Writing a resume for an Insurance Operations Analyst role can be intimidating since you have to stand out from the competition and make a great impression. It is essential to create a resume that accurately reflects your skills and experience and shows that you are the ideal job candidate. In this guide, we will provide an overview of what to include in an Insurance Operations Analyst resume, and provide examples and tips to help you create the most effective resume possible. With the right strategy and know-how, you can create a resume that will help you land the job of your dreams.

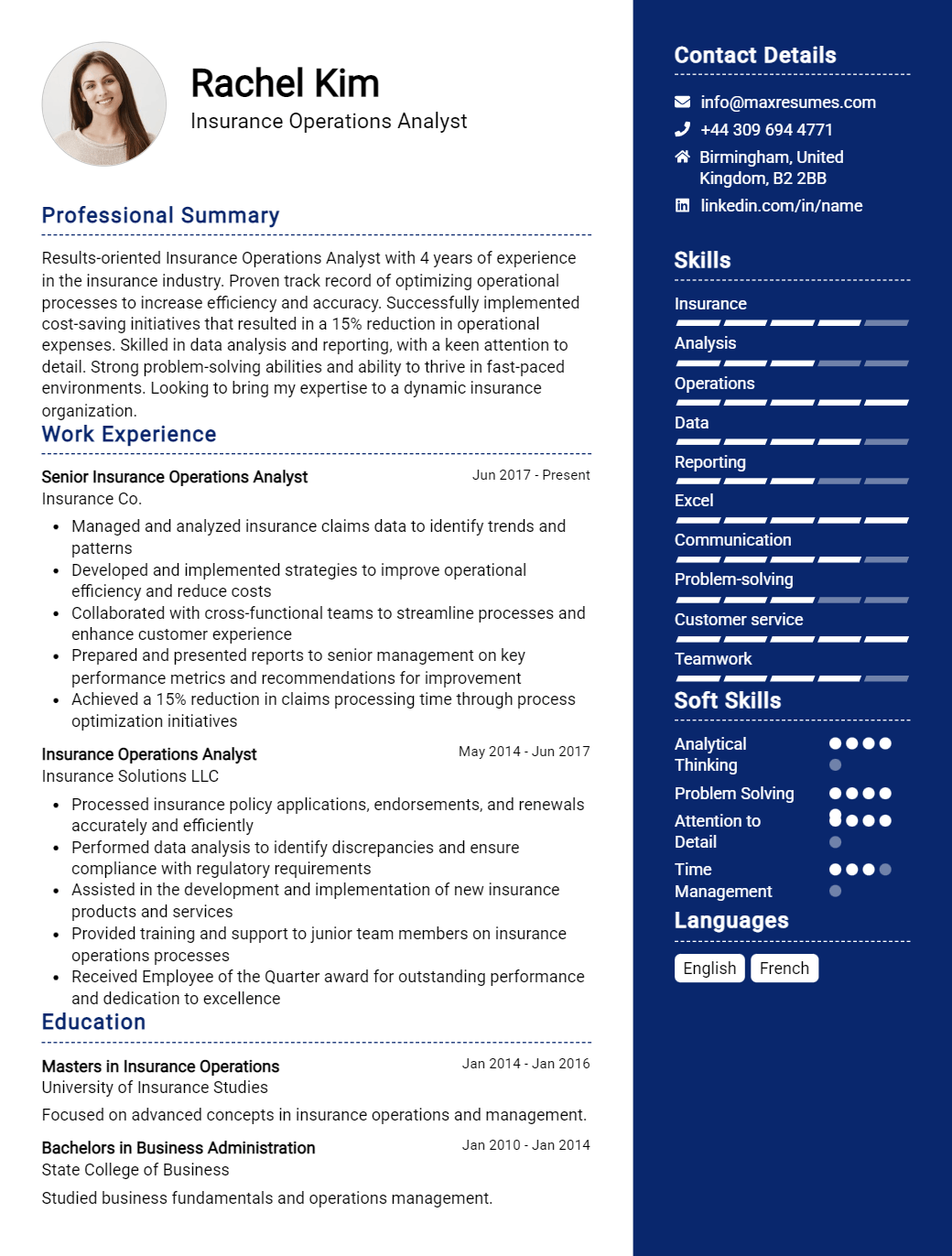

Operations Analyst Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Insurance Operations Analyst Resume Examples

John Doe

Insurance Operations Analyst

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am a highly analytical and detail- oriented insurance operations analyst with 5+ years of experience in the industry. I have a proven track record for developing and implementing new processes and procedures in order to improve operational efficiency and maximize profitability. My experience also includes analysis of data, production of reports, and providing strategic advice for decision- making. I have exceptional skills in problem solving and organizational management, as well as strong communication skills. I am adept at using various software tools to execute the tasks required of me and can easily develop solutions to complex problems.

Core Skills:

- Strong analytical and problem- solving skills

- Excellent communication and interpersonal skills

- Organizational and management abilities

- Proficiency in Microsoft Office Suite and other software tools

- Data analysis and report preparation

- Experience with insurance operations

Professional Experience:

Insurance Operations Analyst, ABC Insurance, Houston, TX

- Analyzed customer data to identify market trends and develop strategies to increase sales

- Developed and implemented new processes and procedures to improve operational efficiency

- Produced reports to track performance metrics and identify areas of improvement

- Collaborated with other departments to develop solutions to complex problems

- Provided strategic advice for decision- making to upper management

Education:

Bachelor of Science in Business Administration, University of Houston, Houston, TX

Insurance Operations Analyst Resume with No Experience

To secure a position as an Insurance Operations Analyst, where I can leverage my enthusiasm, research skills, and ability to analyze data to help the organization reach its goals.

Recent college graduate with strong research, problem solving, and data analysis skills. I have a desire to learn and grow professionally as an Insurance Operations Analyst. I am an eager and fast learner who is open to new ideas and feedback in order to advance my knowledge.

Skills:

- Strong research and data analysis skills

- Excellent problem solving and critical thinking abilities

- Proficiency in Microsoft Office Suite, especially Excel

- Ability to learn quickly and adapt to new situations

- Highly organized and detail- oriented

Responsibilities:

- Organize and analyze data to help the company identify trends and make effective business decisions

- Coordinate with other team members to ensure that operations are running smoothly and efficiently

- Assist in developing and implementing processes to ensure accuracy and efficiency of operations

- Research and develop new methods to improve operations

- Identify and analyze potential risks and compliance issues

- Monitor and audit operations to ensure compliance with regulations and policies

Experience

0 Years

Level

Junior

Education

Bachelor’s

Insurance Operations Analyst Resume with 2 Years of Experience

Insurance Operations Analyst with 2 years of experience in the insurance industry. Demonstrated ability to review and analyze data and develop solutions to optimize operations. Proactive team player with strong problem- solving, communication and organizational skills.

Core Skills:

- Data Analysis

- Fraud Detection

- Risk Management

- Financial Performance

- Regulatory Compliance

- Process Improvement

- Research and Troubleshooting

- Leadership and Team Building

Responsibilities:

- Analyzing and monitoring insurance operations data to identify trends and anomalies

- Developing, implementing, and maintaining operational control frameworks to reduce operational risk

- Implementing and managing fraud detection systems to reduce fraudulent activities

- Developing and maintaining operational procedures to ensure operational efficiency

- Creating and delivering presentations to senior management to obtain buy- in for operational initiatives

- Leading cross- functional teams and providing guidance to ensure projects are completed in a timely manner

- Conducting research to identify and develop business opportunities to improve operational performance

- Maintaining and monitoring compliance of regulations, policies and procedures

- Analyzing data to identify areas of improvement and develop solutions

- Collaborating with internal and external parties to ensure accurate and timely data delivery

- Providing support to senior management in developing strategies to maximize operational performance.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Insurance Operations Analyst Resume with 5 Years of Experience

I am an Insurance Operations Analyst with 5 years of experience. I have a strong background in the insurance industry and a proven track record of success in providing exceptional customer service and increasing operational efficiency. My core skills include project management, data analysis, problem solving, and technical proficiency. I have a solid understanding of the insurance policies and procedures, and I am able to effectively communicate complex solutions to stakeholders. I am also well- versed in using software to increase operational efficiency and data accuracy.

Core Skills:

- Project Management

- Data Analysis

- Problem Solving

- Technical Proficiency

- Insurance Policies & Procedures

- Software Proficiency

Responsibilities:

- Analyze customer data to identify operational issues and recommend solutions

- Monitor operational performance and ensure compliance with insurance regulations

- Develop and implement processes to improve operational efficiency

- Prepare reports for management and stakeholders

- Maintain accurate records of customer data and activity

- Train and manage staff on operational processes and procedures

- Manage customer service inquiries and respond to customer complaints

- Utilize software to analyze data and generate reports

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Insurance Operations Analyst Resume with 7 Years of Experience

Insurance Operations Analyst with 7 years of experience in the insurance industry. Skilled in policy management, underwriting, and claims management. Possess strong organizational, customer relations and communication skills. Adept in identifying and resolving operational issues and providing creative solutions to improve processes. Experience working with databases, spreadsheets, and other software programs to generate reports and analyze data.

Core Skills:

- Insurance Operations

- Policy Management

- Underwriting

- Claims Management

- Data Analysis

- Report Generation

- Database Management

- Problem Solving

- Microsoft Office

- Customer Service

Responsibilities:

- Monitored daily operations of the insurance department and identified areas with room for improvement.

- Provided underwriting services for clients, including risk analysis, policy management and claims processing.

- Prepared and analyzed reports for identifying trends, patterns, and discrepancies in data.

- Developed and implemented standard operating procedures and policies to improve operational efficiency.

- Conducted reviews of all claims documents to ensure accuracy and compliance with state regulations.

- Resolved customer complaints and disputes in a timely and professional manner.

- Maintained insurance databases to ensure accurate records and records retention.

- Assisted in the development of training procedures, as well as coached and mentored new employees.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Insurance Operations Analyst Resume with 10 Years of Experience

I am a highly analytical and results- driven Insurance Operations Analyst with 10+ years of experience. My expertise in developing and designing financial models and analyzing data to create business strategies has proven to be an invaluable asset to any organization. I am also highly efficient in managing complex projects, summarizing findings and making recommendations for product development and improvement. My keen attention to detail, communication skills, problem- solving skills, and ability to stay organized are all essential qualities I possess to successfully complete any task.

Core Skills:

- Advanced financial modeling

- Data analysis and interpretation

- Business analysis and strategy formulation

- Product development

- Advanced problem- solving

- Excellent verbal and written communication

- Project management

- Organizational and time management

Responsibilities:

- Develop and analyze financial models to assess risk and profitability of insurance products

- Analyze and interpret data to identify trends and inconsistencies

- Develop and implement business strategies to optimize business performance

- Monitor changes in the insurance industry to ensure compliance

- Create product development plans and recommend improvements

- Collaborate with other departments to streamline processes

- Conduct research and provide detailed summaries of findings

- Provide technical support and training to employees

- Identify and resolve issues in a timely manner

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Insurance Operations Analyst Resume with 15 Years of Experience

Results- driven Insurance Operations Analyst with 15 years of experience in the industry. Skilled in leading projects, analysing and monitoring insurance operations, and developing efficient solutions to improve overall performance and customer service. Experienced in resolving customer complaints and resolving technical issues in a timely manner. Strong collaborator with excellent communication and leadership skills to attain organisational goals.

Core Skills:

- Customer Service

- Insurance Operations

- Project Management

- Analytical and Problem- Solving

- Conflict Resolution

- Leadership

- Process Improvement

- Technical Troubleshooting

- Documentation

- Communication

Responsibilities:

- Gathered and analysed insurance data to create reports for management

- Developed, implemented, and maintained insurance operational procedures

- Monitored changes in insurance regulations to ensure compliance

- Trained and evaluated staff, providing guidance and feedback

- Assisted customers with insurance claims and disputes

- Coordinated with other departments to analyse and resolve technical issues

- Performed comprehensive reviews of insurance processes to identify inefficiencies and develop solutions

- Processed customer payments, updated records, and maintained customer accounts

- Responded to customer complaints in a timely and professional manner

- Prepared detailed reports and presentations on insurance operations and processes

- Developed and executed strategies to improve customer service performance

- Collaborated with other departments to ensure compliance with insurance regulations

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Insurance Operations Analyst resume?

A well-crafted resume can help you stand out among a pool of applicants and give you the best chance of securing a job as an Insurance Operations Analyst. When creating your resume, it is important to include a few key elements that will make you a top choice for employers.

Here are some key elements to include on your Insurance Operations Analyst resume:

- Professional summary that outlines your experience in the insurance industry and highlights your key skills

- Comprehensive list of duties and accomplishments in your current or previous positions

- Detailed knowledge of insurance operations principles and processes

- Demonstrated ability to identify and analyze trends in data

- Experienced in developing and implementing insurance operations strategies

- Expertise in problem solving and decision making

- Knowledge of Risk Management and Regulatory Compliance

- Proficient in Microsoft Office Suite and other relevant software

- Strong communication and interpersonal skills

What is a good summary for a Insurance Operations Analyst resume?

A successful Insurance Operations Analyst resume should demonstrate strong analytical, problem-solving, and communication skills. It should highlight the ability to analyze and interpret data, identify trends and relationships, implement process improvements, and develop business strategies. Additionally, the resume should showcase knowledge of relevant insurance regulations, risk management principles, and insurance industry best practices. The successful candidate should also have experience working with data mining, database management, and programming. Finally, the resume should include any applicable certifications or qualifications in their field.

What is a good objective for a Insurance Operations Analyst resume?

A well-crafted objective is essential for a successful Insurance Operations Analyst resume. It helps employers quickly evaluate how your qualifications, experiences, and skills match the requirements of the job.

- An effective objective should be concise and to the point, showcase your relevant qualifications, and describe your career goals.

- It should demonstrate that you are the ideal candidate for the job and focus on the key skills and experiences that make you an excellent fit for the role.

- A good objective for an Insurance Operations Analyst resume should demonstrate your expertise in managing and analyzing insurance operations and processes.

- It should also highlight your ability to identify areas of improvement in workflow processes and recommend changes to optimize efficiency.

- You should also emphasize your problem-solving skills and your ability to work with stakeholders to develop strategies and guidelines that maximize customer satisfaction.

- You should also include any previous experience with developing and implementing data processing policies and procedures.

- Finally, you should highlight your excellent communication and organizational skills and your ability to work independently and in a team environment.

By crafting a clear and concise objective for your Insurance Operations Analyst resume, you will distinguish yourself from other applicants and give employers a better understanding of your qualifications and career goals.

How do you list Insurance Operations Analyst skills on a resume?

When applying for an Insurance Operations Analyst position, employers will want to see a comprehensive list of the skills and abilities you can bring to the role. Crafting a resume that accurately and effectively demonstrates your qualifications is essential in order to gain the attention of recruiters and hiring managers.

Listing your skills for an Insurance Operations Analyst role on your resume should be detailed and specific in order to stand out from the competition. Here are some of the key skills you will want to include:

- Proficient in data analysis and reporting: An Insurance Operations Analyst must be able to interpret data, identify trends, and generate reports. Make sure to highlight any software or tools you are familiar with to demonstrate your proficiency in data analysis and reporting.

- Knowledgeable in regulatory compliance: Insurance Operations Analysts must be well-versed in laws and regulations, and must be able to interpret and implement them when necessary. If you have any certifications related to regulatory compliance, be sure to include them on your resume.

- Experienced in risk management: Employers will be looking for candidates who have a strong understanding of risk assessment and management. Include any past experience you have had with risk management, such as developing strategies, policies, and processes.

- Strong communication and problem solving skills: Good communication and problem solving skills are essential for an Insurance Operations Analyst. Make sure to highlight any relevant experience you have had in these areas.

- Excellent organizational and interpersonal skills: Insurance Operations Analysts must be well organized and must be able to work effectively with individuals at all levels, both internally and externally. Include any past experience you have had working in a team environment.

By including these key skills on your resume, you will be able to demonstrate to employers that you have the necessary qualifications to be a successful Insurance Operations Analyst.

What skills should I put on my resume for Insurance Operations Analyst?

Insurance operations analysts are responsible for ensuring the efficient operation of an insurance company through data analysis and reporting. To be successful in this role, insurance operations analysts should have a combination of technical and interpersonal skills. When writing your resume for this role, you should include the following skills:

- Analytical Skills: Insurance operations analysts must have the ability to analyze large volumes of data and identify trends. This includes being able to use data to generate reports and make recommendations.

- Problem-Solving: Insurance operations analysts are problem solvers. They must be able to take a systematic approach to solving complex issues by gathering data, analyzing it and then offering accurate solutions.

- Technical Skills: Insurance operations analysts must have a working knowledge of computers and the ability to use software programs such as Excel, PowerPoint, and Access.

- Financial Knowledge: Knowledge of insurance and financial principles is essential for insurance operations analysts. This includes understanding of accounting, financial markets, and investment practices.

- Communication: Insurance operations analysts must be able to effectively communicate both verbally and in writing. This includes the ability to explain complex concepts in an easy to understand format.

- Interpersonal Skills: Insurance operations analysts must have the ability to build relationships with colleagues, clients and vendors. They must also be able to work independently and as part of a team.

By including these skills on your resume, you can demonstrate to potential employers that you have the necessary qualifications for the role of an insurance operations analyst.

Key takeaways for an Insurance Operations Analyst resume

Your resume as an insurance operations analyst should reflect your experience analyzing data, managing budgets, and ensuring compliance with insurance regulations. When writing your resume for an insurance operations analyst role, consider the following key takeaways.

- Highlight your experience in analytics: As an insurance operations analyst, you will be responsible for analyzing data, so make sure to emphasize your experience working with databases and data programs. Highlight the data tools that you are familiar with, such as Tableau or SAS.

- Showcase your budgeting skills: Many insurance operations analysts are responsible for managing budgets, so be sure to include your experience with financial planning and budgeting. Demonstrate your expertise with accounting software, such as QuickBooks or Xero.

- Demonstrate your knowledge of insurance regulations: To be an effective insurance operations analyst, you must be well-versed in the policies and regulations of the insurance industry. Show employers that you have a thorough understanding of the regulations by listing any certifications you may have.

- Demonstrate your problem-solving skills: Insurance operations analysts often need to identify and solve complex problems. Show employers that you have the skills to do so by highlighting your experience in troubleshooting and problem-solving.

By following these key takeaways, you can ensure that your resume stands out from the rest. An effective resume will demonstrate your broad range of skills and experiences in insurance operations analysis, as well as your expertise in data analytics, budgeting, and understanding of insurance regulations.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder