For those looking for a job in the insurance appraiser field, having an effective resume is essential. A resume should be tailored to the job and stand out from the crowd. A well-crafted resume can help you make a great first impression and land the job you’ve been looking for. This guide offers helpful tips on how to write a resume for an insurance appraiser position, complete with examples. From highlighting relevant experience to focusing on key skills, this guide will help you create a resume that stands out and increases your chances of getting hired.

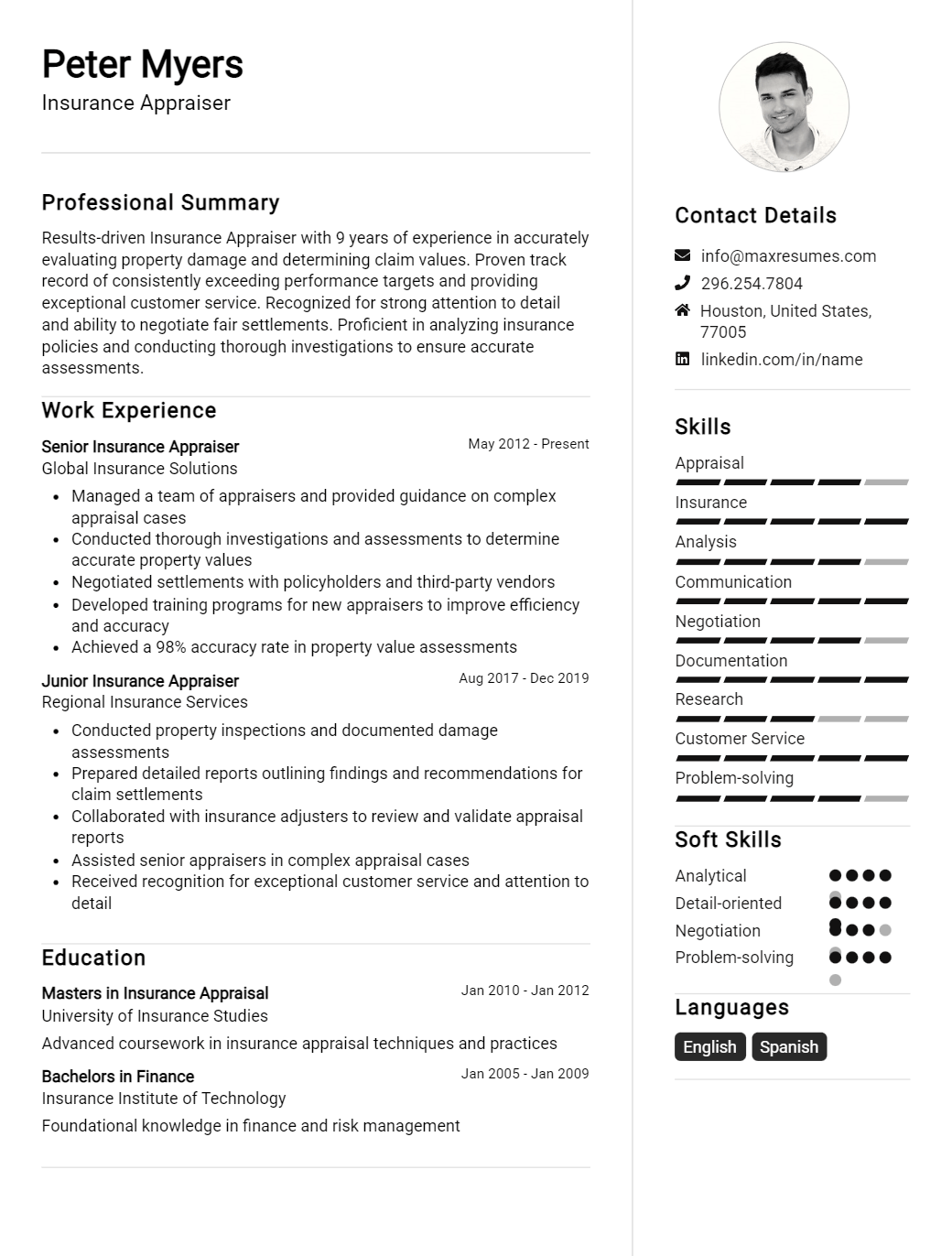

Appraiser Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Insurance Appraiser Resume Examples

John Doe

Insurance Appraiser

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

Dynamic and experienced insurance appraiser with a track record of success in providing timely and accurate appraisals of commercial and residential properties. Knowledgeable in all types of properties, with expertise in providing estimates for homeowners’ insurance, auto insurance, and commercial insurance policies. Skilled in customer service, data analysis, and problem- solving.

Core Skills

- Analytical Thinking

- Data Entry

- Research & Investigations

- Policy & Procedure

- Risk Mitigation

- Insurance Estimation

- Report Preparation

- Property Valuation

- Customer Service

Professional Experience

Insurance Appraiser, XYZ Insurance

June 2019 – Present

- Completed appraisals for homeowners’, auto, and commercial insurance policies

- Drafted detailed property appraisals that included a comprehensive evaluation of the structure and its condition

- Investigated the property and associated structures to determine fair coverage

- Created professional and accurate reports within set timelines

- Advised clients on the cost of insurance policies

- Conducted property inspections to identify existing and potential risks

Insurance Appraiser, ABC Insurance

August 2017 – June 2019

- Assessed properties and provided accurate estimates of their value

- Compared property values to market values and adjusted insurance rates as needed

- Analyzed risks associated with the property, such as damage from natural disasters

- Investigated with local and state government to determine zoning and other regulations

- Provided support to customers in selecting the best insurance policy for their needs

- Built relationships with local real estate agents and appraisers for collaboration purposes

Education

Bachelor of Science in Insurance, ABC University

2013–2017

Insurance Appraiser Resume with No Experience

A highly motivated individual seeking an entry- level position as an Insurance Appraiser, with a passion for helping people and understanding complex insurance concepts. I possess excellent communication skills and have experience working in customer service. I am looking to develop my appraisal skills, and am eager to learn more about the insurance industry.

Skills:

- Customer service experience

- Strong written and verbal communication

- Organizational and time management skills

- Able to multi- task in a fast- paced environment

- Computer proficient (Microsoft Office Suite, database management, etc.)

- Analytical thinking and problem solving

Responsibilities:

- Conducting detailed appraisals of vehicles

- Analyzing information to determine the value of cars

- Communicating with customers regarding their appraisals

- Maintaining accurate records of appraisals

- Assisting customers with questions and concerns

- Negotiating and settling on the appraised value of vehicles

Experience

0 Years

Level

Junior

Education

Bachelor’s

Insurance Appraiser Resume with 2 Years of Experience

A motivated and organized Insurance Appraiser with two years of experience in collecting and evaluating data related to insurance claims. Possesses a keen attention to detail in assessing and quantifying damages, as well as a solid understanding of the insurance claims process. A strong communicator and negotiator, who is comfortable interacting with customers, attorneys, and other professionals.

Core Skills:

- Insurance Claims Evaluation

- Excellent Verbal and Written Communication

- Problem Solving and Negotiation

- Data Collection and Analysis

- Damage Appraisal and Quantification

Responsibilities:

- Evaluate insurance claims and determine the final settlement amount for customers

- Interview customers and other parties to determine the facts related to the claim

- Gather and analyze data related to the claim, including photos, documents, and other evidence

- Work with customers, attorneys, insurance carriers, and other parties involved to reach a settlement

- Calculate the cost of repairs and replacement items related to the claim

- Conduct field inspections of damage and assess the scope of repairs required

- Negotiate and mediate claims settlements between customers and insurance carriers

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Insurance Appraiser Resume with 5 Years of Experience

Dynamic Insurance Appraiser with proven experience in appraising property and casualty losses for a national independent adjusting firm. Skilled at reviewing policy documents and assessing damage to personal property, commercial assets, and liability claims. Adept at conducting thorough investigations of claims and documenting related findings through the use of photographs, diagrams and clear, detailed written reports. Demonstrated expertise in developing strong relationships with clients and providing exceptional service.

Core Skills:

- Insurance Appraisal

- Claims Investigation

- Policy Documentation Review

- Loss Estimation

- Damage Assessment

- Report Writing

- Negotiation

- Client Relations

Responsibilities:

- Reviewed policy documents to ensure accuracy and validity of insurance claims.

- Conducted investigations of reported losses, interviewed witnesses and obtained relevant documents.

- Assessed damage to personal property, commercial assets and liability claims.

- Generated comprehensive reports detailing the investigation and findings.

- Provided detailed cost estimates for repair and replacement of damaged items.

- Negotiated with customers and insurance companies to resolve discrepancies.

- Developed strong relationships with clients and provided exceptional customer service.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Insurance Appraiser Resume with 7 Years of Experience

Results- driven and detail- oriented Insurance Appraiser with over 7 years of experience in evaluating and assessing the value of cars, boats, and other types of personal property. Experienced in conducting comprehensive market research, interviewing customers and underwriting risk. Possesses excellent communication, customer service and analytical skills.

Core Skills:

- Underwriting Risk

- Problem Solving

- Data Analysis

- Research and Investigations

- Time Management

- Customer Service

- Inspecting Property

- Insurance Adjusting

Responsibilities:

- Conduct extensive market research in order to determine the value of personal property

- Interview customers to gain a clear understanding of their insurance needs

- Inspect property to ensure that it meets the requirements of the policy

- Verify claim documents and ensure accuracy

- Analyze customer information in order to accurately underwrite risk

- Calculate premiums and corresponding payments

- Prepare detailed reports outlining the findings of property inspections

- Provide customer support services and resolve issues in a timely manner

- Maintain and update insurance databases and records

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Insurance Appraiser Resume with 10 Years of Experience

A reliable, results- oriented Insurance Appraiser with 10 years of experience in analyzing and evaluating the cost and value of insurance claims to ensure accurate settlements. Possess a comprehensive knowledge of insurance contracts, appraisal and negotiation techniques, and a proficient understanding of the real estate and automobile markets. Demonstrated ability to utilize effective problem- solving techniques, build relationships, and manage time effectively.

Core Skills:

- Knowledge of insurance contracts, appraisal, and negotiation techniques

- Proficient understanding of the real estate and automobile markets

- Excellent communication, problem- solving, and time management skills

- Ability to build strong positive relationships with clients

- Ability to accurately analyze and evaluate insurance claims

Responsibilities:

- Assess damage to property, vehicles and/or goods and determine the estimated value

- Negotiate and settle claims with insurance companies

- Conduct research and analyze market data to determine the value of claims

- Interpret policy coverages, terms and limitations

- Provide clear and accurate updates to customers on the progress of their claims

- Ensure all claims are processed in a timely and cost- effective manner

- Review claims forms and investigate suspicious activities

- Maintain a detailed and accurate record of all claims

- Develop and implement procedures for efficient claim processing

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Insurance Appraiser Resume with 15 Years of Experience

I am a highly experienced Insurance Appraiser with 15 years of experience in the insurance industry. I have a strong understanding of the insurance appraisal process, from the initial claim assessment to the final appraisal report. I have worked for a number of insurance companies, appraising a variety of risks and claims. I have excellent communication skills and the ability to effectively manage complex appraisal projects. I am comfortable working independently and as part of a team.

Core Skills:

- Expert knowledge of insurance appraisal process

- Strong understanding of insurance risks and claims

- Excellent communication and interpersonal skills

- Ability to manage complex appraisal projects

- Ability to work independently and as part of a team

Responsibilities:

- Assessing insurance claims

- Investigating and evaluating damages

- Preparing accurate and detailed appraisal reports

- Negotiating settlements with insurance companies

- Ensuring accurate and timely completion of appraisal projects

- Providing technical advice and guidance

- Keeping up to date with relevant industry trends and developments

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Insurance Appraiser resume?

When you’re applying for a job as an Insurance Appraiser, it’s important to create an effective resume that showcases your unique skills and experience. Here are some key things to include in a resume for an Insurance Appraiser:

- Relevant Education: Include your education and certifications related to insurance appraisals.

- Job Experience: Highlight your experience with past insurance appraisal roles, including the companies you’ve worked for and the roles you’ve held.

- Insurance Appraisal Skills: Emphasize the skills you have that are related to insurance appraisal, such as knowledge of insurance regulations, data analysis, and customer service.

- Communication Skills: Emphasize your oral and written communication skills, as these will be important when working with clients.

- Computer Skills: Highlight any computer skills you have that are related to insurance appraisals, such as knowledge of spreadsheets and database software.

- Technical Skills: Outline any technical skills you have, such as knowledge of appraisal software, that demonstrate your ability to perform the duties of an Insurance Appraiser.

- Leadership Experience: Include any leadership roles you’ve held, such as team leader or project manager, as these demonstrate your ability to manage complex projects and work with a variety of stakeholders.

What is a good summary for a Insurance Appraiser resume?

A good summary for an Insurance Appraiser resume should highlight key skills related to appraising insurance values, estimating damage costs, assessing risk levels, and communicating complex concepts in an understandable way. An ideal candidate should also demonstrate knowledge of local ordinances and regulations, as well as a strong familiarity with the insurance industry. Additionally, the candidate should be able to demonstrate strong problem-solving and analytical skills, as well as excellent organizational, communication, and customer service skills. Experience in the insurance field, particularly in the areas of claims, appraisals, and customer service, is also valuable to an employer. Finally, a successful candidate should possess a valid appraisal license or certification.

What is a good objective for a Insurance Appraiser resume?

An insurance appraiser resume should have a clear objective that outlines the goals and qualifications of the job seeker. A good objective for an insurance appraiser resume might include the following:

- Demonstrate ability to accurately assess property damage due to natural disasters, vandalism, or other incidents

- Show strong knowledge of the insurance industry, including legal regulations and claims process

- Possess strong analytical and problem-solving skills to determine cost and repair estimates

- Utilize excellent communication and customer service skills to negotiate with clients

- Possess a thorough understanding of the claims process and the ability to work with insurance companies to reach a settlement

How do you list Insurance Appraiser skills on a resume?

When crafting your resume and highlighting your Insurance Appraiser skills, it is essential to include a comprehensive list of skills and qualifications. This list will demonstrate to employers that you possess the necessary qualifications to succeed in the role.

To list your Insurance Appraiser skills on your resume, consider the following:

- Familiarity with appraisal processes and techniques: An Insurance Appraiser should be well-versed in the different appraisal processes and techniques and demonstrate this knowledge on their resume.

- Research and analysis: An Insurance Appraiser should have strong research and analytical skills, enabling them to assess and evaluate available information for accurate appraisals.

- Detail-oriented: Insurance Appraisers should be detail-oriented, as accuracy is essential in this role.

- Communication skills: Insurance Appraisers must possess strong communication skills to effectively convey appraisal results to clients and other parties.

- Time management: Insurance Appraisers should have excellent time management skills and be able to balance multiple tasks and deadlines.

- Knowledge of property valuation: An Insurance Appraiser should demonstrate knowledge and understanding of property valuation and be able to accurately determine the value of a property.

Highlighting these skills on your resume will demonstrate to employers your ability to perform the tasks and duties of an Insurance Appraiser.

What skills should I put on my resume for Insurance Appraiser?

When crafting your resume for an Insurance Appraiser position, it is important to include relevant skills that will help you stand out from the competition. Insurance Appraisers must possess a wide range of skill sets in order to accurately assess and appraise a variety of different insurance policies.

To give yourself the best chance of landing the job, here are some skills that you should include on your resume to demonstrate your expertise as an Insurance Appraiser:

- Valuation Expertise: Insurance Appraisers must be able to accurately assess the value of a variety of different insurance policies. This requires a knowledge of the market and an understanding of the various factors that can influence the value of an insurance policy.

- Analytical Thinking: Insurance Appraisers must be able to analyze data and information to accurately assess and value insurance policies. This includes the ability to identify trends and patterns, as well as draw conclusions from the data.

- Research Skills: Insurance Appraisers must be able to conduct thorough research in order to accurately assess and value insurance policies. This includes the ability to locate and analyze relevant data and information, as well as draw accurate conclusions from it.

- Interpersonal Skills: Insurance Appraisers must be able to communicate effectively with clients and stakeholders in order to explain their findings. This includes the ability to explain technical concepts in a simple and straightforward way.

- Attention to Detail: Insurance Appraisers must be able to pay close attention to detail in order to accurately assess and value insurance policies. This includes the ability to identify inconsistencies and discrepancies in the data.

These are just a few of the skills that you should include on your resume for an Insurance Appraiser position. With the right combination of skills and qualifications, you can give yourself the best chance of landing the job.

Key takeaways for an Insurance Appraiser resume

Creating an effective resume is a key factor in the job search process. For those looking to become an insurance appraiser, there are a few key takeaways to keep in mind when creating an effective resume.

First, include a professional summary that outlines your qualifications and experience as an insurance appraiser. Include a list of skills and qualifications that show your expertise in appraising property and assessing damage due to natural disasters or other causes.

Second, highlight your experience dealing with insurance companies and related businesses. Include any special certifications you have earned or previous roles you have held in the insurance sector.

Third, emphasize any awards or accolades that demonstrate your professionalism and industry experience. This will help employers gain confidence in your ability to accurately appraise property.

Fourth, include any volunteer experience or industry-related activities that demonstrate your commitment to the profession. This will help employers gain an understanding of your dedication and enthusiasm for the job.

Finally, be sure to include contact information (name, email address, phone number, etc.) in the contact information section of your resume. This will make it easier for employers to reach out to you for interviews and for you to follow up with them.

By following these key takeaways, you will create an effective resume that will help you stand out from the competition.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder