The resume process for a reinsurance underwriter can be tricky due to the complexities of the job market within the sector. It’s important to ensure your resume includes the information that can demonstrate your qualifications and experience in the reinsurance underwriting field. With the right resume writing tips, you can differentiate yourself from other applicants and get your dream job. In this blog post, we’ll provide you with examples and tips for crafting an impressive reinsurance underwriter resume.

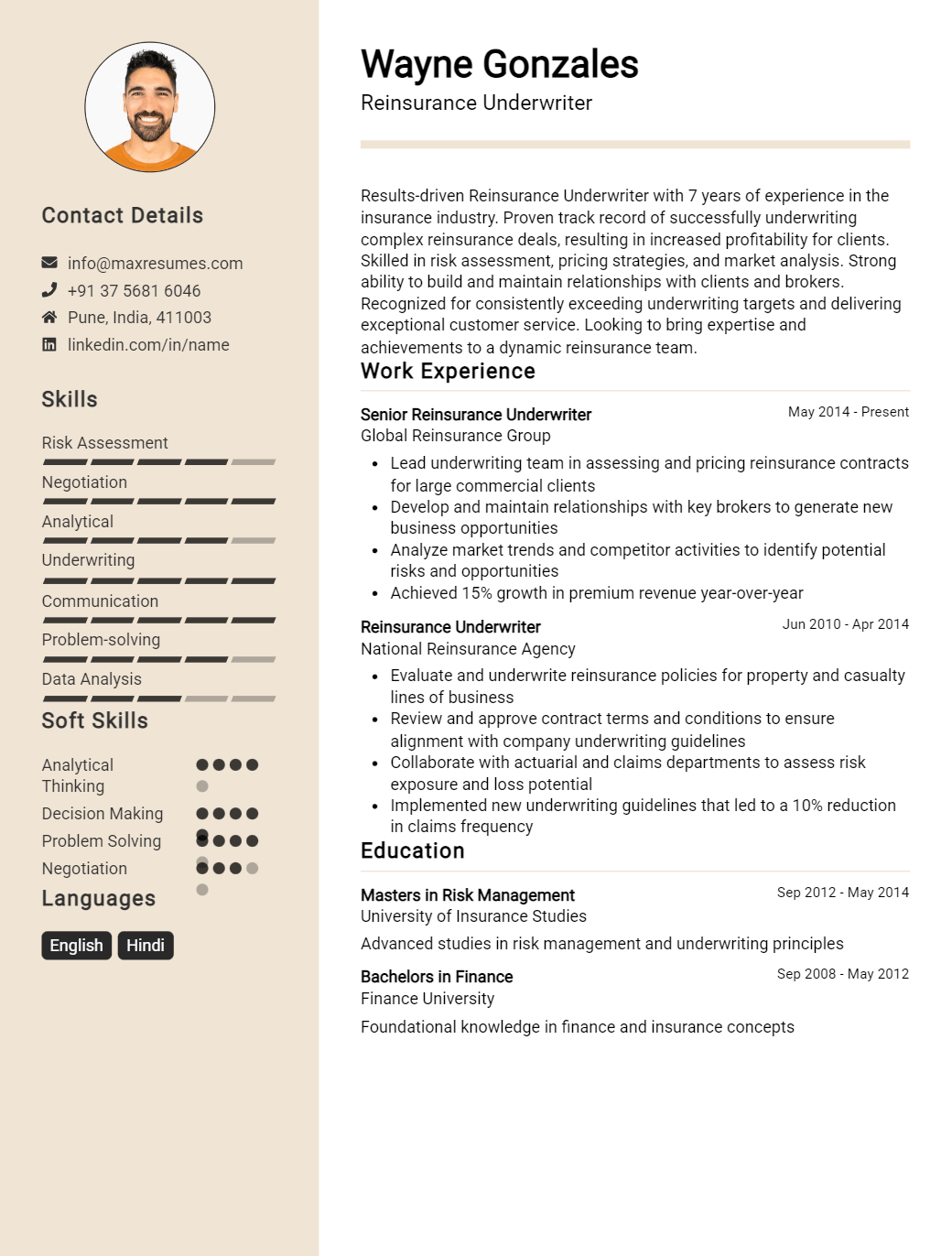

Reinsurance Underwriter Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Reinsurance Underwriter Resume Examples

John Doe

Reinsurance Underwriter

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

Highly experienced and organized Reinsurance Underwriter with 10+ years of experience in the property and casualty insurance industry. Skilled in researching and analyzing market trends and customer needs to develop reinsurance policies. Adept at using various software applications, including underwriting systems and databases, to complete analysis and develop customer profiles. Exceptional at identifying risk factors and using that information to negotiate reinsurance terms and conditions.

Core Skills:

- Reinsurance Underwriting

- Risk assessment and analysis

- Negotiating skills

- Customer service

- Microsoft Office Suite

- Underwriting software

- Market research

Professional Experience:

Reinsurance Underwriter, ABC Insurance, 2009- 2020

- Evaluated customer needs to determine the best reinsurance options

- Analyzed customer data to accurately determine the risk involved

- Negotiated terms and conditions with underwriters

- Developed reinsurance policies and contracts

- Monitored and tracked customer accounts

- Provided customer service and responded to inquiries

Reinsurance Analyst, XYZ Insurance, 2006- 2009

- Gathered and analyzed data to identify customer needs

- Conducted market research to identify trends in the industry

- Researched and studied market data to develop reinsurance policies

- Created customer profiles using underwriting software

- Resolved customer problems and inquiries

Education:

Bachelor of Science in Insurance Studies, University of New Mexico, 2006

Reinsurance Underwriter Resume with No Experience

- Recent college graduate with an educational background in finance and accounting, eager to apply my knowledge of insurance and reinsurance to an underwriting role in the reinsurance industry.

Skills

- Excellent written and verbal communication

- Highly organized and detail- oriented

- Proficient in Microsoft Office Suite, including Excel

- Strong analytical and quantitative skills

- Ability to quickly learn new concepts

- Strong collaboration skills and a team- player attitude

Responsibilities

- Understand reinsurance products and associated risks

- Assess risk and complete reinsurance underwriting

- Identify reinsurance opportunities and negotiate with clients

- Develop and maintain relationships with key clients

- Analyze data and make decisions based on information

- Develop and implement underwriting strategies

- Monitor industry and market trends to identify potential risks

- Keep abreast of regulatory changes and compliance requirements

Experience

0 Years

Level

Junior

Education

Bachelor’s

Reinsurance Underwriter Resume with 2 Years of Experience

A motivated and proactive professional with two years of experience as a Reinsurance Underwriter, leveraging strong customer service and communication skills to review reinsurance contracts and analyze risk profiles. Adept at developing relationships with clients to better assess their needs and providing the best possible coverage in line with their requirements. Committed to providing consistent and quality service that exceeds customers’ expectations.

Core Skills:

- Knowledge of reinsurance contracts

- Understanding of the reinsurance industry

- Research and analytical skills

- Understanding of insurance and risk management

- Excellent Customer service

- Ability to communicate effectively

- Highly organized

- Problem- solving aptitude

Responsibilities:

- Review reinsurance contracts and analyze risk profiles.

- Negotiate terms and conditions of reinsurance contracts.

- Develop relationships with clients to better assess their needs.

- Provide recommendations and advice on suitable reinsurance coverage.

- Prepare and submit quote requests to reinsurers.

- Monitor and document all changes made to existing reinsurance contracts.

- Review and analyze loss data reports.

- Evaluate reinsurance applications and make appropriate decisions.

- Develop and implement policies and practices related to reinsurance.

- Maintain accurate records of all reinsurance transactions.

- Handle customer inquiries and complaints.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Reinsurance Underwriter Resume with 5 Years of Experience

Highly motivated and detail- oriented Reinsurance Underwriter with 5+ years of experience in analyzing risk profiles, underwriting reinsurance policies, and providing advice to stakeholders. Proven track record of successfully evaluating and recommending risk protection strategies to clients. Experienced in conducting research, analyzing data and making informed decisions to minimize losses. Adept at developing and maintaining strong professional relationships with clients and insurance providers.

Core Skills:

- Risk Analysis

- Policy Underwriting

- Loss Management

- Data Analysis

- Time Management

- Relationship Building

- Insurance Regulations

- Financial Modeling

Responsibilities:

- Analyzing client risk profiles and conducting research to determine risk levels and develop reinsurance strategies

- Reviewing existing policies and recommending changes to maximize coverage.

- Creating and issuing reinsurance policies, ensuring accuracy and adherence to regulatory standards.

- Developing and maintaining relationships with reinsurance providers and clients.

- Reviewing and evaluating data to identify potential areas of risk and develop preventative strategies.

- Monitoring financial and investment performance to identify trends and potential losses.

- Working closely with stakeholders to ensure compliance with insurance regulations and industry best practices.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Reinsurance Underwriter Resume with 7 Years of Experience

Results- oriented professional with 7 years of experience in reinsurance underwriting and sales. Proven ability to analyze and assess financial data to develop reinsurance solutions for clients. Skilled in developing a strong client base and establishing long- term relationships. Experienced in maintaining and creating new business opportunities, as well as interfacing with management on complex client negotiations.

Core Skills:

- Knowledge of reinsurance product lines and underwriting processes.

- Experienced in evaluating financial data of potential and current clients.

- Ability to maintain good relationships with senior management, clients, and industry contacts.

- Proficient in preparing quotes, negotiating terms, and writing policies.

- Experienced in delivering timely and accurate renewal and new business presentations.

- Skilled in assessing risk appetite and making sure underwriters are aware of reinsurance exposure.

- Knowledge of reinsurance law and regulations, as well as industry standards.

Responsibilities:

- Analyzing and assessing financial data of prospective and existing clients to determine reinsurance needs.

- Developing new and existing business opportunities through client base and industry contacts.

- Interacting with management on complex client negotiations and delivering timely presentations.

- Writing policies and quotes in accordance with reinsurance law and regulations.

- Maintaining strong relationships with clients and industry contacts and managing risk appetite.

- Staying current on industry standards and best practices to ensure accuracy and compliance.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Reinsurance Underwriter Resume with 10 Years of Experience

A motivated and experienced Reinsurance Underwriter with ten years of experience in formulating underwriting policies and procedures, assessing risk, and conducting reinsurance negotiations. Demonstrated ability to analyze complex reinsurance contracts, assess and evaluate risk, prepare recommendations and make profitable decisions. Proven track record of establishing and maintaining relationships with reinsurance brokers and clients. Experienced in analyzing loss data and creating underwriting reports.

Core Skills:

- Risk Assessment

- Underwriting Policies & Procedures

- Reinsurance Negotiations

- Analyzing Reinsurance Contracts

- Loss Data Analysis

- Client Relationships

- Financial Analysis

- Report Writing

- Decision Making

Responsibilities:

- Analyzing and assessing reinsurance contracts to determine exposure and risk

- Negotiating contracts with reinsurance brokers to ensure maximum profitability

- Developing and implementing underwriting policies and procedures

- Evaluating and assessing risk to determine the feasibility of reinsurance contracts

- Establishing and maintaining relationships with clients and brokers

- Analyzing financial data and implementing strategies to generate profitable business

- Developing and preparing reports and recommendations for reinsurance decisions

- Presenting reports and recommendations to management for approval and implementation

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Reinsurance Underwriter Resume with 15 Years of Experience

A seasoned Reinsurance Underwriter with 15 years of experience in the insurance industry. Possesses a comprehensive understanding of reinsurance treaty and facultative underwriting, including loss portfolio transfers, renewal of existing treaties and quoting of new treaties. Has extensive knowledge of reinsurance pricing, the underwriting process, and reinsurance contract structure. Superior analytical skills and demonstrates excellent grasp of market trends and competitive landscape. Proficient in the use of reinsurance- specific software and systems

Core Skills:

- Underwriting

- Reinsurance

- Price negotiation

- Market trends

- Competitive landscape

- Contract structure

- Reinsurance- specific software

- Systems

Responsibilities:

- Analyze complex reinsurance treaties and facultative underwriting

- Determine premium rates, discounts and coverage limits

- Develop and manage relationships with clients, reinsurers and brokers

- Review and assess client’s risk management needs

- Conduct research and assess reinsurance market trends

- Identify and recommend new opportunities for reinsurance

- Advise and assist clients in making decisions about their reinsurance needs

- Maintain accurate records of reinsurance contracts and data

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Reinsurance Underwriter resume?

A reinsurance underwriter resume should include the following sections and details:

- Professional Summary: A brief account of your accomplishments, experience, and qualifications related to the role of a reinsurance underwriter.

- Education: Include relevant degrees or certifications received and any other educational accomplishments.

- Relevant Skills: List any technical, analytical, problem-solving, communication, or other skills you have that are applicable to the role of a reinsurance underwriter.

- Work Experience: Provide a list of your previous positions related to reinsurance, including details of your responsibilities and accomplishments.

- Projects: Include any projects you’ve worked on, either in a professional setting or as a volunteer, that are related to reinsurance.

- Additional Relevant Experience: Include any other experience related to reinsurance that is not included in your work experience section, such as writing for industry publications, organizing events, or networking with industry professionals.

- References: Provide contact information for professional references who can speak to your skills and abilities as a reinsurance underwriter.

What is a good summary for a Reinsurance Underwriter resume?

A reinsurance underwriter resume should summarize the candidate’s professional experience and qualifications for the position. It should include details about their background in financial services, insurance, and reinsurance, as well as their skills in assessing risk and developing effective reinsurance solutions. The summary should also emphasize the candidate’s abilities in negotiation, customer service, and leadership. Additionally, the summary should highlight any specialties the candidate has in specific areas of reinsurance, such as marine, property and casualty, life, health, and annuities. Finally, the summary should reflect the candidate’s commitment to safety, compliance, and professionalism.

What is a good objective for a Reinsurance Underwriter resume?

When it comes to writing an effective resume for a Reinsurance Underwriter position, it is important to set a clear objective. Your objective should be tailored to the job you are applying for, and should be geared towards emphasizing the skills and experience you have that would make you an ideal candidate for the position. Here are some suggestions for a good objective for a Reinsurance Underwriter resume:

- To use my extensive knowledge of reinsurance and analytical skills to help a company effectively manage and reduce their risk of losses.

- To leverage my experience in reinsurance to develop and maintain successful relationships with clients and partners.

- To maximize profits through exceptional underwriting and risk analysis, while adhering to company policies and regulations.

- To utilize my expertise in reinsurance to identify new opportunities, sources of revenue, and innovative solutions.

- To be an effective leader within a team of reinsurance professionals, contributing to the development and implementation of sound strategies and processes.

By including a clear and tailored objective on your Reinsurance Underwriter resume, you can give potential employers an insight into your experience and qualifications, setting yourself apart from other applicants.

How do you list Reinsurance Underwriter skills on a resume?

Your resume is a crucial document that can help you stand out among the competition for a reinsurance underwriter position. A great resume includes the skills and qualifications you possess that make you the ideal candidate for the job.

As a reinsurance underwriter, you’re responsible for evaluating the risk of reinsuring a policy, so it’s important to list your skills that demonstrate your ability to do this. Here are some skills you should consider including on your resume:

- Thorough understanding of reinsurance contracts and products: Reinsurance underwriters need to understand different types of reinsurance contracts and products in order to effectively assess the risk of a policy.

- Strong analytical skills: Underwriters need to be able to analyze large amounts of data and make informed decisions.

- Excellent communication skills: Reinsurance underwriters must be able to effectively communicate with clients, brokers, and other stakeholders.

- Detail-oriented: Underwriters need to pay attention to detail in order to accurately evaluate a policy.

- Ability to work independently: Reinsurance underwriters need to be able to work independently and make decisions without relying on others.

By including the above skills on your resume, you can demonstrate that you have the qualifications to be an effective reinsurance underwriter. Showing that you have the necessary skills and qualifications can help you get the job you want.

What skills should I put on my resume for Reinsurance Underwriter?

Reinsurance Underwriters perform a critical role in the insurance industry, managing risk for the company and the customers they serve. As a Reinsurance Underwriter, you need to have a set of skills that demonstrate your expertise in the field. Here are some of the most important skills you should include on your resume when applying for a Reinsurance Underwriter role:

- Proficiency in Reinsurance Processes: As a Reinsurance Underwriter, you should have a thorough understanding of all the processes and procedures related to reinsurance. You should know how to interpret underwriting policies, evaluate and assess risks, and familiarize yourself with industry standards and regulations.

- Analytical Thinking: Reinsurance Underwriters need to be able to take a logical approach to analyzing data, making decisions, and setting rates. You should possess strong analytical and problem-solving skills in order to interpret data and evaluate potential risks.

- Communication Skills: Reinsurance Underwriters need to be able to communicate effectively with colleagues, clients, and other stakeholders. You should have excellent verbal and written communication skills, as well as the ability to negotiate and explain complex concepts in a clear and concise manner.

- Detail Oriented: Reinsurance Underwriters should have an eye for detail and the ability to review contracts and documents carefully in order to identify any potential flaws or risks.

- Decision Making: Reinsurance Underwriters must be able to make informed decisions quickly and confidently. You should have the ability to evaluate data, analyze risks, and make sound decisions that benefit the company and customers.

By including these skills on your resume, you will demonstrate to potential employers that you possess the skills required for success in the field of Reinsurance Underwriting.

Key takeaways for an Reinsurance Underwriter resume

As an insurance underwriter, your resume must include a few specific items in order to stand out to potential employers. Below are some key takeaways to help make your resume stand out from the competition.

- Accurate Technical Knowledge: Insurance underwriters must have a thorough understanding of insurance policies, contracts, and regulations. Make sure your resume highlights your knowledge of the industry and your technical skills.

- Risk Analysis: Employers want to know you can accurately assess the risk associated with any given policy. Your resume should demonstrate your ability to determine the best course of action based on risk analysis.

- Reinsurance Experience: Reinsurance underwriters must understand the complexities of the reinsurance market and be able to navigate them effectively. Include any experience you may have in this area on your resume.

- Negotiation Skills: Insurance underwriters must be able to negotiate with potential clients in order to create policies that are mutually beneficial. Highlight any success you’ve had in negotiating on your resume.

- Customer Service: Your resume should show that you have a strong customer service background. Employers want to know you can handle difficult customer inquiries and take care of their needs in a professional manner.

By following these key takeaways, you can create a resume that will make you stand out from the competition and get the attention of potential employers. Your resume should reflect your knowledge, experience, and skills in the reinsurance industry, as well as your customer service abilities. With the right approach, you can land the reinsurance underwriting job of your dreams.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder