Are you looking for a job as a claims adjuster? Writing a strong resume is an essential step in the job search process. A strong claims adjuster resume is the first step to getting the job you want. This guide will provide tips on how to write a claims adjuster resume, as well as resume examples to get you started. With the right tools and practices, you’ll be ready to write a resume that will stand out to employers and land you the job you want.

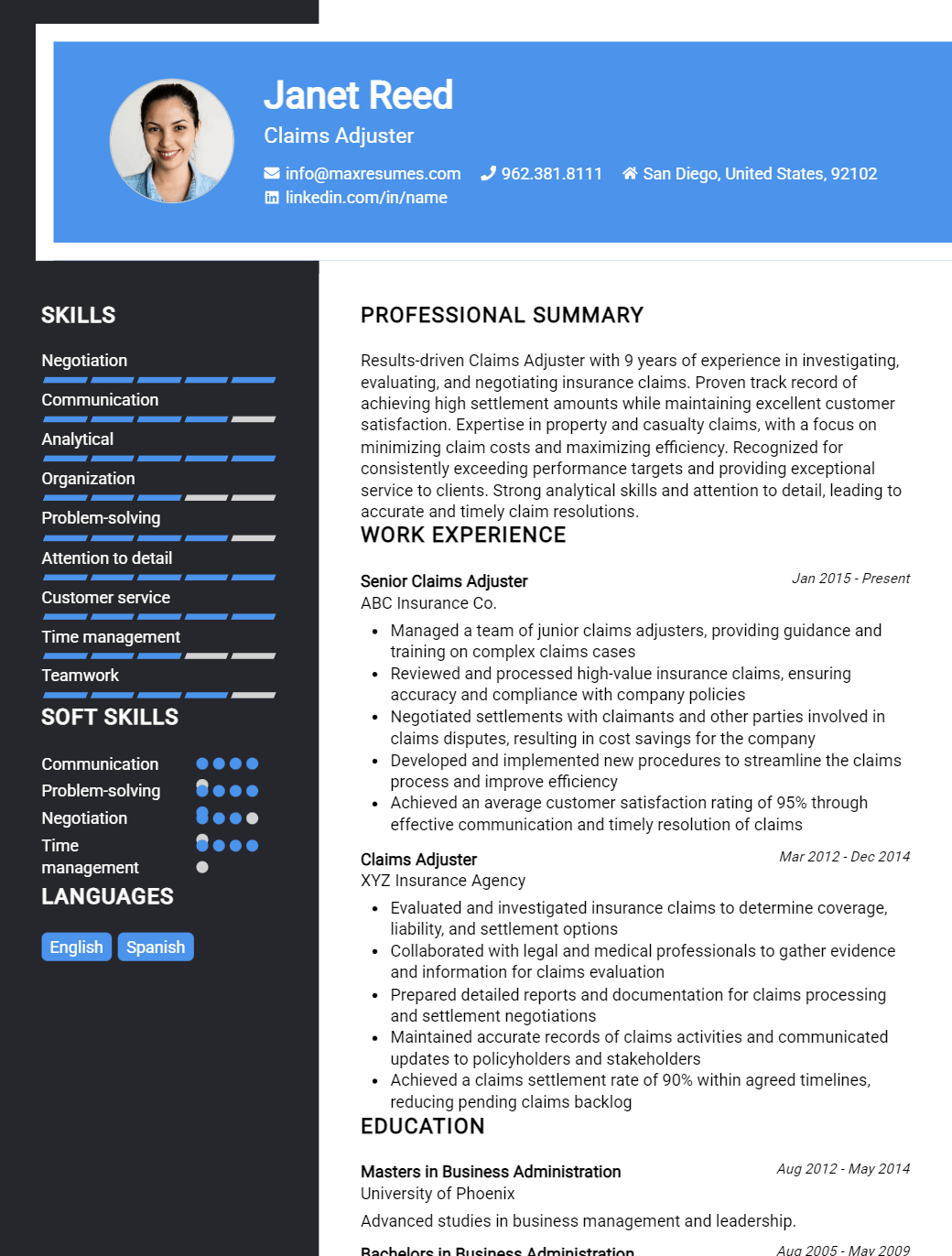

Claims Adjuster Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Claims Adjuster Resume Examples

John Doe

Claims Adjuster

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am an experienced Claims Adjuster with over eight years of experience in the industry. I have dealt with a broad range of claims from auto, property, and liability. I am organized and have excellent communication, interpersonal, and customer service skills. I have a thorough understanding of the claims process and regulatory compliance. I am adept at using various software and tools to efficiently manage claims and I am looking to leverage my experience and skills to benefit an organization.

Core Skills:

- Excellent communication and interpersonal skills

- In- depth understanding of claims process and regulatory compliance

- Exceptional customer service

- Proficiency in Microsoft Office Suite, claims systems, and other software

- Ability to assess and analyze insurance policies

- Resolving complex insurance claims

- Highly organized and detail- oriented

Professional Experience:

Claims Adjuster, ABC Insurance Co. – Seattle, WA

- Processed and handled over 100 auto, property, and liability claims

- Assessed, analyzed, and evaluated auto, property, and liability insurance policies

- Submitted accurate and thorough claims

- Collaborated with other departments to ensure claimant satisfaction

- Investigated and reviewed all kinds of claims to determine validity

- Negotiated and settled claims with claimants

- Developed and maintained relationships with clients and networked to support the organization

Education:

Bachelor of Science in Insurance, University of Washington – Seattle, WA

Graduated with Honors

Claims Adjuster Resume with No Experience

Recent graduate with a Bachelor’s degree in Business Administration looking for a Claims Adjuster position. Possess strong ability to efficiently investigate and analyze insurance claims, and to work with customers to ensure their satisfaction.

Skills

- Excellent communication and customer service skills

- Proficient in Microsoft Office, including Word and Excel

- Organizational and problem- solving skills

- Strong analytical, research, and investigative skills

- Knowledge of insurance policy provisions and coverage

- Ability to work independently and as part of a team

Responsibilities

- Process and review insurance claims, ensuring accuracy and completeness

- Evaluate and investigate claims to determine the extent of insurance company liability

- Negotiate settlements with claimants, attorneys, and other insurance companies

- Review medical and legal documents, police reports, and other records to determine validity of claims

- Monitor pending claims to ensure timely resolution and payment

- Provide excellent customer service to claimants and other parties involved in claims process

Experience

0 Years

Level

Junior

Education

Bachelor’s

Claims Adjuster Resume with 2 Years of Experience

An experienced and motivated Claims Adjuster with 2 years of experience in the insurance industry. Possesses a keen understanding of claims handling and dispute resolution processes. Demonstrates strong analytical and negotiating skills, as well as excellent interpersonal and communication abilities. Able to work well independently or as part of a team. Highly organized and detail- oriented, with the ability to work under pressure and meet deadlines.

Core Skills:

- Experience in claims processing and problem solving

- Knowledge of insurance policies, procedures and regulations

- Ability to analyze, investigate and review complex claims

- Excellent communication and interpersonal skills

- Strong analytical and negotiation skills

- Highly organized, detail- oriented and able to work under pressure

- Proficient in Microsoft Office suite and related software

Responsibilities:

- Receive and review insurance claims for accuracy and completeness

- Communicate with claimants and/or their representatives to obtain needed information

- Analyze claims to determine coverage and liability

- Investigate claims to determine validity

- Negotiate settlements with claimants to arrive at fair and equitable results

- Maintain accurate records of claims and settlements

- Provide timely and accurate documentation of claims and settlements

- Monitor claims to ensure timely and accurate processing

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Claims Adjuster Resume with 5 Years of Experience

I am a highly experienced Claims Adjuster with 5 years of experience in the industry. I am highly experienced in conducting investigations and inspections, collecting evidence, reviewing policies and contracts, analyzing claims and preparing reports. My expertise includes providing customer service, researching facts and providing detailed reports. I also have excellent communication and interpersonal skills which help me in effectively negotiating on behalf of the clients. I am confident in my abilities to provide accurate, timely and comprehensive claims service.

Core Skills:

- Detailed knowledge of insurance policies, contracts and coverages

- Ability to investigate and analyze claims

- Comprehensive research skills

- Exceptional customer service and interpersonal skills

- Excellent communication skills

- Ability to coordinate with other departments

- In- depth knowledge of insurance regulations

- Computer proficiency

- Skilled at data entry, recordkeeping and documentation

Responsibilities:

- Investigating and inspecting claims to determine liability

- Examining documents and reports to identify discrepancies

- Initiating contact with insurance agents, claimants, witnesses and other parties to obtain accurate information

- Negotiating settlements and resolving claims disputes

- Processing and submitting claim payments

- Drafting and filing reports in a timely manner

- Answering customer inquiries and providing support and guidance

- Keeping accurate records of claims and updates

- Maintaining up to date knowledge of insurance laws and regulations

- Assisting in developing internal policies and procedures related to claims handling.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Claims Adjuster Resume with 7 Years of Experience

Experienced and highly motivated Claims Adjuster with 7+ years of experience in claims assessment and investigation. Possess an in- depth knowledge of the insurance industry and a proven track record of providing exceptional customer service while successfully managing large caseloads. Proven ability to multitask and handle complex cases while maintaining a high level of accuracy and attention to detail.

Core Skills:

- Knowledge of industry laws and regulations

- Proficient in claims management software

- Strong analytical skills

- Excellent verbal and written communication

- High degree of accuracy and attention to detail

- Proven ability to multi- task

- Superior customer service skills

- Investigatory and problem- solving skills

Responsibilities:

- Assess claims for coverage under applicable policies

- Investigate and evaluate claims to determine liability and coverage

- Develop and maintain a thorough understanding of all applicable state and federal regulations

- Interview claimants, witnesses, medical practitioners and other relevant parties to obtain relevant information

- Analyze facts and evidence to determine claim validity

- Prepare and negotiate settlements in accordance with company guidelines

- Process, review and evaluate insurance documents

- Maintain accurate claims records and provide detailed reports as required.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Claims Adjuster Resume with 10 Years of Experience

Seasoned Claims Adjuster with 10 years of experience in the insurance industry. Possess an extensive knowledge of insurance policies and claims procedures. Have a successful track record of accurately and efficiently assessing claims, researching and verifying cases, and providing financial compensation in a timely manner. Proven ability to successfully handle complex investigations, analyze complex data, and provide exceptional customer service to claimants.

Core Skills:

- Insurance Analysis

- Claims Processing

- Investigative Techniques

- Data Analysis

- Claim Resolution

- Customer Service

- Contract Negotiations

- Regulatory Compliance

- Documentation

- Organizational Skills

Responsibilities:

- Evaluate claims presented by policyholders, claimants, or providers to determine the extent of the insurance company’s liability

- Analyze complex information obtained from documents, reports, and interviews to determine the facts of a claim

- Investigate and verify the accuracy of the facts and figures provided by the claimants

- Negotiate settlements with claimants to ensure satisfactory outcomes

- Provide claimants with information regarding their claims status and available benefits

- Resolve disputes and answer any questions or concerns related to the claim

- Prepare detailed written reports of all claim investigations

- Ensure that all claims are processed and resolved in accordance with the terms of each policy

- Maintain and update claims records to ensure accuracy and compliance with all regulations

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Claims Adjuster Resume with 15 Years of Experience

A highly experienced Claims Adjuster with 15 years of experience in reviewing and responding to insurance claims. Possessing a strong knowledge of state and federal regulations and the ability to effectively manage complex cases. Experienced in conducting legal research and preparing detailed reports for both internal and external clients. An excellent communicator with the ability to manage multiple tasks, prioritize workloads and collaborate to ensure successful outcomes.

Core Skills:

- Analytical thinker: strong problem solving and decision- making skills

- Strong organizational and time management skills

- Excellent communication, negotiation and interpersonal skills

- Proficient in legal research and the use of computer software

- Excellent written and verbal communication skills

- Knowledge of state and federal regulations

- Ability to work independently and effectively manage complex cases

Responsibilities:

- Review and evaluate property, casualty and liability insurance claims

- Interview insured and claimants to obtain information and determine the extent of liability

- Investigate and analyze facts and evidence to determine the validity of claims

- Determine liability and damages to be paid

- Prepare detailed reports of investigations and evaluate findings

- Negotiate settlements with claimants and their attorneys

- Maintain up- to- date records of claims and the claims process

- Provide timely feedback and updates to clients and other stakeholders

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Claims Adjuster resume?

- Skills and Qualifications

- Knowledge of legal and insurance principles

- Excellent verbal and written communication skills

- Strong customer service skills

- Analytical and problem-solving skills

- Ability to assess and analyze claims and adjusters

- Proficiency in Microsoft Office

- Educational Requirements

- Bachelor’s degree in a related field (e.g., insurance, business, law)

- Certified Claims Adjuster (CCA)

- Experience-Minimum of 3 years of experience as a claims adjuster

- Experience with claims-related software such as Xactimate and Claims Adjuster

- Experience in evaluating, adjusting, and resolving insurance claims

- Additional Certifications or Licenses

- Property and casualty license

- Certified Professional Insurance Adjuster (CPIA)

- Certified Insurance Appraiser (CIA)

- Certified Insurance Adjuster (CIA)

- Soft Skills

- Strong organizational and time management skills

- Ability to work independently and in a team environment

- Adaptability and flexibility

- Good attention to detail

- Strong negotiation and persuasion skills

What is a good summary for a Claims Adjuster resume?

A Claims Adjuster resume should be a one-page document that summarizes relevant qualifications and experience in the field. It should detail the applicant’s experience with insurance policies and processes, as well as any skills or knowledge related to the position. It should also highlight any successes the applicant has had while working as an adjuster, such as successfully closing cases or identifying fraudulent claims. The summary should be concise, concisely outlining the applicant’s ability to handle the responsibilities of a Claims Adjuster. It should also include any relevant certifications or other specialized qualifications. A good Claims Adjuster resume should be well-organized, clearly outlining the applicant’s qualifications and experience in the field.

What is a good objective for a Claims Adjuster resume?

A Claims Adjuster resume should have a clear objective that highlights the applicant’s strengths and qualifications.

It is important to be specific and concise when writing an objective, as this will help the employer understand what kind of candidate they are looking at and how they can best utilize the applicant’s skills. Here are some good objectives to consider adding to a Claims Adjuster resume:

- To utilize my excellent problem-solving, communication, and negotiation skills to contribute to the success of the claims adjusting team

- To apply my experience in customer service, data analysis, and investigative research to effectively manage and process claims

- To use my attention to detail and ability to understand complex information to accurately assess claims

- To provide effective resolutions to customer claims disputes using my strong technical and interpersonal skills

- To utilize my organizational skills and knowledge of insurance policies to successfully process and settle claims

- To utilize my expertise in claims management to effectively assess, analyze, and administer customer claims

How do you list Claims Adjuster skills on a resume?

Claims adjusters are responsible for evaluating and settling insurance claims for policyholders. To be successful in this role, claims adjusters must possess strong communication, interpersonal, and analytical skills. When listing your claims adjuster skills on a resume, it is important to highlight the skills that you possess that make you a successful claims adjuster.

Here are some of the skills that you could list on your resume to demonstrate your claims adjuster abilities:

- Investigating Claims: Claims adjusters must be able to thoroughly investigate claims to ensure that they are legitimate and accurate.

- Negotiation: Claims adjusters must have the ability to effectively negotiate with claimants to reach settlements that are satisfactory to both parties.

- Analytical Skills: Claims adjusters must be able to analyze data to determine validity and accuracy of claims.

- Interpersonal Skills: Claims adjusters must possess excellent interpersonal and communication skills to effectively interact with claimants.

- Conflict Resolution: Claims adjusters must be able to effectively resolve conflicts between claimants and insurance companies.

- Technological Proficiency: Claims adjusters must be able to proficiently use the latest technology to process claims quickly and efficiently.

- Time Management: Claims adjusters must be able to manage their workloads efficiently in order to meet deadlines.

- Regulatory Knowledge: Claims adjusters must have a thorough understanding of the regulations and laws governing the insurance industry.

What skills should I put on my resume for Claims Adjuster?

When creating your resume for a Claims Adjuster position, it’s important to have a resume that highlights the skills and experiences best suited to the job. Claims Adjusters manage the claims process from start to finish, so it’s essential to demonstrate knowledge of the entire process on your resume.

When deciding what skills to include on a resume for a Claims Adjuster position, consider customer service, communication, and problem-solving skills, as well as any specific experience adjusting claims.

- Excellent customer service: Claims Adjusters must be able to effectively communicate with customer and provide excellent customer service.

- Knowledge of claims processes: Demonstrate your knowledge of the entire claims process, from filing to resolution.

- Attention to detail: Details are important when adjusting claims, so be sure to emphasize your attention to detail.

- Problem solving: Claims Adjusters must be able to identify and solve problems quickly and efficiently.

- Adaptability: The claims process can be unpredictable at times, so demonstrate your ability to adapt and adjust to changing circumstances.

- Negotiation skills: Claims Adjusters must be able to negotiate with customers and other parties in order to reach acceptable outcomes.

- Computer proficiency: You should be comfortable using computers to access necessary information and fill out forms.

- Written and verbal communication: This is an important skill for any Claims Adjuster as they will be communicating with customers and other parties on a regular basis.

By demonstrating these skills on your resume, you can showcase your qualifications for the Claims Adjuster role and stand out from the competition.

Key takeaways for an Claims Adjuster resume

If you’re a Claims Adjuster looking to create a standout resume, there are a few key takeaways to keep in mind. A successful Claims Adjuster resume should highlight your experience in the field, your ability to work with clients and vendors, and your understanding of applicable laws and regulations.

When creating your resume, start off with a strong summary that outlines your expertise in the field. Be sure to include any certifications or qualifications you have obtained as well. You also want to list relevant job experience, emphasizing your successes and accomplishments. As a Claims Adjuster, you need to demonstrate your ability to analyze and evaluate claims, establish coverage and damages, and negotiate settlements. Be sure to include any experience handling litigation and working with legal teams in your summary.

You should also make sure that your resume reflects your ability to work with clients and vendors. As a Claims Adjuster, you will be expected to provide excellent customer service and maintain strong relationships with clients. Include any experience you have in developing customer relationships and providing customer service.

Finally, you need to show that you understand applicable laws and regulations. Make sure to include any experience you have in researching and interpreting legal documents, as well as any experience you have in managing compliance with state and federal laws.

Creating a standout resume as a Claims Adjuster is not an easy task. These key takeaways will help you ensure that your resume reflects your expertise in the field and helps you land the job of your dreams.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder