienced Collection Manager with seven years of experience in overseeing credit and collection operations. Comprehensive knowledge of collection laws and a deep understanding of the financial and legal aspects of debt collection. Adept at developing strategies to ensure timely collection of payments and successful resolution of delinquent accounts. Possesses excellent organizational and communication skills as well as strong negotiation and interpersonal skills.

Core Skills:

- Proficient in debt collection laws, regulations and policies

- Excellent communication, negotiation and interpersonal skills

- Knowledge of financial and legal aspects of debt collection

- Proficient in Microsoft Office applications

- Strong organizational and analytical skills

- Ability to develop effective debt collection strategies

Responsibilities:

- Oversee the daily operations of the collection team

- Develop and implement collection policies and procedures

- Monitor debtors’ accounts and contact them to negotiate payment plans

- Prepare collection reports and analyze work performance

- Maintain and update accounts receivable information

- Handle disputes and negotiate with collection attorneys

- Enforce judgments and coordinate with legal departments for collection actions

- Communicate with all credit departments to ensure timely collection of payments

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Collection Manager Resume with 10 Years of Experience

An experienced Collection Manager with 10 years in the field, I have a proven track record of being able to successfully build relationships and manage collections processes. I have a comprehensive knowledge of the credit and collections industry, as well as a deep understanding of the importance of customer service and satisfaction. I have a record of providing exemplary customer service and helping to increase customer loyalty and satisfaction. I am highly organized and detail- oriented, and am able to effectively manage and prioritize multiple tasks.

Core Skills:

- Excellent communication and customer service skills

- Knowledge of the credit and collections industry

- Strong organizational and time management skills

- Ability to manage multiple tasks

- Proficient in Microsoft Office Suite and other software packages

- Ability to work independently and as a team

Responsibilities:

- Developing and maintaining effective relationships with customers

- Maintaining records of customer accounts and payment histories

- Negotiating payment plans with customers in arrears

- Handling customer inquiries and resolving their problems

- Managing customer accounts and billing to ensure timely payments

- Generating reports and analyzing customer data to identify areas for improvement

- Assisting with collection efforts by calling customers

- Ensuring compliance with internal and external regulations

- Performing collections research to ensure accuracy of accounts

- Filing and preparing legal documents for collection processes

- Reviewing and updating collection policies and procedures

- Providing excellent customer service to maintain customer loyalty and satisfaction.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Collection Manager Resume with 15 Years of Experience

Enthusiastic and results- oriented Collection Manager with over 15 years of experience in collection operations, workout strategies, and portfolio management. Proven experience of leading teams to generate maximum returns from non- performing assets (NPAs) while adhering to applicable laws, regulations and standards. Demonstrated expertise in developing efficient strategies, streamlining procedures and processes, and restructuring the distressed assets. Highly organized and an excellent communicator with excellent problem- solving and analytical abilities.

Core Skills:

- Portfolio Management

- Risk Management

- Negotiation and Collection Practices

- Financial Analysis

- Regulatory Compliance

- Communication and Interpersonal Skills

- Conflict Resolution

- Asset Recovery Strategies

Responsibilities:

- Developed and implemented effective collection strategies and tactics to reduce delinquency rates

- Managed collection staff in the recovery of delinquent accounts and defaulted assets

- Analyzed financial statements, credit reports, and other relevant documents to determine the risk associated with delinquent accounts

- Negotiated payment arrangements and settlements with customers to resolve delinquent accounts

- Maintained accurate records of all collection activities and follow up with customers to ensure timely payments

- Developed and monitored team performance against established goals and objectives

- Ensured compliance with applicable laws, regulations, and standards related to collection operations

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Collection Manager resume?

A Collection Manager resume should include the following components to demonstrate the candidate’s qualifications and experience:

- Education: List any degree or certifications, such as a Bachelor’s degree in Business Administration, related to collection management.

- Professional Experience: Include a summary of professional experience related to collection management, including any relevant positions held in financial institutions, collection agencies, or law offices.

- Skills and Competencies: Include any skills, knowledge, and competencies associated with collection management, such as dispute resolution, communication, and data analysis.

- Collections Software: List any knowledge, experience, or certifications related to the use of collections software, such as QuickBooks Collections, Microsoft Dynamics 365 Collections, or others.

- Collection Regulation Knowledge: Demonstrate any knowledge of collection regulation, such as the Fair Debt Collection Practices Act (FDCPA) and the Telephone Consumer Protection Act (TCPA).

- Professional Memberships: List any professional memberships or certifications related to collection management, such as those from the Association of Credit and Collection Professionals (ACA) or the National Creditors Bar Association (NCBA).

By including these components on a Collection Manager resume, candidates can demonstrate their qualifications for the position and increase their chances of being hired.

What is a good summary for a Collection Manager resume?

A Collection Manager resume should provide a succinct yet comprehensive summary of an applicant’s qualifications, experience, and accomplishments in the field of collections. The resume should begin with a clear, concise summary of the applicant’s education and relevant skills, including any certifications or licenses that have been acquired. It should then cover the applicant’s experience in the industry, highlighting any successful collections they have managed, any awards they have received, and any innovative techniques they have employed. It should conclude with a summary of the applicant’s strengths and any other pertinent information, such as references. By providing a comprehensive overview of the applicant’s qualifications, a Collection Manager resume can make a strong impression on employers and help an applicant stand out from other applicants.

What is a good objective for a Collection Manager resume?

Having a well-crafted objective on your collection manager resume is critical for achieving success in your job search. A good objective should be clear and concise, and it should highlight your qualifications and experience in order to make you stand out to employers.

Here are some tips for crafting a good objective for a collection manager resume:

- Showcase your experience: Use your objective to highlight the experience you have in collections management, including your familiarity with collection laws, procedures and policies.

- Demonstrate your organizational skills: Showcase your ability to manage, organize, and process collection accounts and data. Be sure to explain how your organizational skills make you an ideal candidate for a collection manager position.

- Highlight your communication and problem-solving abilities: Collection managers must be able to effectively communicate with debtors, as well as maintain a positive relationship with them. Furthermore, you should highlight your problem-solving abilities and explain how you can identify debtors’ personal needs and develop creative solutions.

- Demonstrate your customer service skills: Collection managers must have excellent customer service skills in order to handle customer inquiries and complaints. Highlight your ability to remain courteous and professional when dealing with difficult situations.

By following these tips, you can craft an effective objective for your collection manager resume that will stand out to employers and demonstrate why you are the ideal candidate for the role.

How do you list Collection Manager skills on a resume?

Collection Managers are a critical part of many businesses and organizations. The ability to manage collections and handle customer accounts is a highly sought-after skill. When creating your resume, it is important to highlight your Collection Manager skills in order to stand out from the competition. Here are some tips on how to list Collection Manager skills on your resume:

- Detail-Oriented: Collection Managers must have an eye for detail and be able to pay close attention to customer accounts and payment documentation.

- Proficiency in Accounting Software: Collection Managers should have a working knowledge of relevant accounting software, such as QuickBooks and Microsoft Dynamics, in order to successfully manage collections.

- Excellent Communication Skills: Collection Managers must be able to communicate effectively with customers in order to resolve payment issues and negotiate payment arrangements.

- Negotiation Skills: Collection Managers must be able to negotiate payment arrangements that are beneficial to both the customer and the company.

- Time Management Skills: Collection Managers must be able to manage their time effectively in order to meet deadlines and keep customer accounts up to date.

- Problem-Solving Skills: Collection Managers should be able to solve problems quickly and efficiently in order to keep customer accounts current and prevent costly mistakes.

By including these Collection Manager skills on your resume, you can demonstrate to potential employers that you have the skills needed to manage collections and customer accounts. Employers will be impressed with your attention to detail and ability to handle customer accounts and payments. With the right combination of skills and experience, you can be confident that you will make a great impression on potential employers.

What skills should I put on my resume for Collection Manager?

A Collection Manager is responsible for the safeguarding, inventorying, and utilization of an organization’s collections according to established procedures and standards. To be successful in this role, one must possess a number of specialized skills and qualities.

When crafting a resume for a Collection Manager position, it is important to emphasize the following skills:

- Expertise in Collection Management: Collection Managers are responsible for the safekeeping, cataloging, and utilization of an organization’s collection. As such, it is essential for a Collection Manager to demonstrate a deep understanding of the entire collection management process.

- Data Analysis and Assessment Skills: Collection Managers must be able to analyze and assess data associated with their collections. This includes gathering, organizing, and interpreting data to effectively manage the collection.

- Ability to Develop Policies and Procedures: Collection Managers must be able to develop and implement effective policies and procedures to protect the collection. This includes creating and enforcing guidelines for the use of the collection by staff and the public.

- Attention to Detail: Collection Managers must be detail-oriented and have excellent organizational skills in order to effectively manage the collection.

- Excellent Communication Skills: Collection Managers must be able to communicate effectively with both staff and the public. This includes the ability to listen, respond, and explain policies and procedures in a clear and concise manner.

- Technical Skills: In addition to the soft skills listed above, Collection Managers must possess some technical skills such as the ability to use computers and systems to manage the collection.

By emphasizing these skills on your resume, you will be able to demonstrate that you possess the necessary qualities to be a successful Collection Manager.

Key takeaways for an Collection Manager resume

When it comes to building a successful collection manager resume, there are a few key takeaways that can help you create a resume that stands out from the competition. Here are some tips to consider when crafting your collection manager resume:

- Highlight your experience and accomplishments. Collection managers must have strong organizational skills, a keen eye for detail, and the ability to juggle multiple tasks at once. Be sure to showcase the experience you have that demonstrates these qualities, including any awards or achievements you have earned.

- Showcase your customer service skills. Collection managers must be prepared to handle customer inquiries, disputes, and difficult conversations. Highlight any customer service experience you have that demonstrates your ability to remain cool and collected under pressure.

- Demonstrate your proficiency with technology. Collection managers need to understand modern technology and be able to use electronic systems to identify and address accounts. Showcase any computer programs or systems you are proficient in using.

- Make sure everything is accurate and up to date. It’s important to make sure that your collection manager resume is accurate and up to date. Make sure all of the information is current and any dates have been updated to reflect your current job experience.

By following these key takeaways when crafting your collection manager resume, you can ensure that you create a resume that stands out from the competition and helps you land the job of your dreams.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder